As we enter the third quarter of 2025, our Quarterly Perspectives dive deeper into a variety of current topics. For this quarter, we have assembled several different graphics to illustrate different approaches to your financial planning, and key themes currently impacting the markets. Read on to learn more about pillars of generational wealth, benefits of a goals-based approach, consumer strength and sentiment as it relates to the economy, tariffs, and federal fund rate expectations.

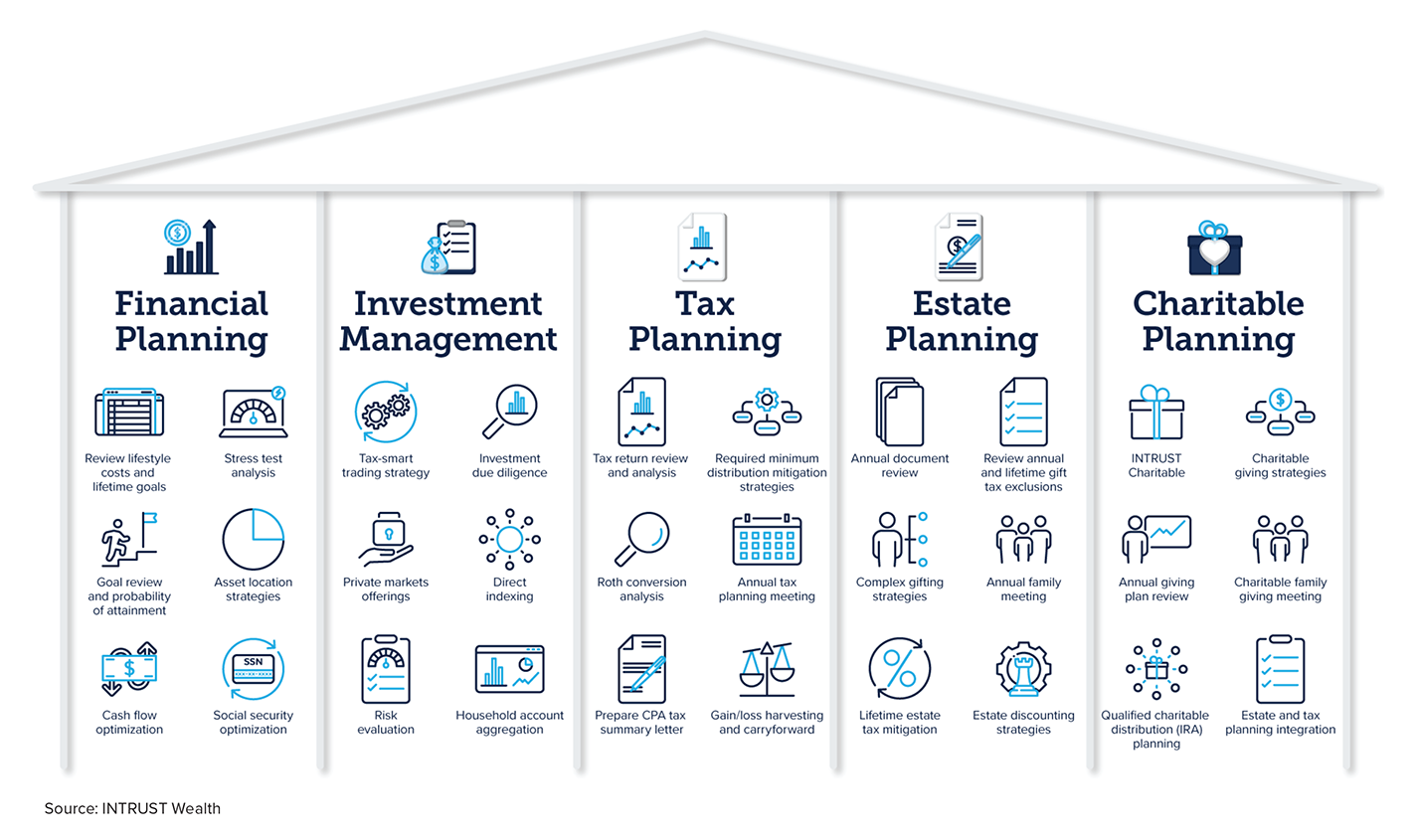

The Pillars of Generational Wealth

INTRUST's multi-pillared approach helps you consider how various aspects of generational wealth can work together to mitigate risks, maximize returns, and build an enduring legacy. INTRUST Wealth customers can expect the services below and more from their advisory team across our five pillars.

FINANCIAL PLANNING - The Benefits of a Goals-Based Approach

A goals-based approach is a holistic strategy that simultaneously aligns all aspects of your financial life with your personal objectives. This can increase efficiency and enhance communication and understanding, creating a more cohesive wealth management experience.

Consumer strength drives the US economy

The US economy is 70% consumer driven so a strong US consumer should translate into good news for the economy. The current debt picture for US households remains healthy in spite of renewed emphasis on repayment of student loans. Strong recent growth in real estate values coupled with financial market performance continues to support household debt at reasonable levels.

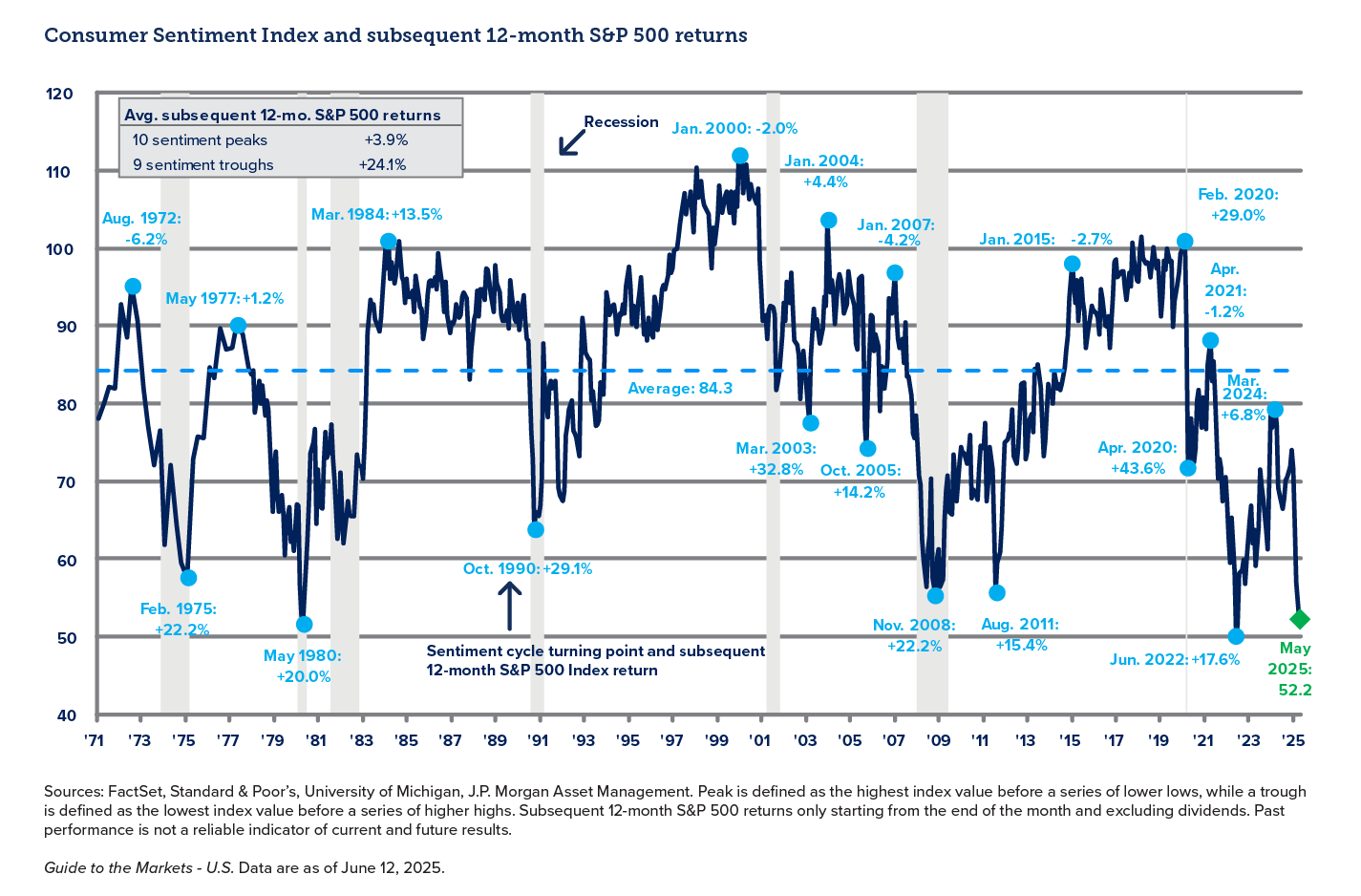

Consumer confidence and the stock market

Warren Buffett’s famous quote “Be fearful when others are greedy and be greedy only when others are fearful" seems applicable to our current market environment. Despite healthy balance sheets, consumer confidence is low, which is often a good indicator of positive market returns in the months ahead.

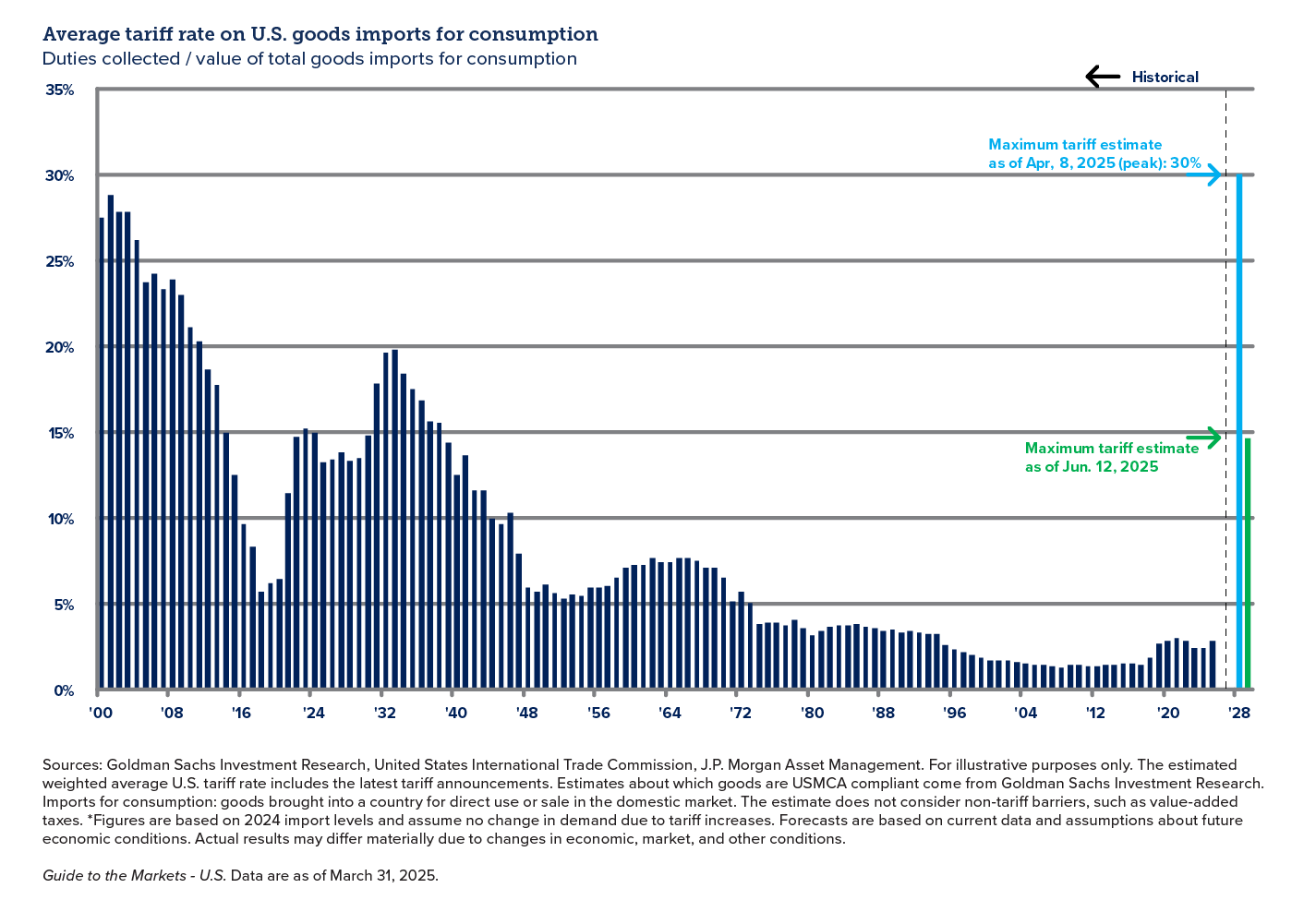

Tariff uncertainty likely to bring market volatility

President Trump’s tariff policy remains volatile and lacks clear direction which has led to significant market swings in 2025. We expect this situation to continue, but with less violent swings in the markets as investors digest the impact tariffs will have on global trade.

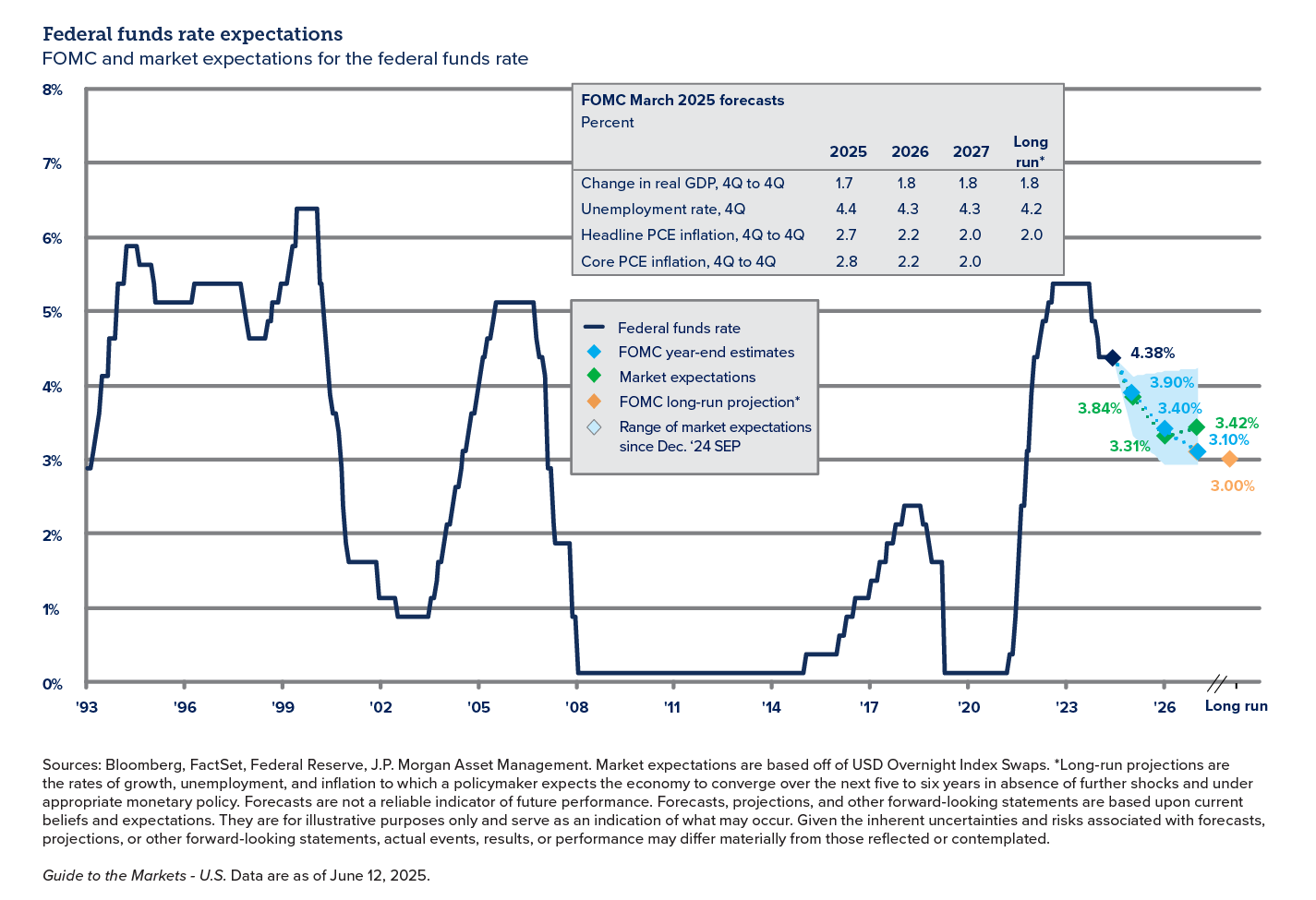

The Federal Reserve and interest rates

All eyes remain on the Federal Open Market Committee (FOMC), a committee within the Federal Reserve, particularly around the pace of future rate cuts. At the moment, the FOMC and the markets are in rough agreement on the pace of cuts but monthly economic data and pressure from the Trump administration will continue to be a factor.

The INTRUST Quarterly Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third-party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third-party information. INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information. The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Quarterly Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

07/24/2025

Category:

Related Blog Posts

.png?Status=Temp&sfvrsn=91c53d6b_2)