Uncertainties Affect Markets

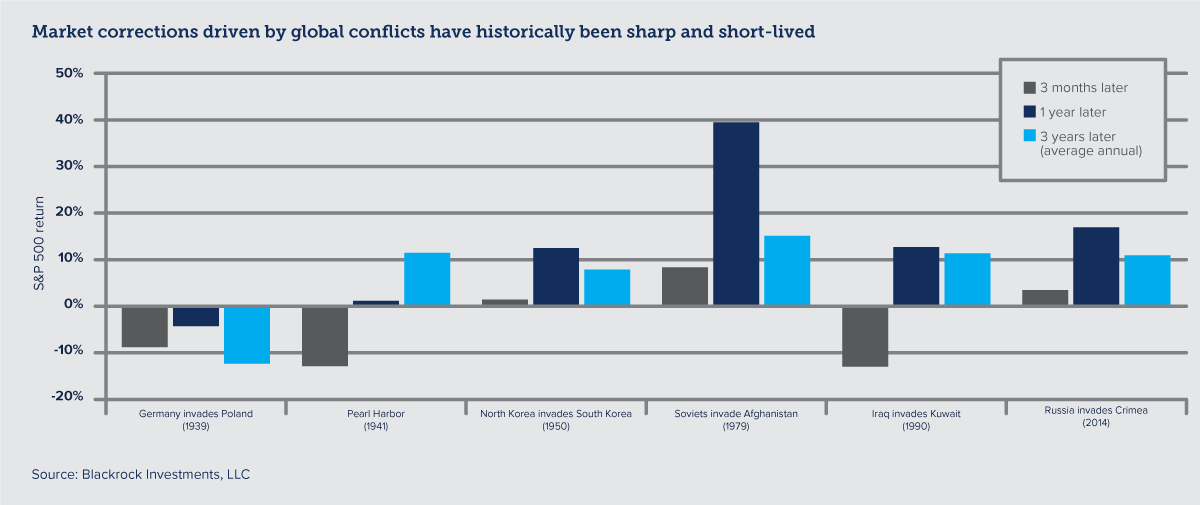

Investors in 2022 are faced with a backdrop of negative information – from elevated inflationary conditions for consumers to the Russian invasion of Ukraine – and the result has been a drop in financial markets coupled with an increase in economic and market volatility. The Covid-19 pandemic destabilized global supply chains but also led to increased emphasis on deglobalization, thereby creating opportunities for new and existing businesses. The Russian invasion of Ukraine has highlighted the world’s dependence on energy which could lead to realignment of fossil fuel sources and spur development of alternative energy solutions. Meanwhile, the sharp divergence in the supply and demand of US workers in the past year will likely lead to improvements in technology and business efficiencies.

In our INTRUST 2022 Economic Outlook we noted that significant geo-political challenges could dominate global headlines in 2022. The speed at which uncertainties are resolved will likely have a significant impact on the performance of financial markets.

Inflation — Temporary Inconvenience or Something More?

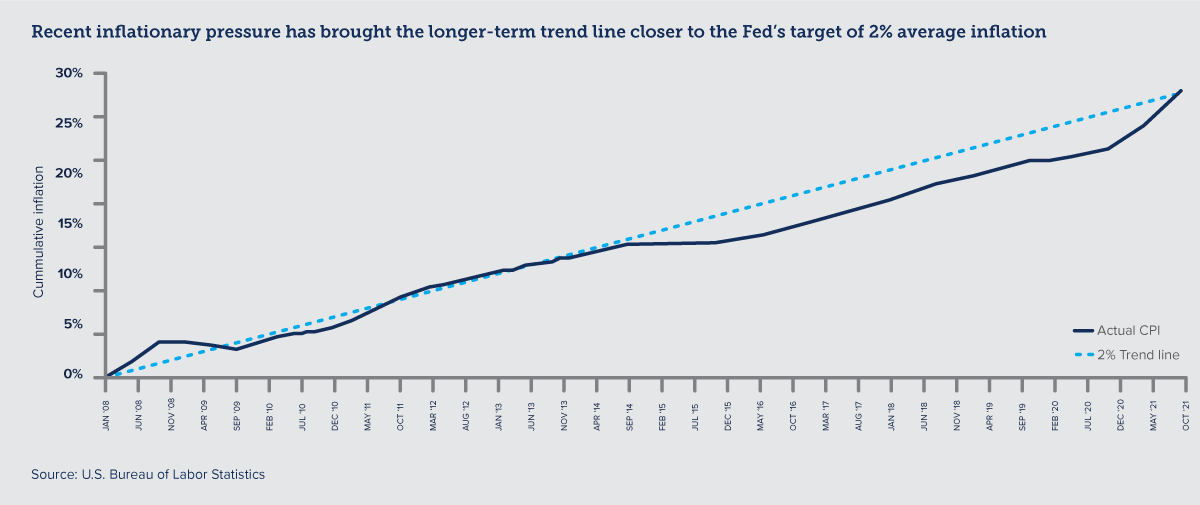

The sharp economic recovery coming out of the Covid-induced recession in 2020 produced elevated inflationary numbers not seen in the U.S. for four decades. Increased supply chain and labor costs on the supply side coupled with healthy consumer balance sheets driving the demand side are the primary culprits of increased pricing across essentially all levels of the global economy.

Generous accommodative economic Fed policies in early 2020 resulted in lower interest rates, providing fuel to inflationary pressures as the economy rebounded. Timing and extent of more restrictive fiscal and monetary policy actions will play a big part in managing inflationary pressures. Likewise, improvements in the global supply chain should help moderate inflation but elevated labor costs will likely be more permanent. While it is too early to determine when inflation will moderate, we note in the chart below that inflation has been running well below the Fed’s stated goal of 2% average inflation for several years.

Market Volatility is Normal

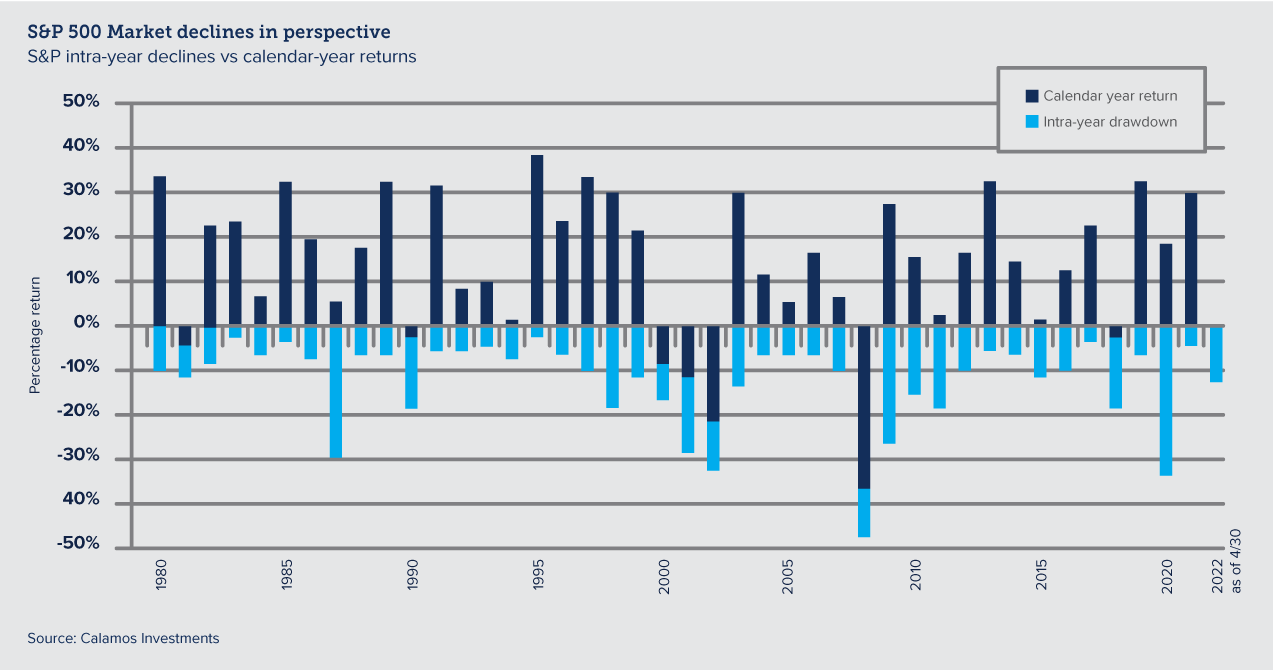

Are the challenges today’s investors face unusual or normal? Some things are different. The speed of change seems to increase with each passing year. And the amount of information available to every investor, from 24/7 news cycles to internet sources, increases exponentially which often creates an urgency among investors to make quick, knee-jerk portfolio changes in response to the latest news story. History shows that the patient investor is rewarded for staying focused on their long-term goals, allowing active portfolio managers to mitigate the short-term market shocks.

Chart updated as of 4/30/2022

Economy/Financial Markets

- Rapid US economic recovery has returned cumulative GDP to levels above pre-pandemic.

- Inflation has accelerated in recent months as the economy restarted but fiscal and monetary policy changes coupled with normalization of supply chain should moderate inflationary pressures over the next 12-24 months.

- Fed’s dual mandate of full employment and low inflation will lead to a transition from accommodative fiscal and monetary policies enacted in 2020 to more restrictive ones as we move through 2022.

- Fed has changed course to tightening monetary policy but economic data such as inflation and wage growth could affect the speed and scope of their tightening efforts.

- Labor shortages will likely continue to hamper economic recovery efforts.

- Oil prices are unlikely to affect Fed actions unless they reach the point of materially affecting economic growth.

Growth Assets

- Equity market performance in 2021 was largely driven by a strong rebound in corporate earnings.

- Forecasts for future corporate earnings remain strong but will be heavily influenced by supply-chain disruptions and availability of labor.

- Market fundamentals are more attractive than 2021, potentially signaling opportunities for rebalancing portfolios.

- Attractive valuations exist in parts of the markets, particularly in international markets.

- Emerging markets performance is heavily influenced by the strength of the US dollar. Risks associated with trade and geo-political conflicts have hampered EM near-term prospects. Longer-term, emerging markets continue to look attractive from a risk/return standpoint.

Defensive Assets

- A potential rising-rate environment will be a key driver of fixed income performance.

- Treasury rates are forecasted to increase this year but remain historically low; active bond managers can make portfolio adjustments on Fed news and other periods of volatility.

- Corporate and high-yield bonds have seen spreads widen relative to treasury yields, but have provided better downside protection than equities during market corrections.

- An environment of higher levels of interest rate volatility is likely to continue.

The INTRUST Quarterly Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Quarterly Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

03/25/2022

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)