U.S. Economy Opening in Waves

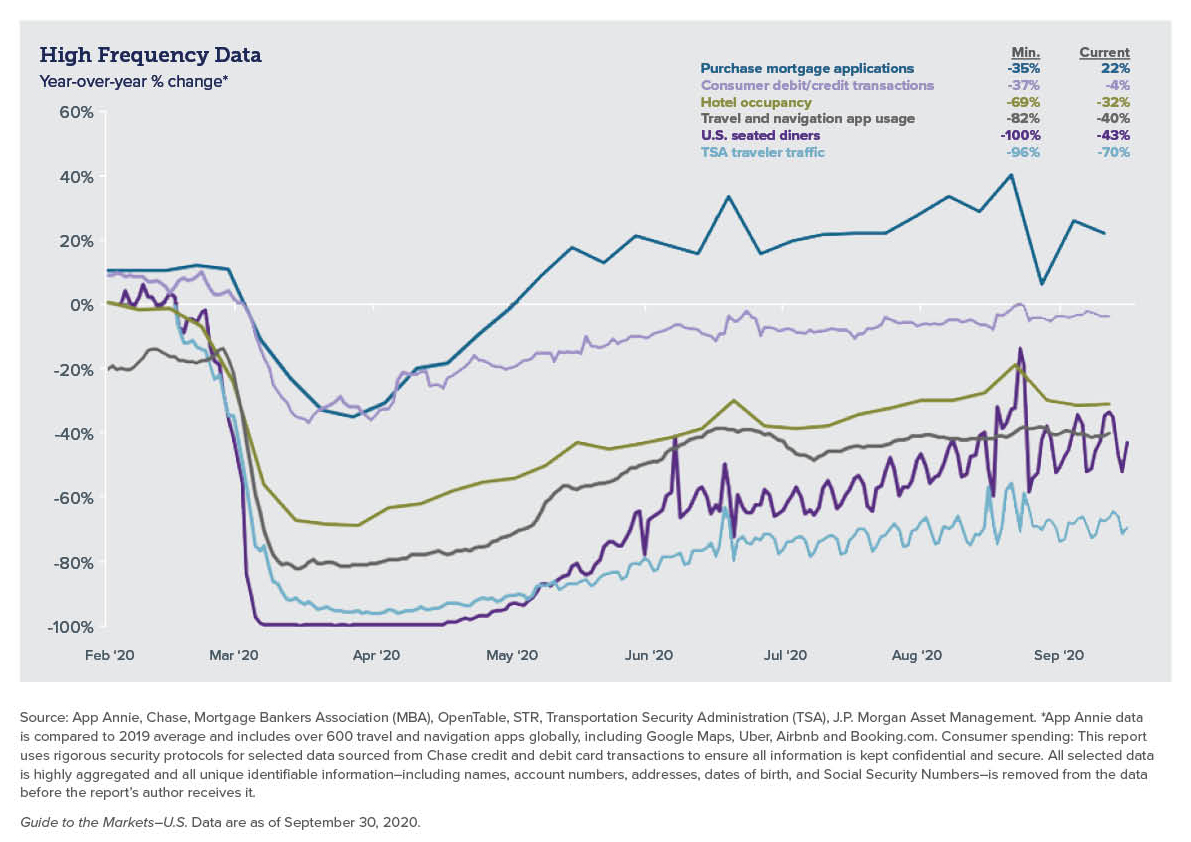

As discussed in our Midyear Outlook, our baseline scenario of a sharp rebound in economic activity followed by a long climb to full recovery appears to be playing out. The pandemic-induced business shutdowns in March and April were followed by a sharp upward surge of summer activity. However, as the U.S. reopens for business, not all sectors of the economy are recovering at the same rate as shown in the graph below. Full recovery hinges on external factors, not the least of which will be widespread acceptance of an effective COVID-19 vaccine.

Elections and the Markets

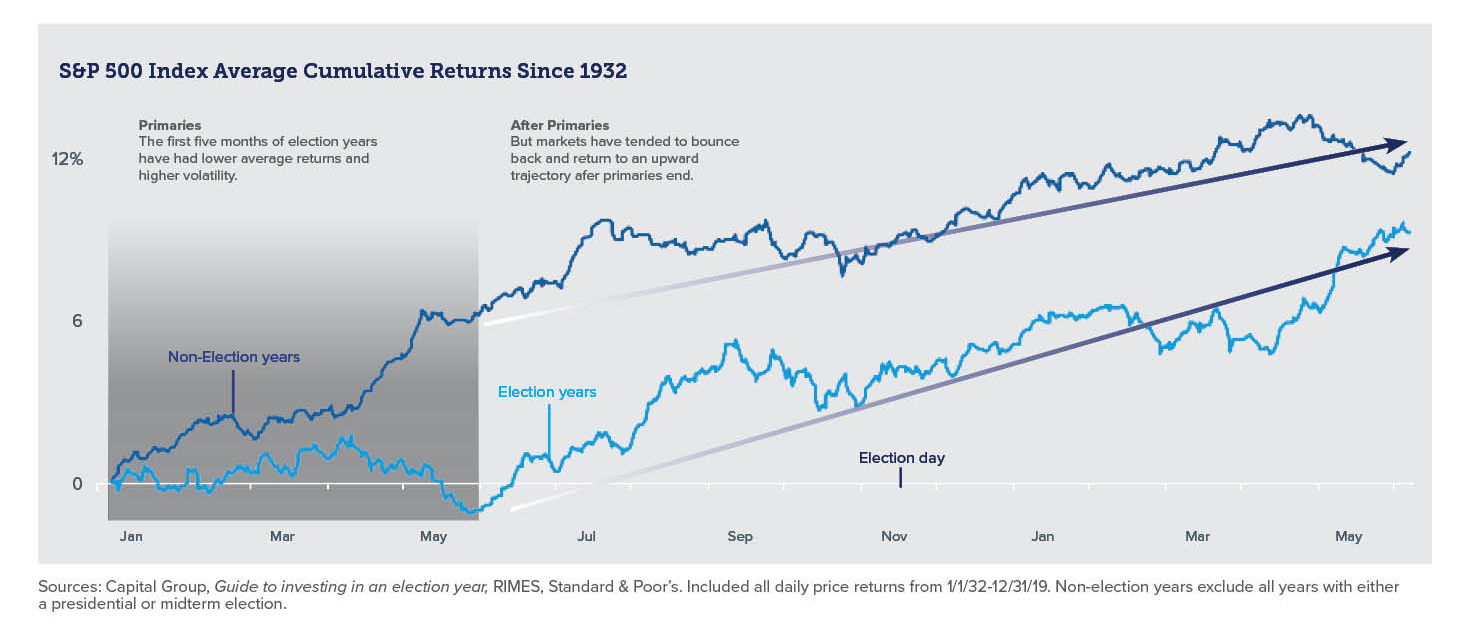

The fourth quarter of 2020 will bring a sharply contested election season. While speculation about the election’s impact on investments makes for entertaining conversation, history indicates that markets generally perform well following an election, regardless of the new makeup of our government.

A Balanced Approach Matters

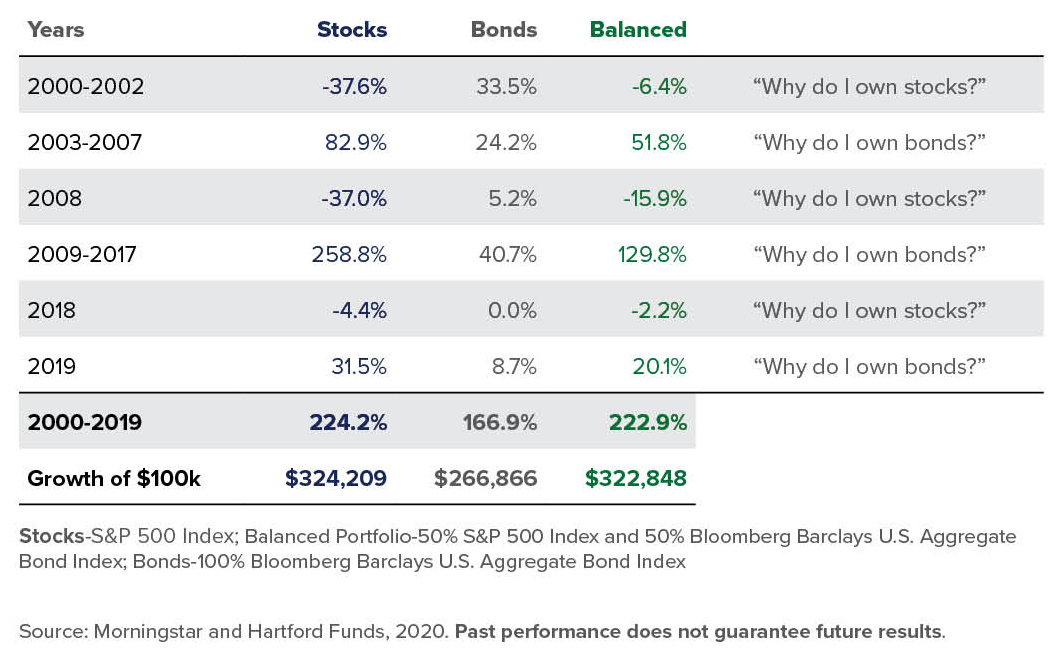

Elections and a pandemic may cause investors to sit on the sidelines or make significant allocation changes in their portfolios. Second-guessing your investment strategy is natural, especially during election seasons. However, these actions often hurt investors in the long term. We believe a balanced portfolio, based on long-term goals, coupled with active tax management, will reward the disciplined investor.

Economy/Financial Markets

- Social distancing due to COVID-19 continues to dampen economic activity.

- The Fed has clearly articulated its plans to keep rates below historical averages for the foreseeable future to stimulate the economy.

- Accommodative policies have swelled the Fed's balance sheet to historic levels.

- The 10-year Treasury yield remains below 1%, as investors seek the safety of U.S. government obligations.

- The strength of the economic rebound will largely depend on the nation's ability to get past the pandemic, fostering improved business confidence and/or consumer confidence levels.

- Inflation expectations remain below the Fed's target level of 2%.

Growth Assets

- A sharp selloff and subsequent rebound in growth assets placed most equity returns in positive territory for 2020.

- Volatility levels have tempered from historic highs in March and April but remain above average.

- Corporate earnings, which came under pressure from the business disruption caused by coronavirus concerns, are showing signs of rebound.

- Recent Fed actions appear to have helped stabilize equity markets.

- Attractive valuations exist in many international markets; accommodative monetary policies provide tailwind to Developed Equity markets.

- Emerging Markets performance is heavily influenced by the strength of the U.S. Dollar. Risks associated with trade and the spread of the coronavirus have hampered EM near-term prospects. Longer-term, Emerging Markets continue to look attractive from a risk/return standpoint.

Defensive Assets

- Treasury rates have fallen sharply and remain historically low.

- Corporate and high-yield bonds have seen spreads widen relative to Treasury yields but have provided better downside protection than equities during market corrections.

- The drop in yields have continued propping up prices of high quality bonds in 2020.

- An environment of higher levels of interest rate volatility is likely to continue, particularly given the economic uncertainty and the upcoming 2020 U.S. elections.

The INTRUST Quarterly Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

10/09/2020

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)