Personal Banking

Personal Banking

Quarterly Perspectives — Q3 2018

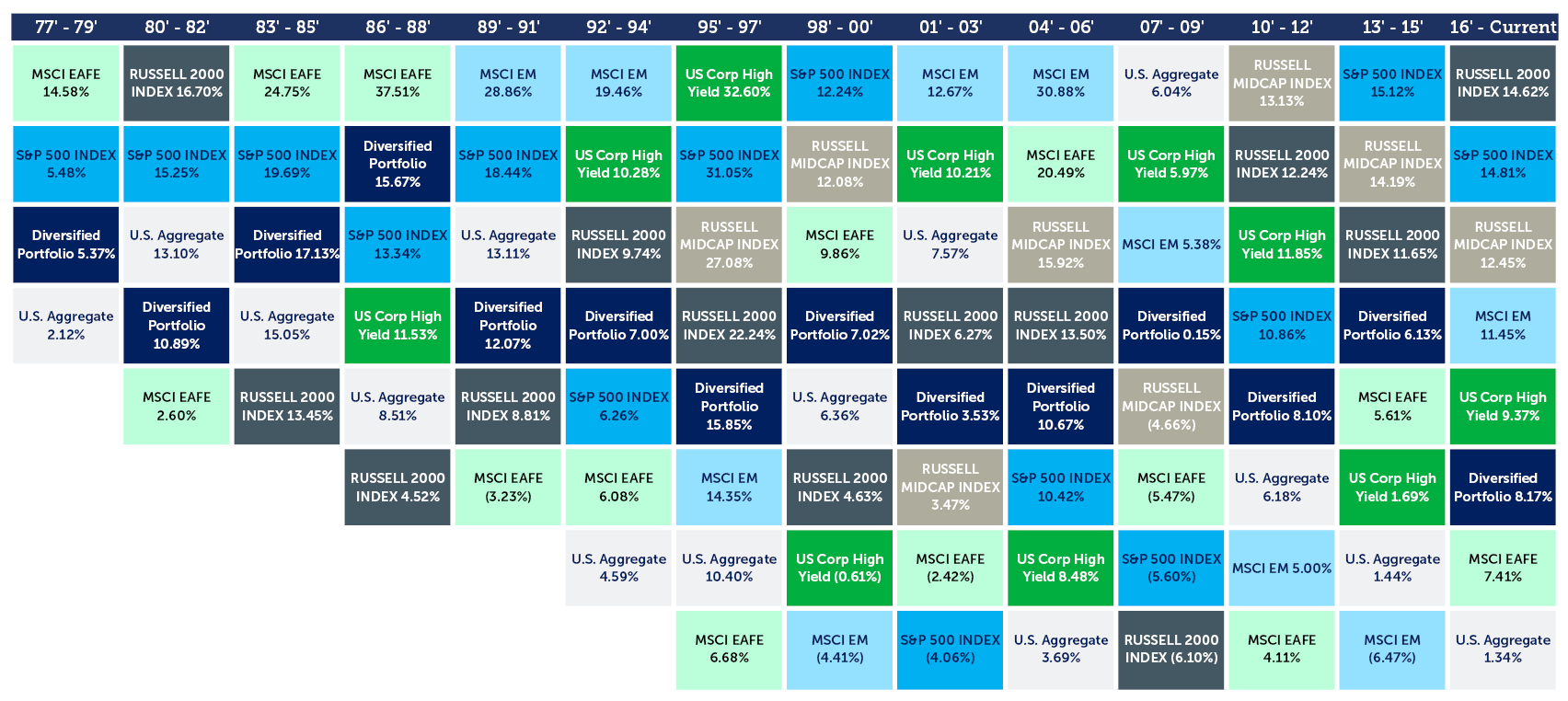

Long-term is more than six months

Theme: In light of recent market performance, investors may be tempted to forego their balanced portfolios in favor of the latest hot asset class. Does the possibility exist to accurately time market cycles in order to consistently ride the highest wave of market returns? We do not believe so. Our professional experience and research suggests that long-term investment success is driven mostly by factors that are within the control of investors. We believe the long-term investor is best served by adhering to a disciplined investment process, saving more, working longer and spending less. These controllable factors, coupled with managing returns through smart tax management, far outweigh the impact of changing a portfolio's asset allocation based on anticipated market conditions.

Source: Bloomberg

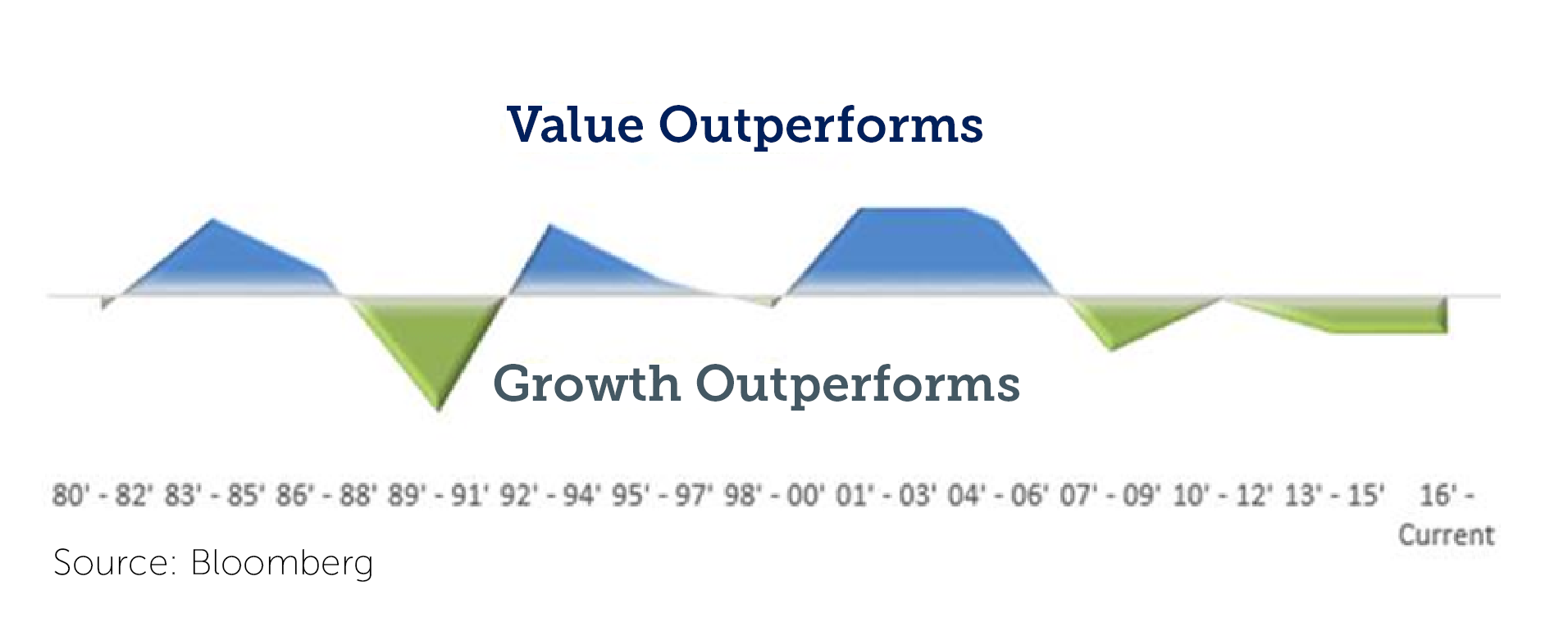

Equities: Growth vs Value

- In U.S. Equities, Growth and Value stocks follow a cyclical pattern of outperforming each other.

- Over the longer historical period, Value slightly outperforms.

- Balanced portfolios will maintain an allocation in both Value and Growth.

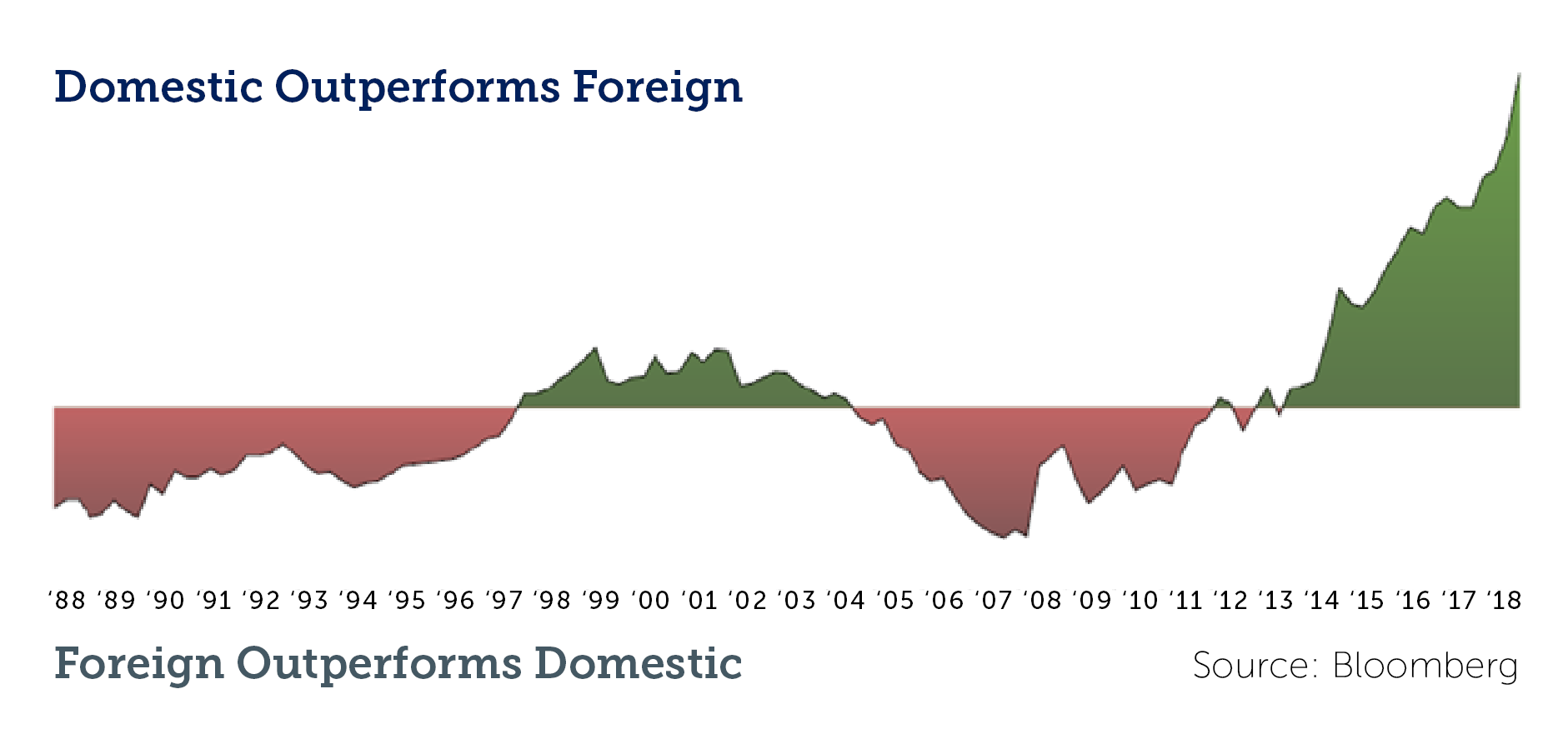

Equities: U.S. vs International

- Much like the performance cycle between Value and Growth Equities, there is a cyclical outperformance between U.S. Equities and International Equities.

- Recent strength in the U.S. Dollar has diminished the performance returns of International Equities for the U.S. investor.

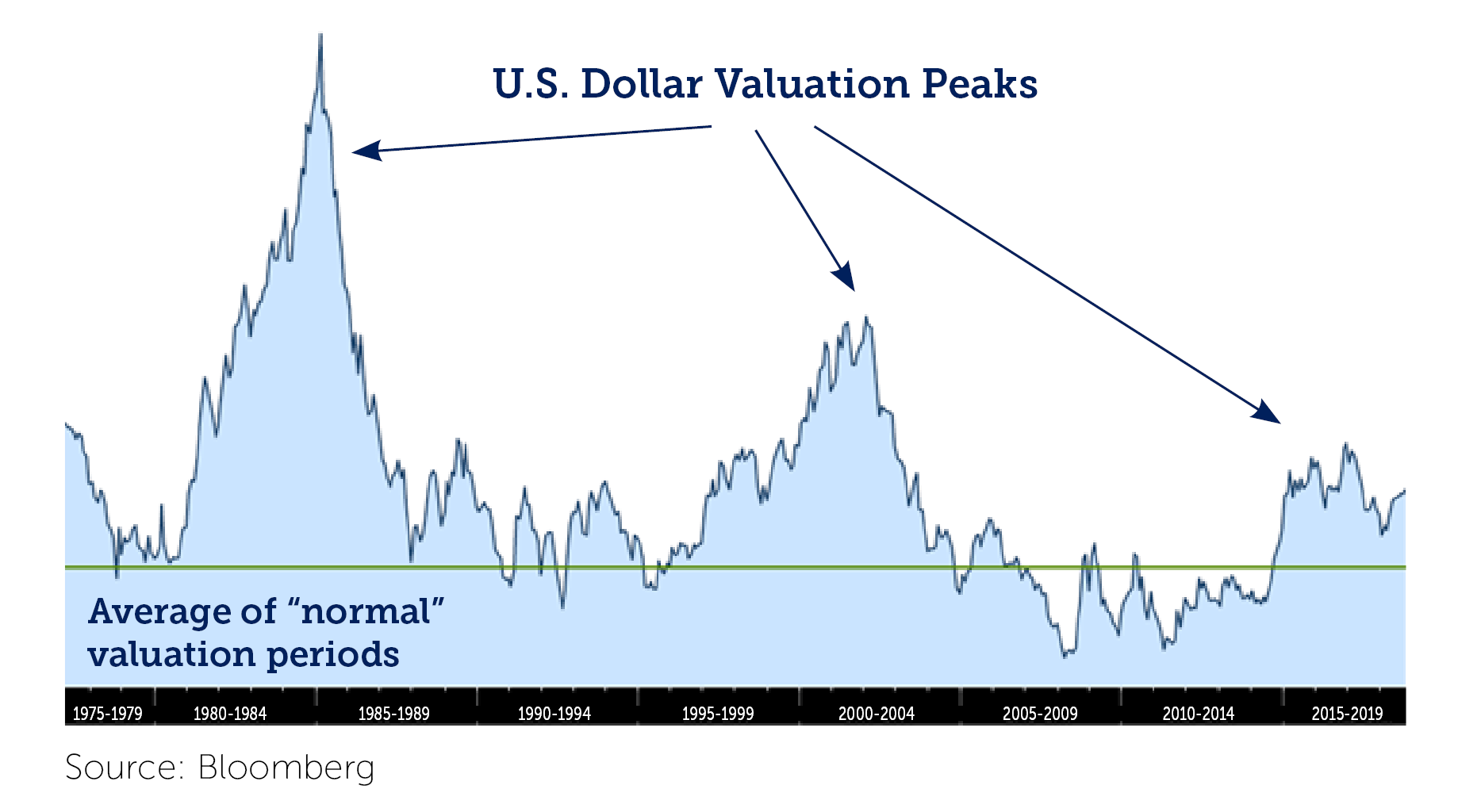

U.S. Dollar Valuation

- The U.S. Dollar has experienced above-normal valuations for several years.

- For the typical investor, a strong U.S. Dollar has far-reaching effects into performance of international markets and alternative investments and can alter the risk profiles of many portfolios.

Economy

- The economic expansion showed continued strength as the consensus estimate for Q3 GDP growth in the U.S. is 3.2%. In June 2018, the U.S. economic expansion became the second longest since WWII and, if it continues, will become the longest ever in June 2019.

- The Personal Consumption Expenditure (PCE) index – which is the Fed's preferred measure of overall inflation, increased 2.3% year over year in July (the most current reading), which is generally in line with the Fed's target.

- GDP growth should moderate due to increased borrowing costs and a less accommodative monetary environment, indicative of a late-stage business cycle.

Equity

- Market volatility in 2018 has returned to more historical levels as global equity markets corrected from all-time highs.

- Tax reform and favorable administrative policies should continue to fuel earnings growth in the short term, providing a foundation for tailwinds for equity markets.

- Developed and Emerging Markets continue to enjoy economic expansion but have been hampered by protectionist U.S. trade policies and a strong U.S. Dollar.

Fixed Income

- Fed rate increases have resulted in a flattened yield curve as long bond rates have been slow to react. Current projections call for one more Fed rate hike in December and another two to three Fed rate hikes in 2019.

- Long-term U.S. bond yields will continue to be pressured by high demand from the yield-starved global bond market.

- Prudent investors should avoid the temptation to reach for yield by positioning portfolios with shorter maturities and higher quality, emphasizing total return over yield.

Alternatives

- As market volatility and the strength of the U.S. Dollar return to more normalized levels, Alternative Investments may play an increasingly important role in supporting a diversified source of returns and risk exposure.

- Our allocation to Real Asset strategies continues to generate positive performance and protect portfolios against rising inflation. With the potential for higher inflation, Real Asset strategies may continue to experience upward momentum.

The INTRUST Market Perspectives are the consensus of the INTRUST Bank, N.A. ("INTRUST") Wealth Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)