In January, we published our 2020 Perspectives. Recession seemed unlikely then, and market expectations were cautiously optimistic. So much has changed. At midyear, we find ourselves in a pandemic-induced recession with double-digit unemployment. Markets have plummeted and bounced upward but remain volatile.

What might be next for the economy and markets? This midyear outlook attempts to answer this challenging question by examining potential recovery paths for the U.S. and regional economies. The political landscape and upcoming U.S. elections are also considered in this midyear update. Lastly, timely considerations for investors are highlighted.

U.S. Economy — Three Scenarios

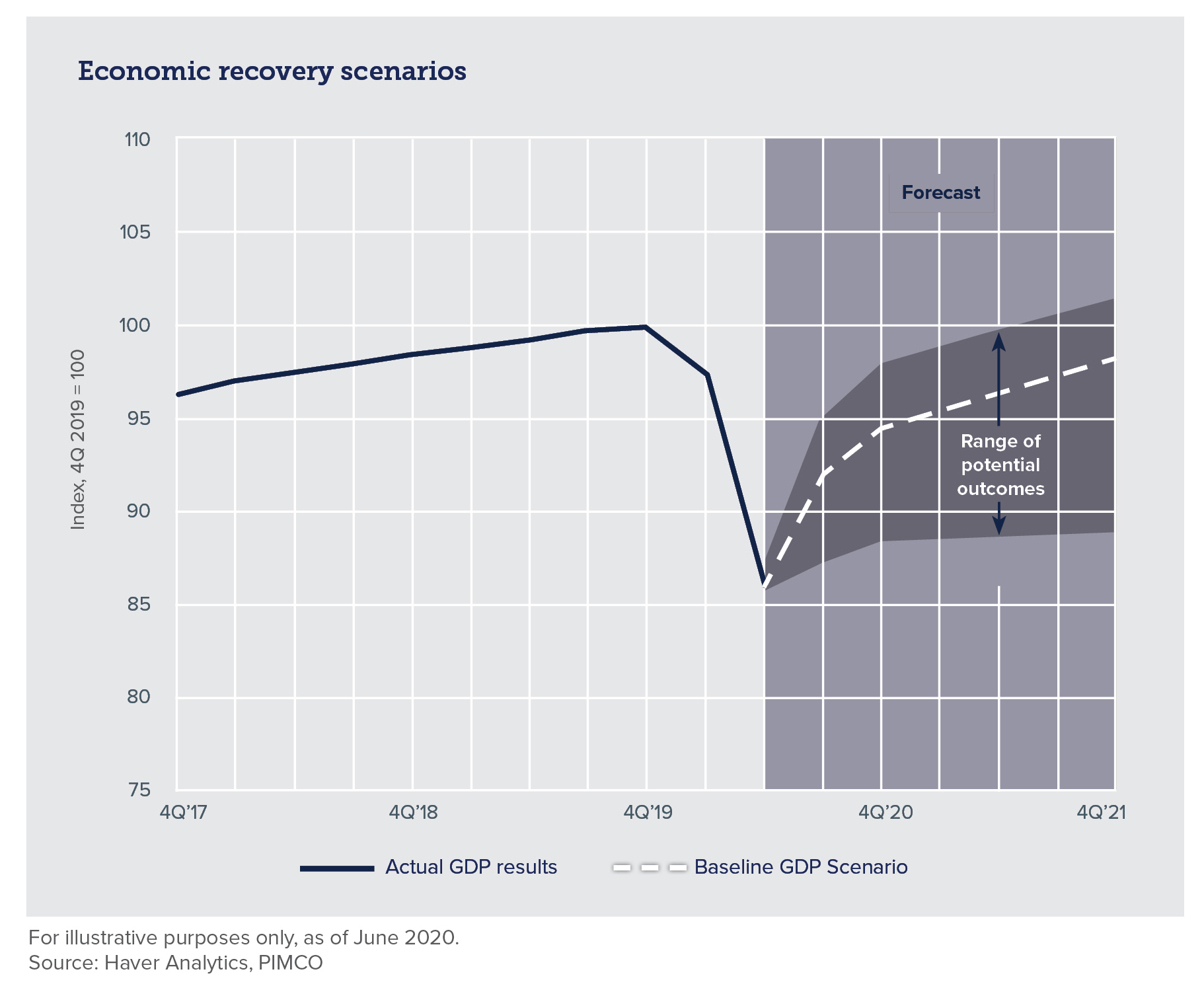

As we enter the second half of the year, the U.S. economy is showing signs of recovery. We anticipate a near-term rebound in economic activity. However, we believe a full recovery may not occur until a vaccine is widely distributed and the need for social distancing subsides.

Our baseline scenario — a sharp rebound in economic activity followed by a long climb to full recovery — is an outcome with much uncertainty. Potential progress or setbacks related to the pandemic could easily tip the economy into better or worse trajectories than anticipated.

A better-than-expected outcome for the economy could emerge if a vaccine is developed later this year or early next year, reducing the need for social distancing. Unfortunately, predicting the timing of such a cure is virtually impossible — even for scientific experts.

A less optimistic scenario could unfold if strong second waves of COVID-19 infections become widespread, leading to mandated or voluntary shutdowns. As mobility and economic activity increases, certain regions are experiencing a re-acceleration in new infections. However, the extent and strength of these second waves remain unknown.

Other economic risks are present but have been overshadowed by the pandemic. Trade tensions between the U.S. and China could reemerge and derail a fragile economic recovery. Also, the U.S. elections in November create further uncertainty, potentially delaying business investment and slowing the recovery. Furthermore, significant levels of stimulus have helped consumers and businesses through the pandemic but increase the likelihood of higher inflation, higher interest rates and higher taxes in the future.

Regional Economies — Kansas, Oklahoma and Arkansas

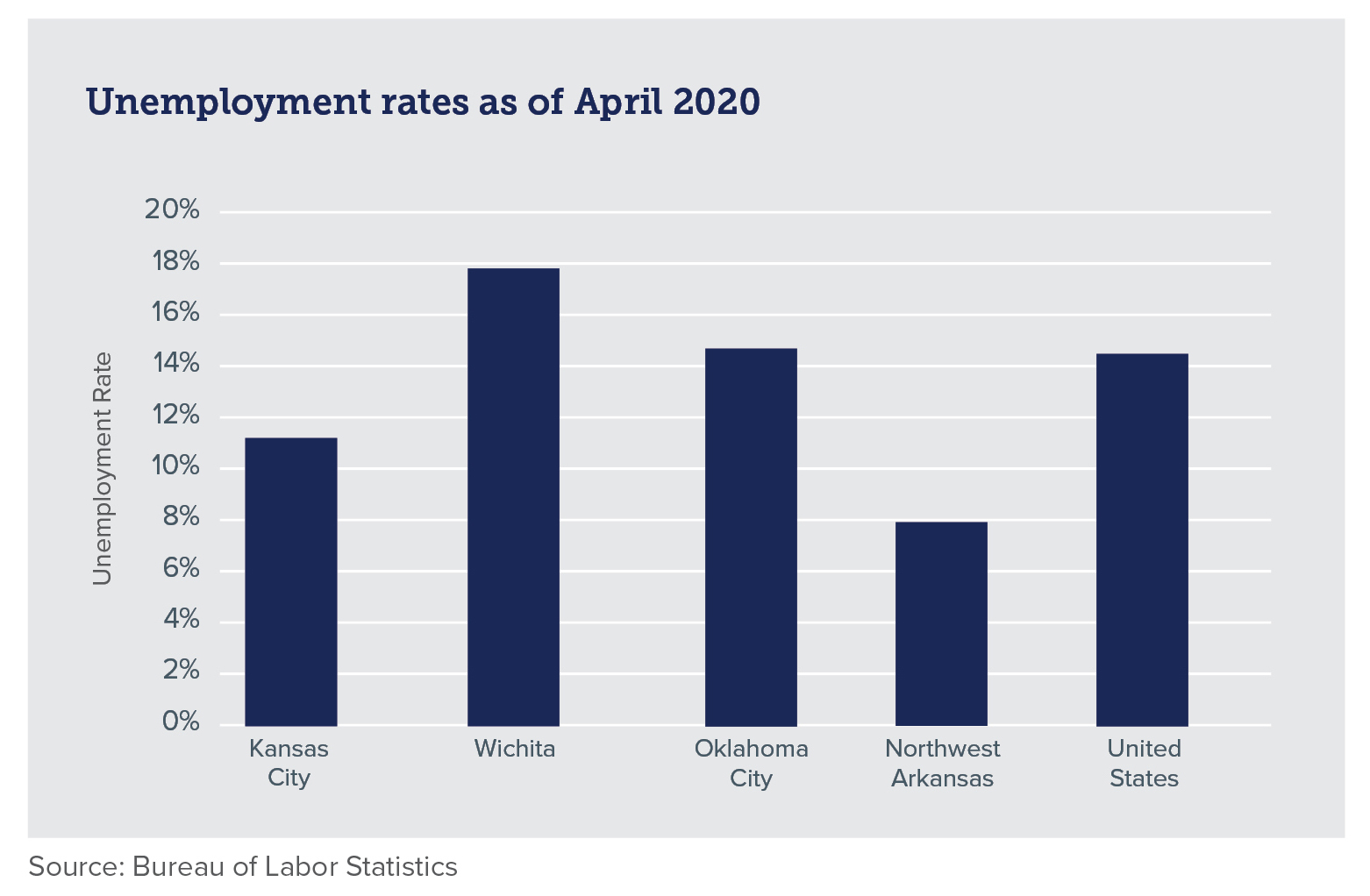

Kansas, Oklahoma and Arkansas did not escape the economic hardships caused by COVID-19. The Kansas City (KC) metro region and Northwest Arkansas (NWA) have fared better than Wichita and Oklahoma City (OKC) during the downturn. In April, KC's and NWA's unemployment rates fell to 11.2% and 8.0%, respectively, compared to 17.8% unemployment rate in Wichita and 14.8% in OKC. Economic sensitivity to the aerospace industry hurt the South Central Kansas economy, and sensitivity to changes in oil prices led to further economic declines in Oklahoma.

Given KC's diversified economy, its recovery may closely mirror the nation's path toward economic stabilization. NWA's population growth, distribution capabilities and concentration of consumer staples suppliers may position this region for accelerated recovery compared to other regions in the U.S. In contrast, Wichita's exposure to aerospace, agriculture and manufacturing may lead to a longer recovery time for the local economy as well as higher levels of unemployment. How quickly oil prices recover will be an important factor for the OKC economic outlook. Despite these regional differences, these four local economies will be largely influenced by the degree of success in containing the spread of the virus — both locally and nationally.

U.S. Elections and Federal Finances

Incumbent presidents normally win reelection unless a recession occurs. If this trend persists, President Trump may face an uphill battle considering the current recession and high unemployment. Given this economic backdrop, presumptive Democratic nominee Joe Biden appears to be the frontrunner. During his campaign, former Vice President Biden will likely stress his experience in the aftermath of the Great Recession.

Swing states in the 2016 election will likely play a decisive role in 2020, too. The economic conditions of these key states may be the deciding factor in this year's presidential election.

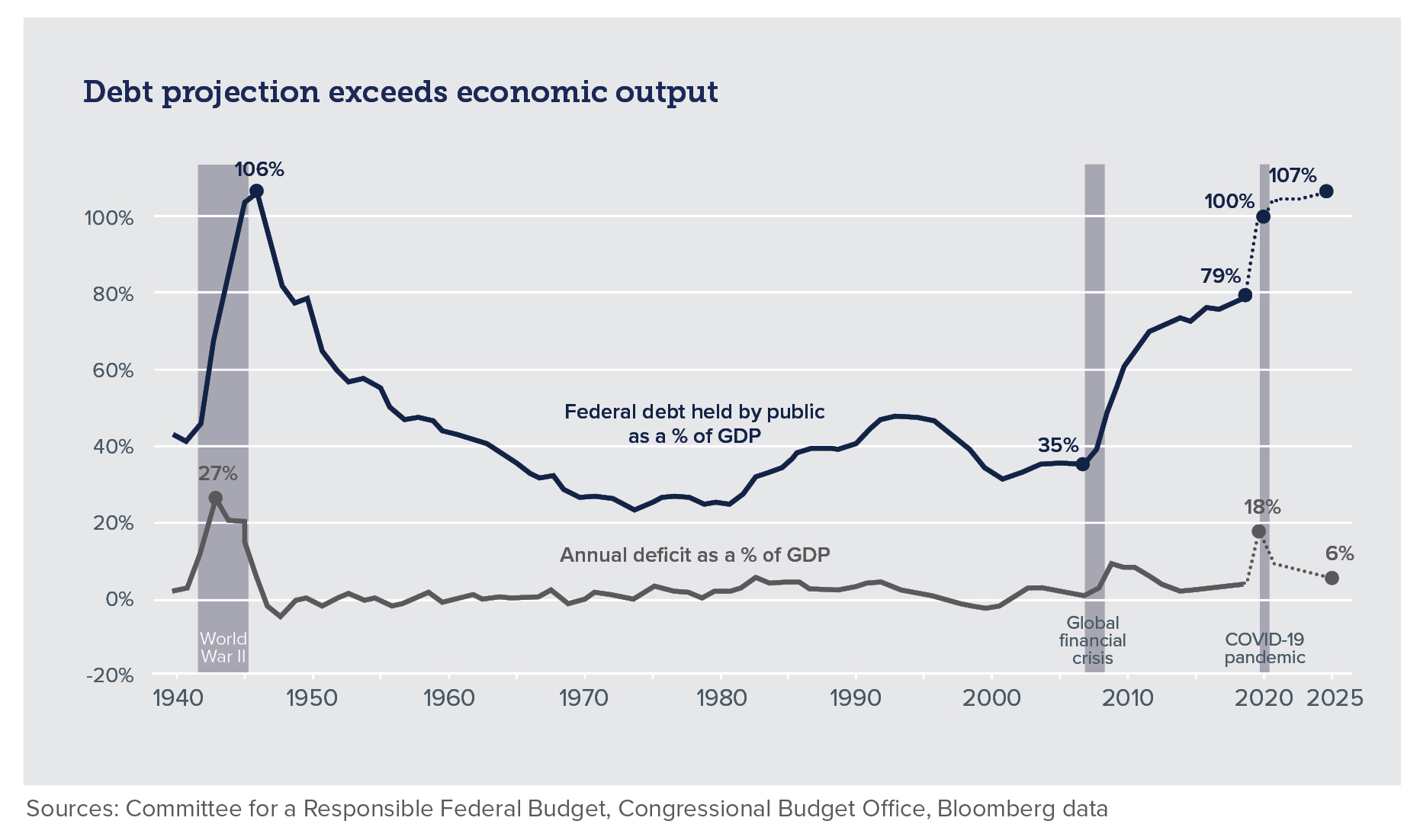

Rebuilding the economy will be the initial focus of the next presidential term. However, once the economy is back on track, addressing the growing federal debt and worsening budget deficit will likely become priority for policymakers. Mounting debt and easy monetary policy may lead to higher inflation. In turn, the Fed may be forced to raise rates, making government debt expensive to service. To restore our country's finances, taxes may have to be raised or spending cut — both unpopular choices among the electorate.

Investment Implications

Under normal economic conditions, returns are usually lower and volatility higher in election years. However, recessionary environments can magnify these trends — as last experienced during the financial crisis in 2008. This year, returns and volatility will likely be more attributable to the pandemic than the elections.

Equities

Why have equity markets rallied so much since hitting lows in March? The most plausible explanations relate to the massive fiscal and monetary policy response and to a slowdown in COVID-19 cases in the U.S. While there are good reasons for the market's resiliency, we encourage investors not to become too optimistic about further advances until the economy stabilizes, corporate earnings recover and/or medical progress is made.

Fixed Income

For the first half of 2020, high quality fixed income performed well. Yields fell and bond prices rose as recessionary concerns emerged, the Fed cut rates to effectively zero, and quantitative easing (QE) was reintroduced. With the Fed balance sheet ballooning to over $8 trillion, higher inflation could emerge, potentially pushing yields higher. Yet, yield increases may be limited given the uncertainty of the fragile economic recovery. Accordingly, we believe fixed income return expectations should be tempered and bond exposure should be weighted toward higher quality issues.

Portfolio Considerations — Four Actions to Consider

During this period of unprecedented volatility, investors may be tempted to focus on short-term market returns rather than long-term goals and objectives. The extraordinary events of the past few months serve as a reminder of the importance of maintaining a disciplined investment approach. Below are four smart actions for investors to consider for the remainder of 2020.

Reassess risk willingness and risk capacity

Risk willingness refers to an investor's subjective aversion to risk, whereas risk capacity objectively measures an investor's financial ability to assume risk. Willingness and capacity to take risk may not always align. For example, an investor with high assets and low liabilities may be able to assume a lot of risk but desires to invest conservatively given a personal aversion towards risk. It is vital that both these measures of risk be met, giving investors the confidence to stick with their financial plan during volatile markets. If market swings are causing anxiety, such an investor — with the help of their advisor — should reassess his or her risk willingness. They also should determine if the investor has sufficient financial capacity to assume less risk while still being able to meet his or her long-term goals.

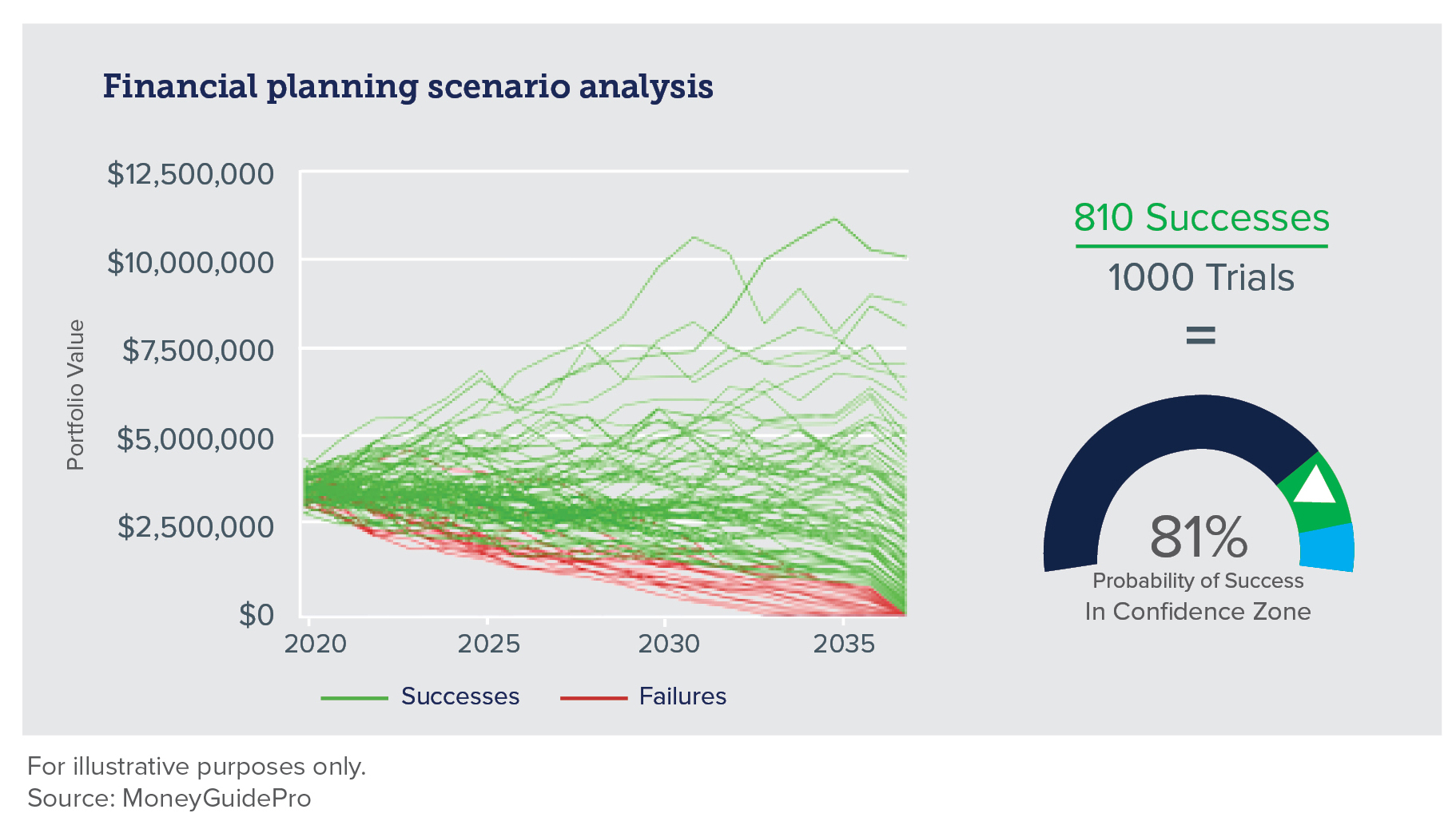

Stress test portfolios

A practical way to assess risk capacity is to stress test portfolios. With the help of financial planning software, advisors and clients can evaluate different market scenarios and gauge the impact of these scenarios on the client's financial plan. Undertaking such an analysis helps investors refocus on their overall plan and long-term investment objectives rather than worrying about short-term market fluctuations.

Lower taxes

Will tax rates in the future go up, go down or remain the same? The burgeoning amounts of government debt suggest tax rates will likely be higher. By using tax-smart strategies now and over time, investors can keep more of their dollars working for them. One such strategy is asset location that takes advantage of different types of investments getting different tax treatments. Using this strategy, advisors help clients determine which investments should be held in tax-deferred accounts and which in taxable accounts to maximize after-tax returns. In market downturns, tax-loss harvesting and Roth IRA conversions are two other tax-smart strategies that may be appropriate for clients to consider.

Maintain adequate liquidity

Selling investments to fund spending needs during market downturns can be costly. Accordingly, it is important for investors to assess their ongoing liquidity needs. Investors with near-term spending requirements generally should have sufficient cash savings to cover these funding needs without having to dip into their portfolios at inopportune times. An important benefit of working with a bank wealth management team is access to a comprehensive set of liquidity, lending and investment solutions. Our experience suggests that clients who appropriately balance their income needs with longer-term investment goals have less concern over short-term market fluctuations and have greater confidence in achieving their long-term financial goals.

The INTRUST 2020 Midyear Outlook is the consensus of the INTRUST Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as recommendation to buy or sell securities or to participate in any investment strategy. The Forward-Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

07/13/2020

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)