Advantage Checking

Put your money to work and get more perks

Advantage Checking gives you all of the benefits of our Free Checking account, plus free personal checks, free cashier's checks, and ATM perks1. Plus, you'll earn interest on your balance.

Not sure if this is right for you? Compare checking accounts to find out.

You get more with Advantage Checking

Earns Interest

Passively grow your account balance by earning interest

Free Checks

Unlimited access and usage of paper checks in our INTRUST design

ATM Fee Reimbursement

Receive up to $6 in refunds on INTRUST's fees and up to $6 in rebates on fees assessed by other banks in a statement cycle.1

Free Cashier's Checks

No fees and no limits on the number of cashier's checks

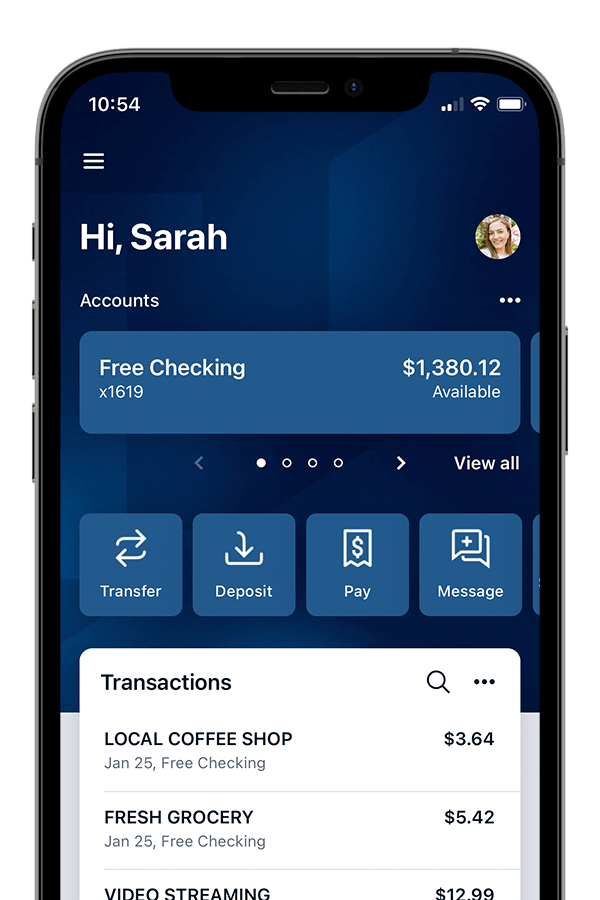

Modern mobile banking app

Do all your banking on your time with our mobile banking app. It's packed with the convenient and easy-to-use features included with your INTRUST Advantage Checking account.

- View and manage your accounts

- Pay your bills

- Manage your debit card

- Deposit checks

- Transfer funds

Articles and Insights

Helpful resources for managing your money

Debit and Credit Cards: What to Know and When to Use Them

The Benefits of Using a Bank

Free INTRUST Visa® Debit Card

Get secure, convenient, 24/7 access to your cash with your contactless debit card, included with your INTRUST Advantage Checking account. Available in exclusive Shocker and Wildcat designs.

- Tap to pay at the register with your debit card or through the mobile wallet on your smartphone or smartwatch

- Access 55,000+ surcharge-free ATMs worldwide

- Exclusive university designs

- Protection with Visa's Zero Liability Policy

Rest Easy

Your money is safe and secure

Member FDIC

Your deposits are insured up to the maximum allowable amount by the FDIC

Zero Liability

You won't be held responsible for unauthorized charges on your account

Security tools

Set up email and text alerts and control your debit card through our mobile app

Rates, Fees, and Terms

| Minimum Opening Deposit | Interest Rate | Annual Percentage Yield (APY) |

|---|---|---|

| $100 | 0.05% | 0.05% |

Variable interest; rate may change after account is opened. Rates may vary by bank location. Annual Percentage Yields (APYs) quoted are accurate as of DATE and are subject to change without notice. Fees may reduce earnings on the account.

The monthly2 account service charge is $15. You can avoid the fee if you maintain a combined deposit account balance3 of at least $10,000.

The minimum opening deposit is $100.

For additional details about INTRUST checking accounts, review our Truth in Savings Disclosure for Personal Accounts, Personal Accounts Fee Schedule, Your Ability to Withdraw Funds from Your Deposit Accounts, and our Terms and Conditions for Your Deposit Accounts (Deposit Agreement).

- Receive up to $6 in refunds on fees that INTRUST charges for your use of an ATM owned by another financial institution. Receive up to $6 in rebates on ATM fees assessed by other financial institutions only if the average collected account balance in your account is equal to or greater than zero ($0) at the time of qualification. All rebates credited to your account for these ATM fees will be reported to the IRS as interest earned. These fees will be credited to your account as a lump sum at the end of the statement period.

- Month or monthly is an approximate four (4) week period or cycle, not necessarily a calendar month.

- The average collected balance of the INTRUST checking, savings and money market accounts and the principal balance of the INTRUST certificates of deposit and IRA accounts on which you are an owner.

.png?Status=Temp&sfvrsn=91c53d6b_2)