Now Available: New Online and Mobile Banking Platform for your business

On May 5, your business was moved to the new online and mobile banking platform. To log in for the first time, please use the login credential formulas you received last week via email.

Frequently Asked Questions

![]()

Benefits of the new platform.

![]()

![]()

A platform designed with your business in mind.

This new platform will enhance your user experience by offering the features you want instead of including services you don’t use.

![]()

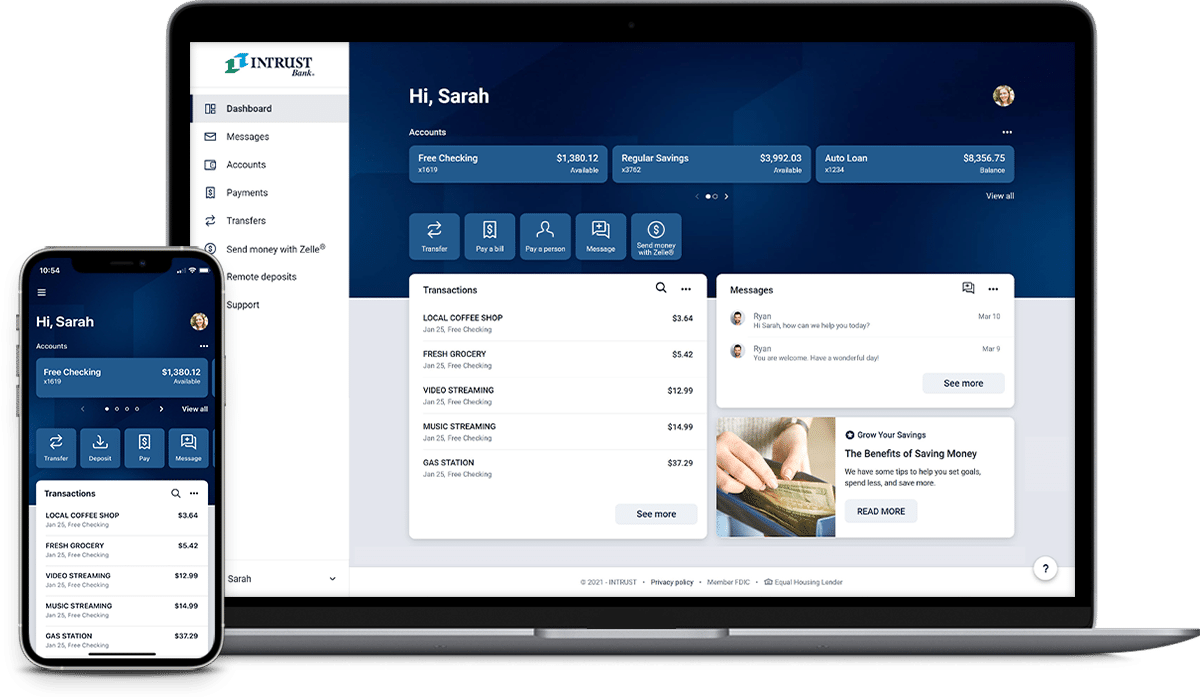

A modern user interface.

We are committed to offering you products and services that evolve over time to reflect a modern look and feel and are easy to use.

![]()

Extended customer support hours.

With this transition comes access to our customer service team for online services support, which is available to you Monday – Friday, 7:00 a.m. to 7:00 p.m., and Saturday 8:00 a.m. to 2:00 p.m. CT.

![]()

New and enhanced features.

Along with a new mobile app, you’ll notice improvements to alerts and notifications, you’ll have access to added features including the ability to manage your company debit cards, and you’ll benefit from enhanced security.

![]()

Familiarity for personal banking customers.

If you have a personal account with INTRUST Bank, and are enrolled in online and mobile banking, the new platform will look familiar.

Once your business moves to the new platform, you’ll be able to use the same mobile app to access both your personal and business accounts by toggling between your profiles.

We're here to help.

![]()

If you have any questions about the move to the new platform, or logging in for the first time, please contact our customer service team at 800-895-2265. Representatives are available Monday – Friday, 7:00 a.m. to 7:00 p.m., and Saturday 8:00 a.m. to 2:00 p.m. CT.

Note: If you are not an administrator for your business, our customer service team will only be able to provide limited assistance regarding your account. Please contact your administrator for help getting logged in, changing your passwords, permissions, etc.

.png?Status=Temp&sfvrsn=91c53d6b_2)