As we enter the fourth quarter of 2025, our Quarterly Perspectives dive deeper into key economic and financial themes shaping the current landscape. For this quarter we explore labor market trends, earnings growth, drivers of headline CPI inflation, and expectations for the Federal funds rate. Beyond the markets, we also highlight foundational topics in financial planning, including generational wealth, charitable giving, focusing on controllable factors in your retirement plan, and fostering well-being in retirement.

Economic and Market Views - Keeping an Eye on Labor

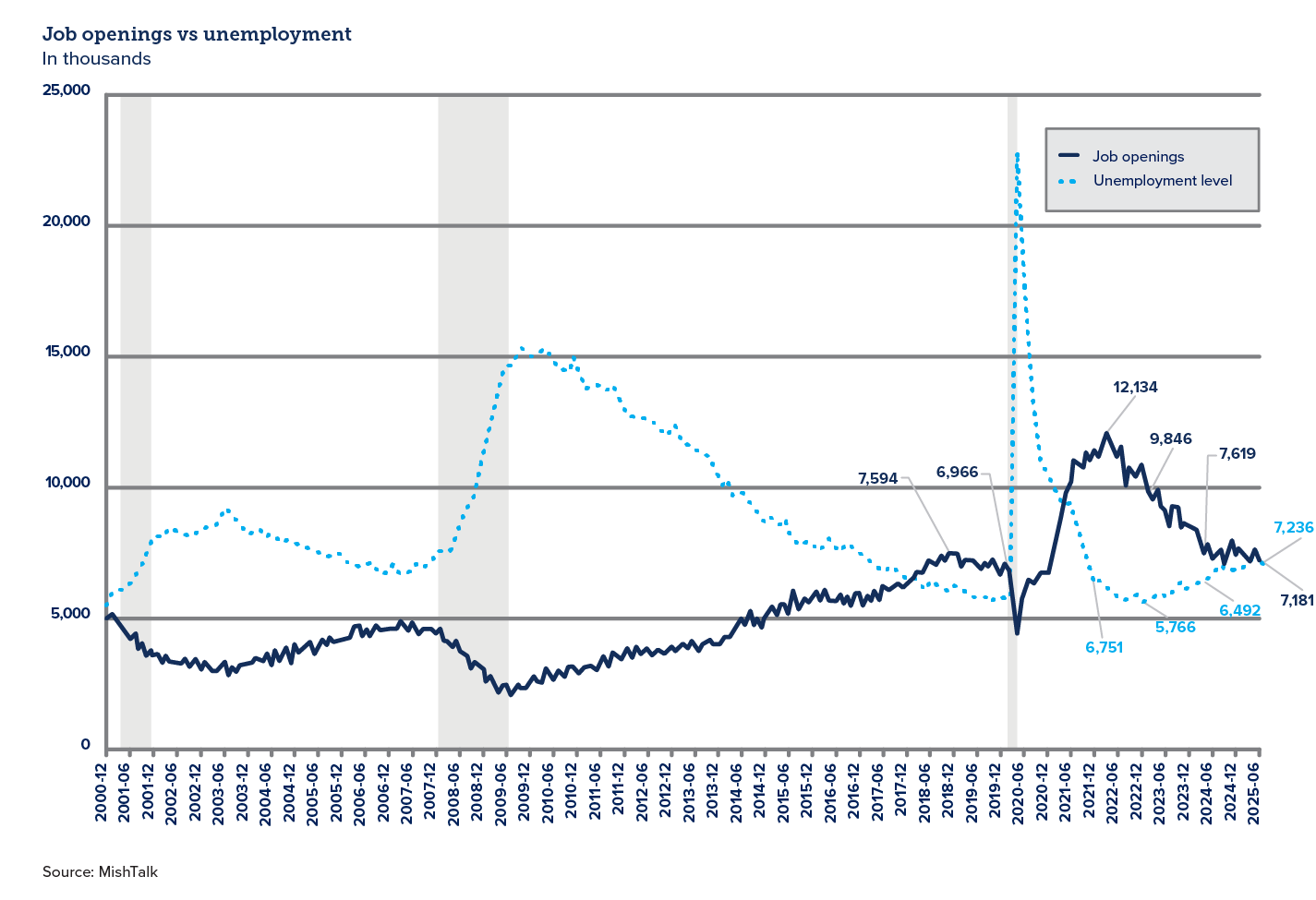

Following the labor market upheaval brought on by the US response to the COVID virus, labor supply and demand are returning to a state of equilibrium. At one point following the pandemic, there were two open positions for every unemployed person. That ratio has diminished to parity between the two and a tighter job market for the unemployed.

Economic and Market Views - Earnings Expand Broadly

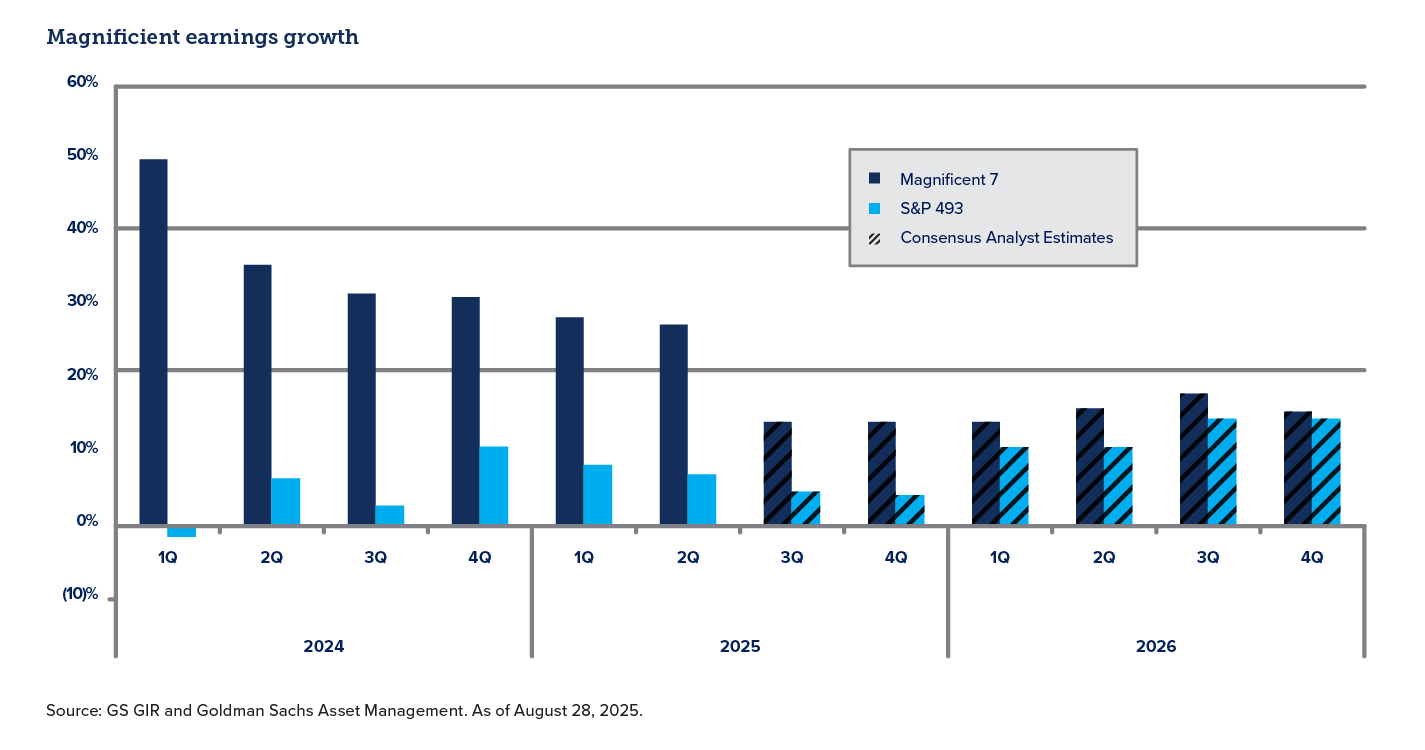

Recently, the US stock market has been largely driven by outsized growth and earnings from the Magnificent 7 (Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta, and Tesla). While recent estimates continue to call for strong earnings growth from the Mag 7, earnings growth from the remaining 493 companies in the S&P 500 is accelerating and should provide support for higher valuations.

Equities

The 2Q earnings season has reaffirmed the earnings exceptionalism of the mega-cap tech stocks, defying market expectations that the earnings gap between the Mag 7 and the rest of the S&P 500 might narrow in the shorter term. The Mag 7 have seen 28% year-over-year EPS growth in 2Q, compared to 7% for the rest of the S&P 500, leading to a larger gap in earnings growth rates than consensus estimated at the beginning of earnings season (21 bps vs 14 bps). The fundamental strength of the mega-cap tech stocks has the potential to offset the impact of cyclical weakness and serves as one of the key sources of upside risk to GIR’s S&P 500 forecasts.

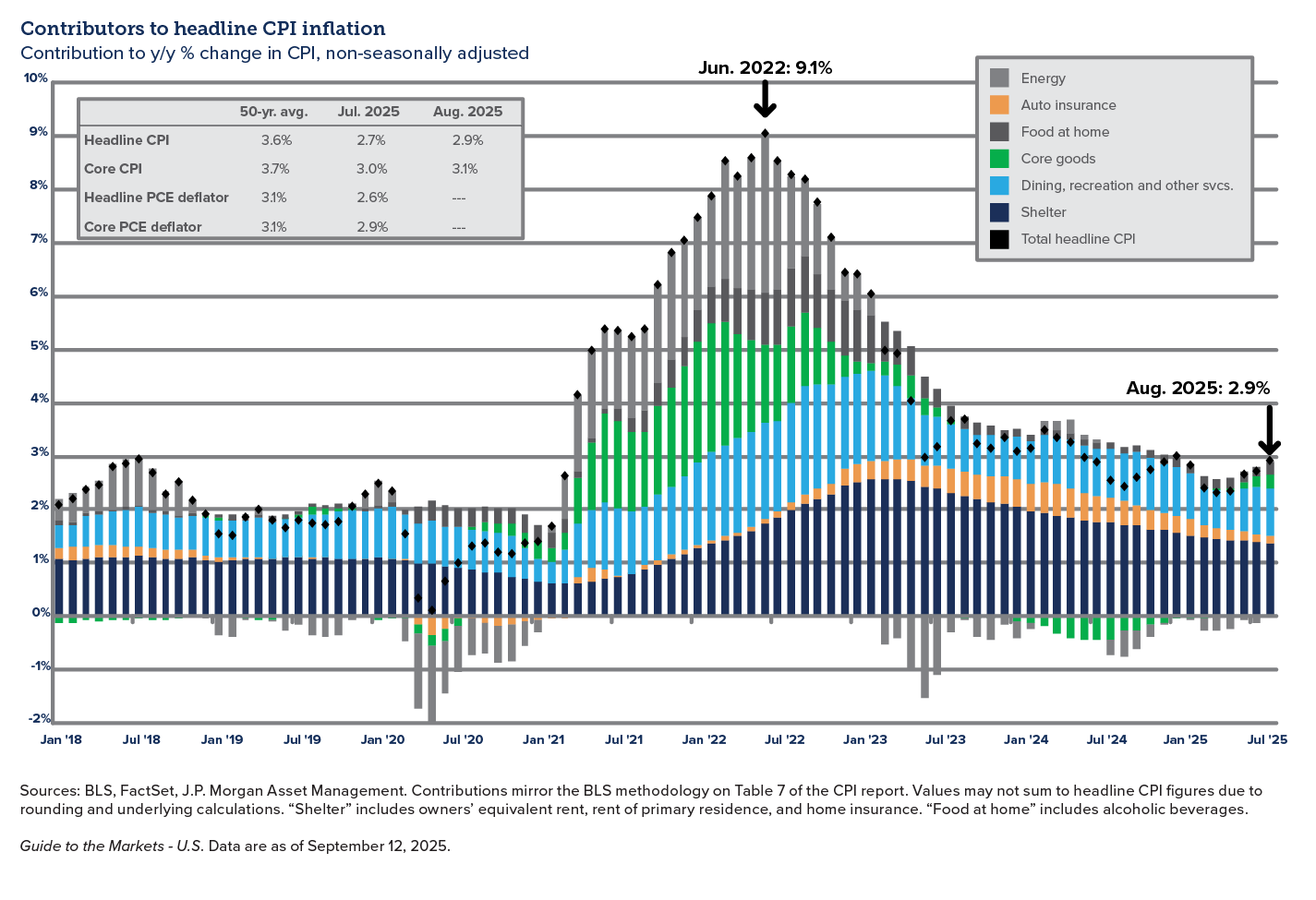

Economic and Market Views - Inflation Components

Inflationary pressure has stabilized in the 2.5-3.0% range in recent months, supported by continued strong demand for housing and an uptick in dining and recreation. While the Fed is committed to a return to 2% inflation, reaching that goal will likely take longer than originally expected.

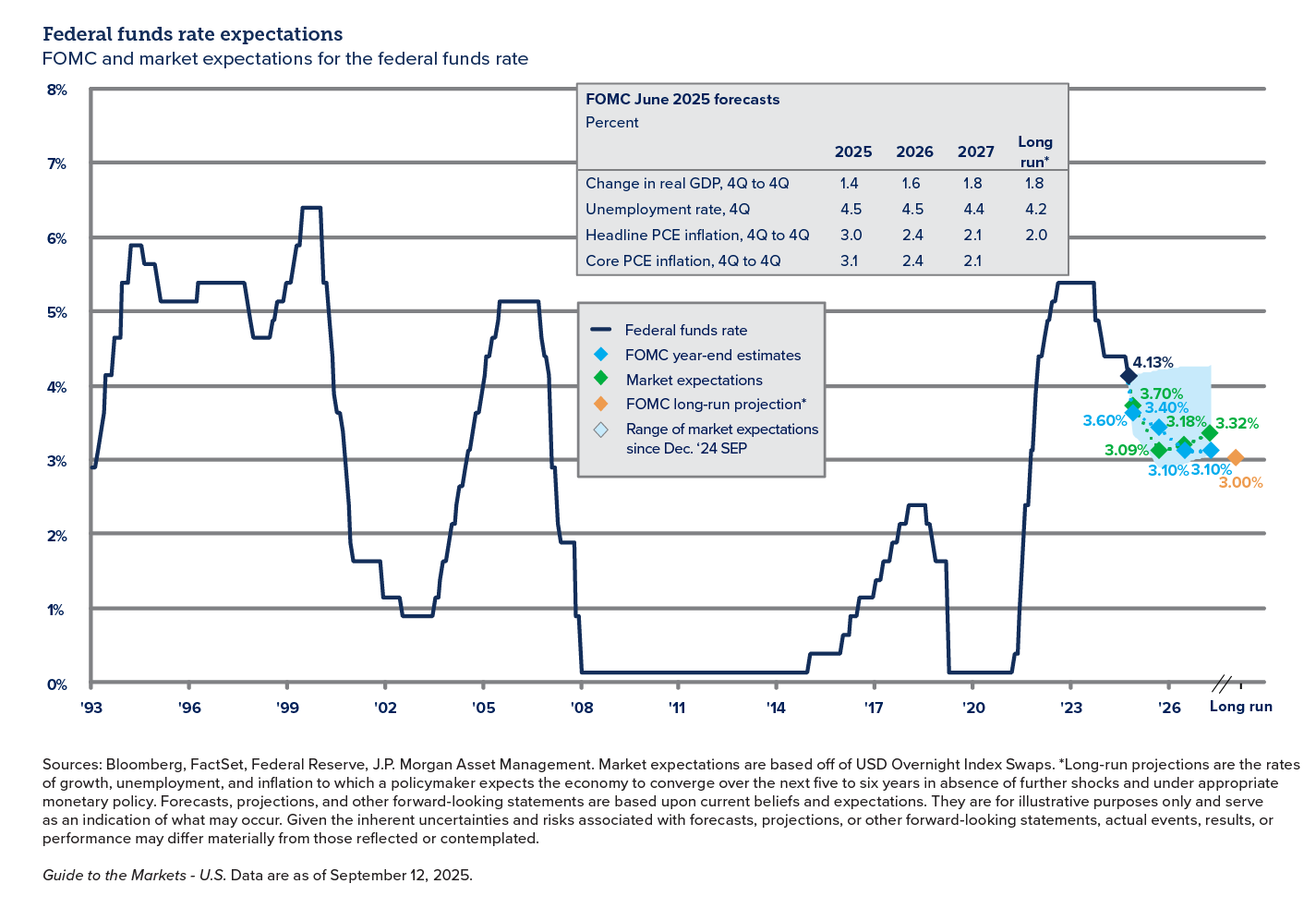

Economic and Market Views - The Fed and Interest Rates

The Fed appears to remain committed to reducing their short-term “Fed rate” through a series of small cuts in the coming months. The current outlook from both the Fed and the financial markets calls for one 25bps cut in the October meeting and another 25bps cut in the December to January timeframe.

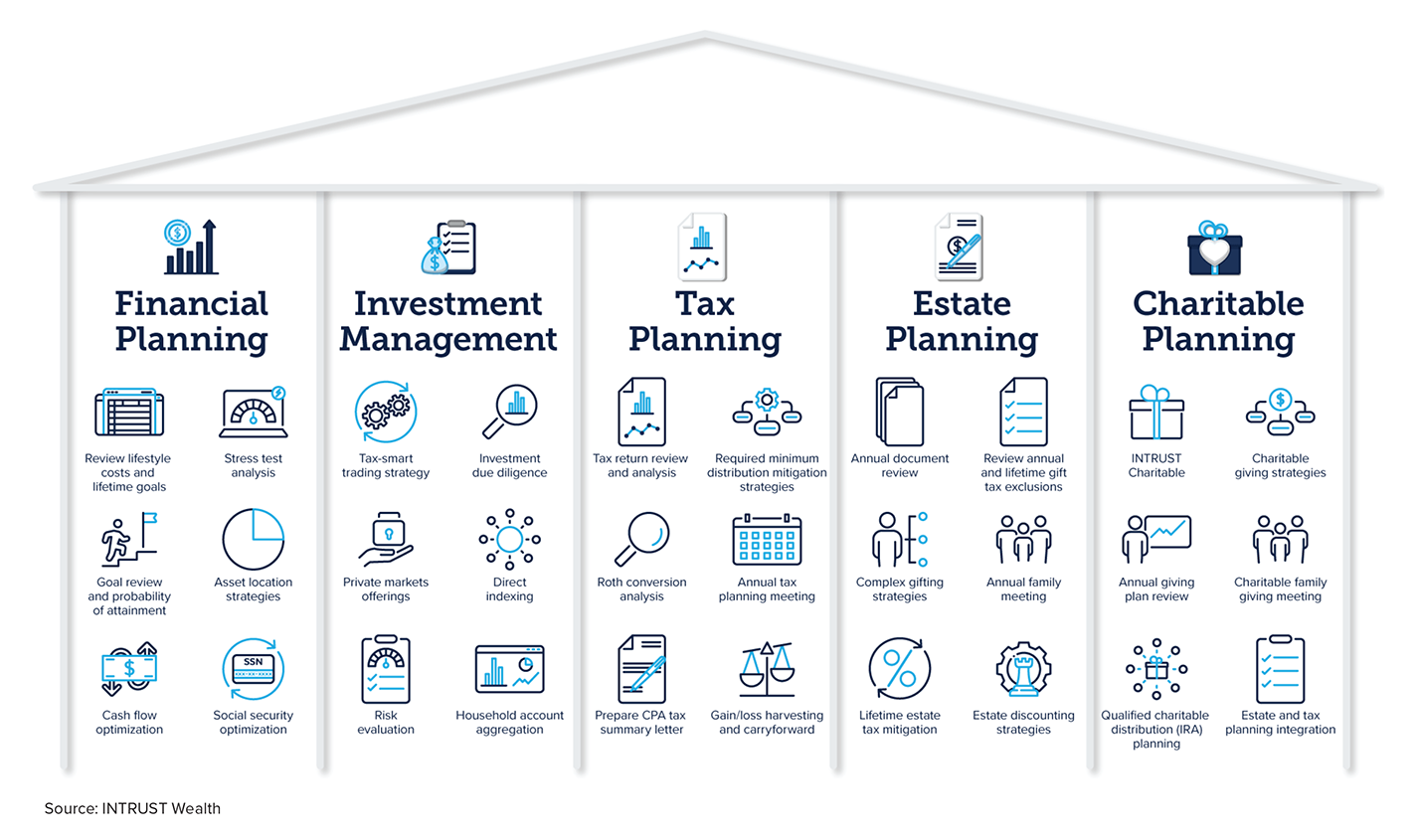

The Pillars of Generational Wealth

Our multi-pillared approach helps you consider how various aspects of generational wealth can work together to mitigate risks, maximize returns, and build an enduring legacy. INTRUST Wealth customers can expect the services below and more from their advisory team across our five pillars.

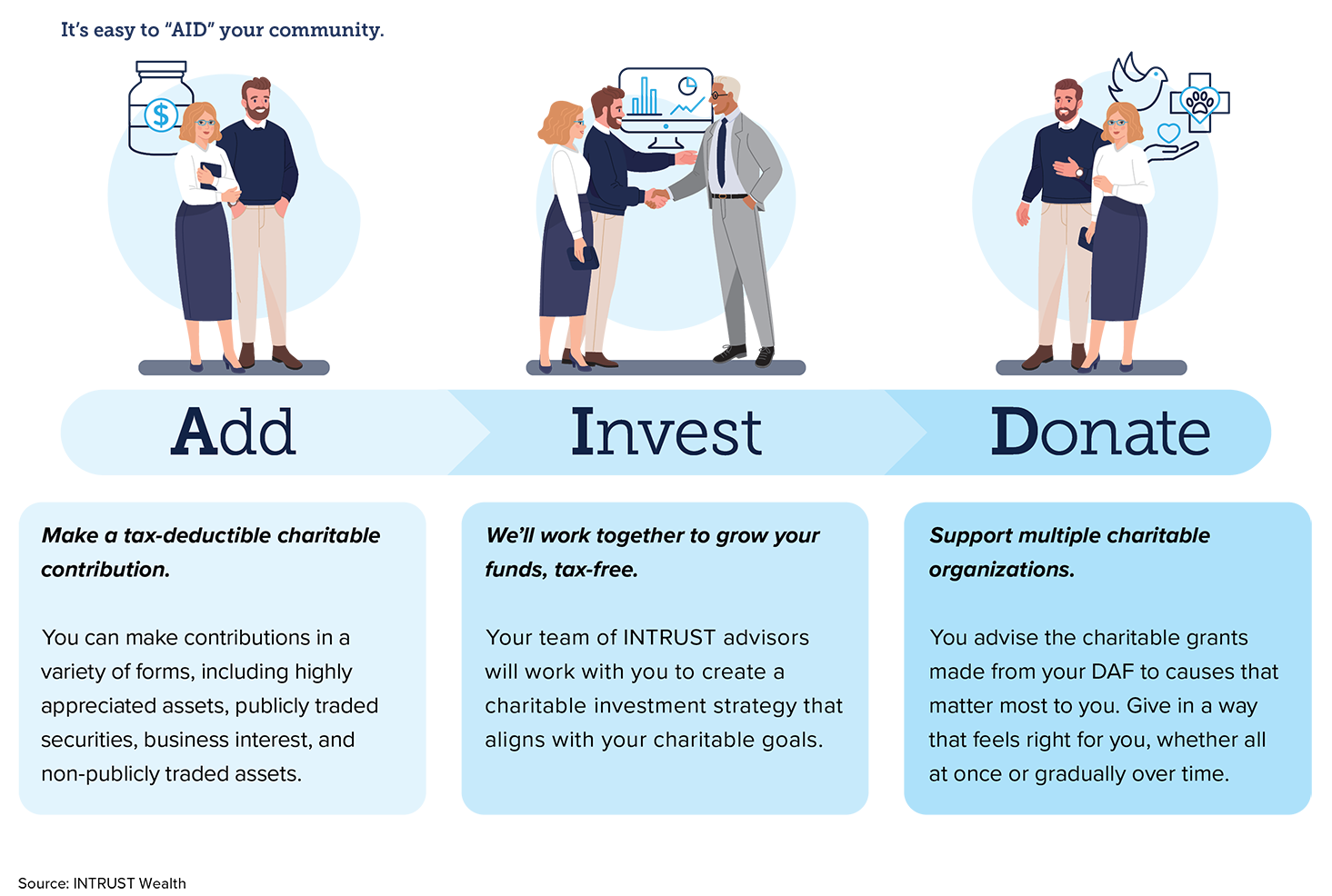

Charitable Planning - INTRUST Donor Advised Fund

INTRUST Wealth is pleased to offer the INTRUST Donor Advised Fund to provide our clients with a flexible vehicle for charitable giving in a tax efficient manner.

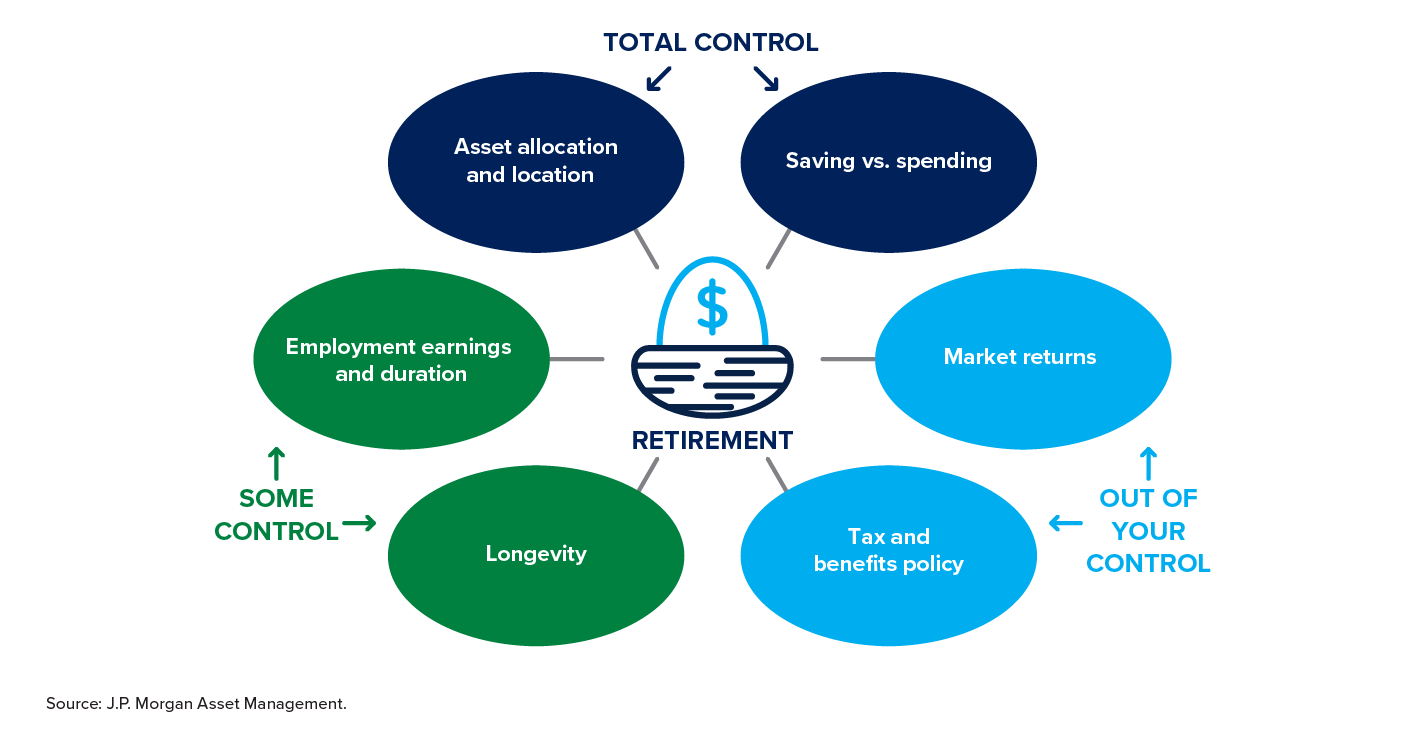

Financial Planning - Focus on What You Can Control

Investors often focus on market returns and tax policies, factors that are completely out of our control. However, a successful retirement can be greatly affected by areas that are within our control, such as asset allocation and our savings and spending habits. Focus on those areas you can control to take ownership in your successful retirement picture.

Lifestyle Planning – Fostering Well-Being in Retirement

A successful retirement is characterized by much more than money. With retirements often spanning 30+ years, a prudent investor should focus on your PUSH – Purpose, Usefulness, Socialization, and Health.

Know what you are retiring to, not just what you are retiring from.

To make the most of your retirement years, using time to "PUSH" may improve your outlook and life satisfaction.

Source: Source: PNAS.org, Vol. 116, No. 4, Leading a Meaningful Life at Older Ages, January 22,2019, Volume 8, Article 517226; Journal of Gerontology, 2019, 65:634-639, Investing in Happiness: The Gerontological Perspective, by Andrew Steptoe; PRB.org, online resource library, Happily Ever After? Research Officers Clues on What Shapes Happiness and Life Satisfaction after Age 65, website as of October 18, 2023.

Guide to the Markets - U.S. Data are as of June 12, 2025.

The INTRUST Quarterly Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third-party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third-party information. INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information. The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Quarterly Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

10/29/2025

Category:

Related Blog Posts

.png?Status=Temp&sfvrsn=91c53d6b_2)