As we begin 2026, INTRUST Wealth’s Quarterly Perspectives offer a concise look at the latest economic and financial trends shaping the year ahead. In this excerpt, we highlight the Federal Reserve’s evolving rate policy, the resilience of the labor market, and the ongoing soft-landing narrative for inflation and employment. We also examine consumer balance sheets, wage growth, and the impact of expiring policy measures on household budgets. Finally, we explore the outsized role of AI-related investment in driving GDP growth, along with the ripple effects across sectors like energy and infrastructure.

Inflation and Labor: The Soft-Landing Story

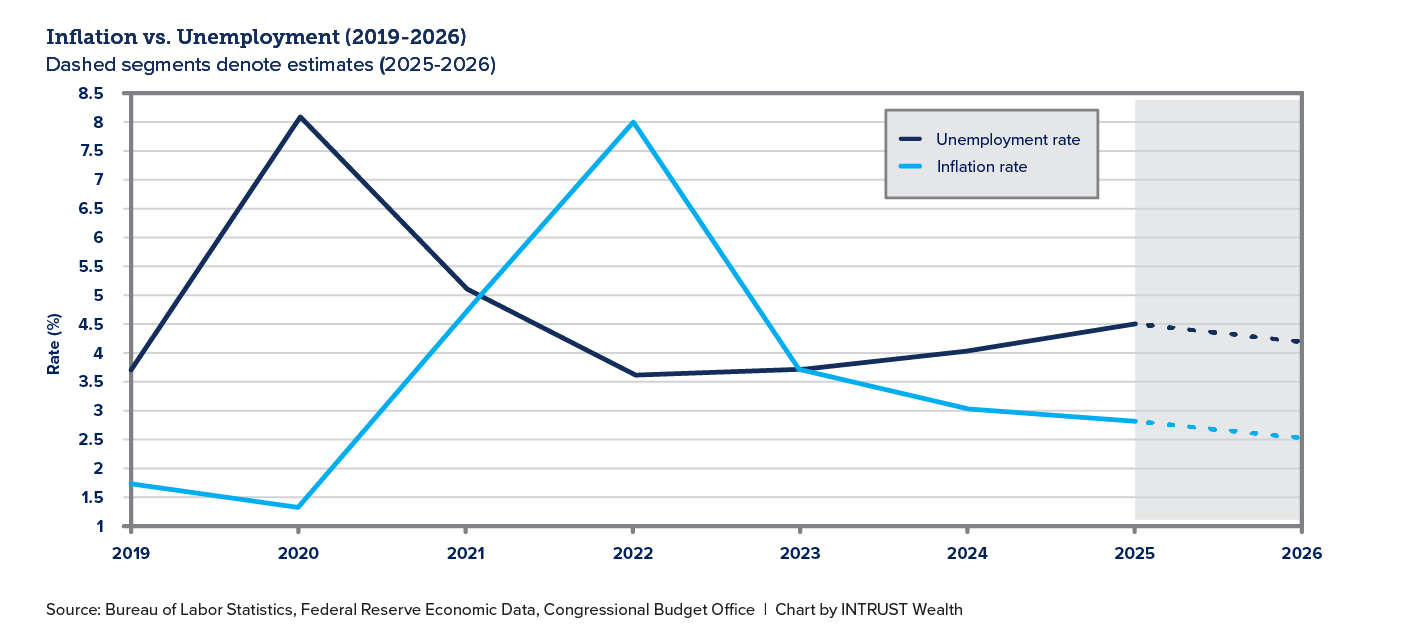

The Fed is expected to ease rates gradually, monitoring shelter costs, core services, and any signs of cooling in the job market.

- Inflation peaked above 9.0% in 2022, then cooled to approximately 3.4% in 2023 and 2.9% in 2024 and will likely end 2025 around 2.7%.

- CBO projects 2.7% CPI for 2026; the Fed’s SEP forecasts core PCE at 2.4%.

- Unemployment averaged 3.6% in 2022–2023, ticked up to 4.0% in 2024, will likely end 2025 around 4.5% before dropping to around 4.2% in 2026.

- Across different measures, the big wave of disinflation is behind us, and the labor market has remained resilient.

- Most public forecasts suggest inflation and employment will continue on a soft-landing path.

Consumer Balance Sheets Strong, Weaker Cashflows

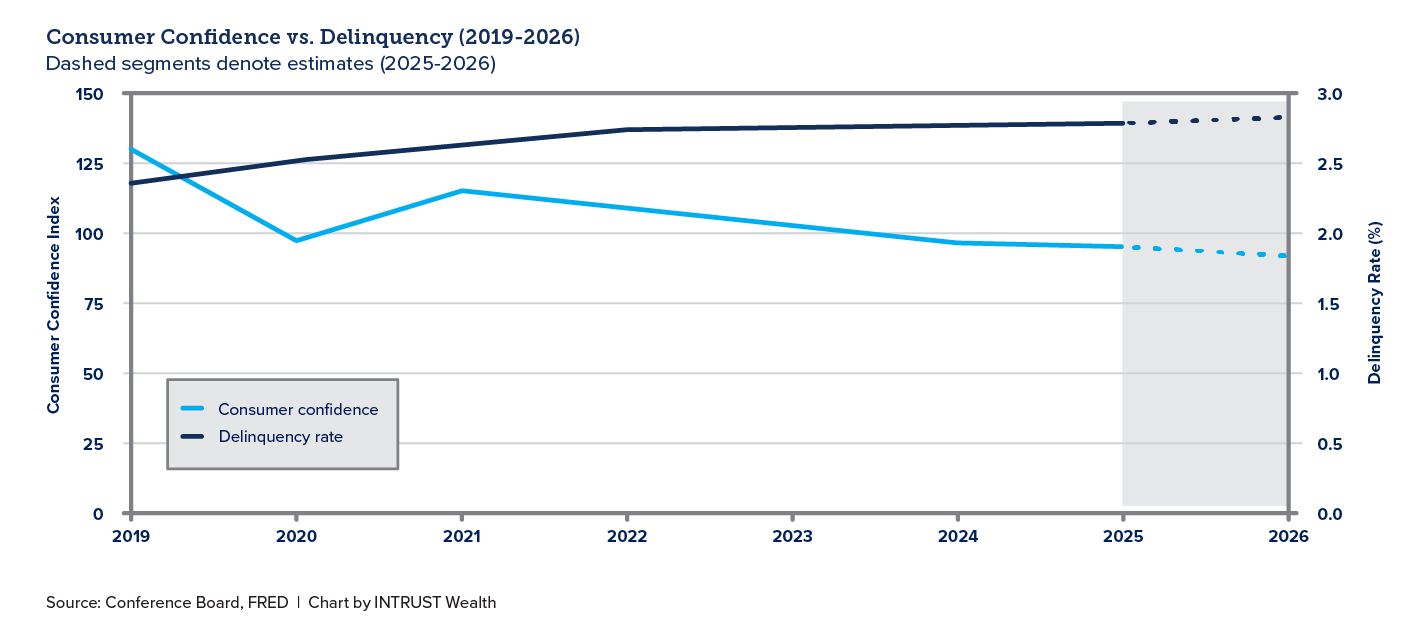

Consumers enter 2026 with solid balance sheets but tighter cashflows; tracking income, credit conditions, and policy changes is more important than headline sentiment.

- Real wage growth turned positive in 2024 and 2025, with U.S. real wages up ~1.7% in 2025 and forecast to rise ~1.8% in 2026.

- Nominal wage growth averaged 3.6% in 2025, with forecasts near 3.5% for 2026; gains remain modest and uneven across sectors.

- Enhanced ACA premium tax credits expired at the end of 2025, potentially doubling premiums for millions and squeezing household budgets.

- Consumer confidence softened to the mid-90s in 2025 and is projected near 91 in 2026; delinquency rates edged up to 2.76% in 2025 and are expected at 2.8% in 2026.

AI Investment

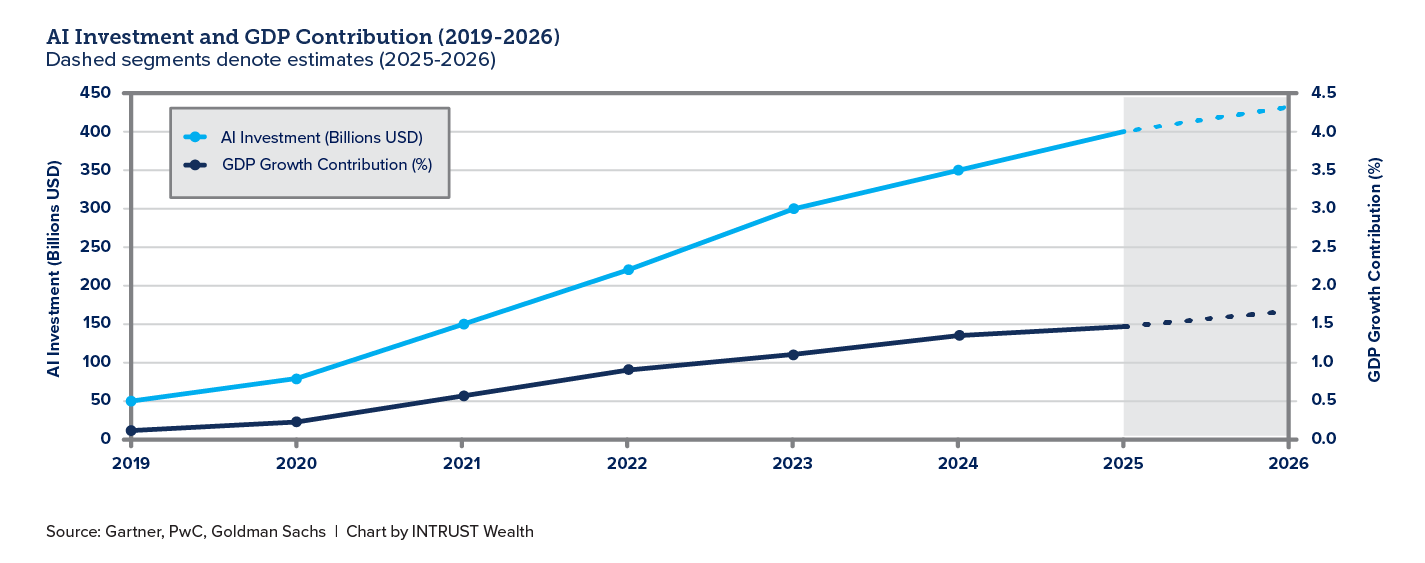

If you strip out AI-related spending, the economy looks thin.

- AI-related capital expenditures drove about half of total GDP growth in early 2025, while private investment outside AI categories remained mostly flat.

- AI investment surged from $50 billion in 2019 to an estimated $400 billion in 2025, with hyperscalers accounting for $344 billion—roughly 1.1% of GDP.

- Rising AI stock prices boosted household wealth and added about $180 billion (≈0.9% of consumption) to spending over the past year.

- 2026 forecasts call for $430 billion in AI investment, contributing an estimated 1.5 percentage points to GDP growth, but at a slower pace than 2025.

- Risks include stretched stock valuations and concerns about a sharp pullback in AI investment, which could subtract up to 1.5 percentage points from growth.

- Ripple effects are seen in energy, utilities, construction, and semiconductors, with data centers straining grids and driving major infrastructure upgrades.

The INTRUST Quarterly Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third-party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third-party information. INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information. The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Quarterly Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

01/21/2026

Category:

Related Blog Posts

.png?Status=Temp&sfvrsn=91c53d6b_2)