Economic Themes: Although the US economy is transitioning from a mid–to–late business cycle, the probability of a US recession in 2018 remains low. Accordingly, the aging US economic expansion, now in its ninth year, may become the longest since World War II by mid–2019.

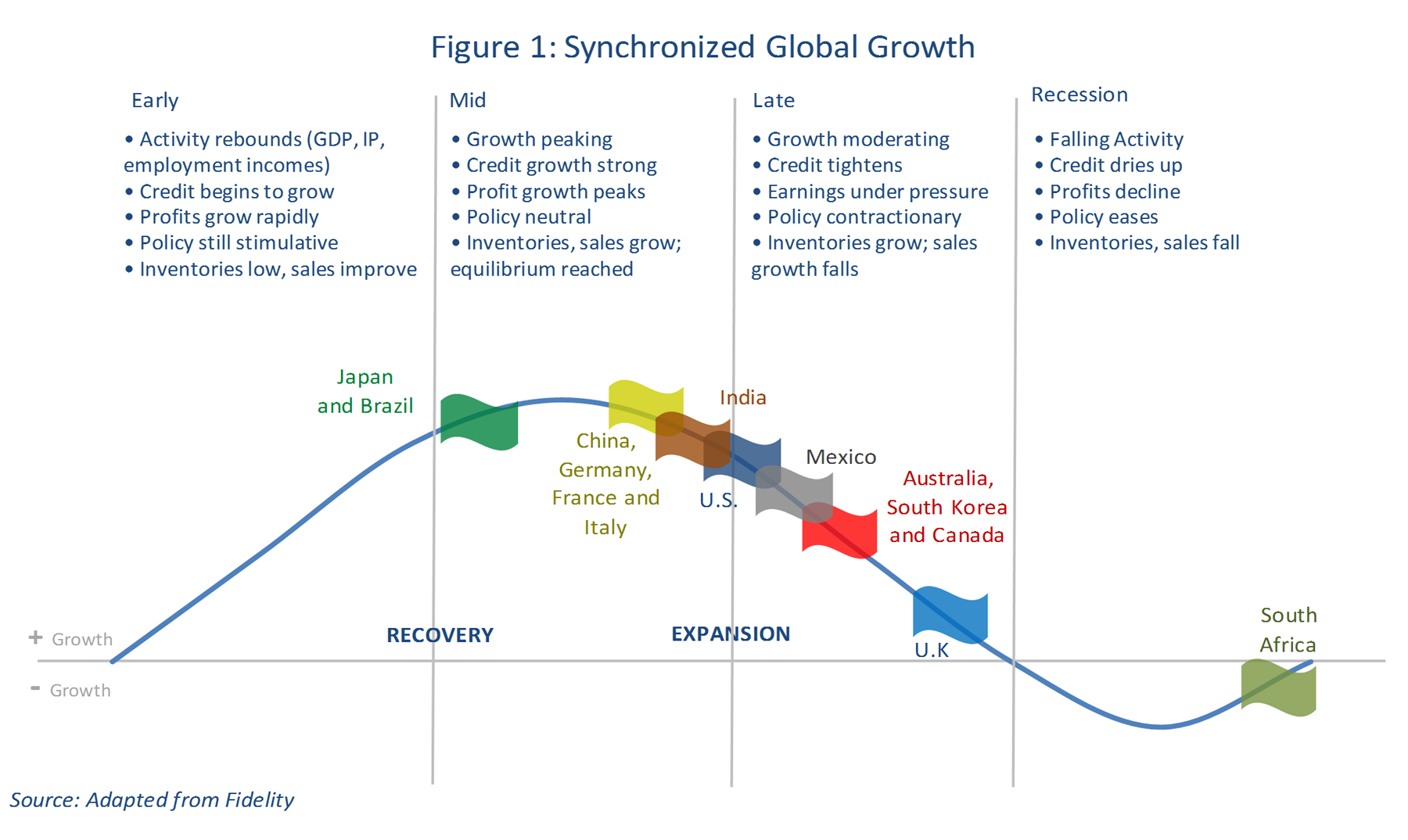

Global Economy: We expect synchronized global expansion to continue from last year into 2018. Most of the world’s major economies will remain in the mid–to–late business cycle as shown in Figure 1. As global monetary policies move into alignment with the global expansion, we forecast many of the developed markets to increase rates. The Eurozone will likely have muted, but positive GDP growth. China continues to move toward a higher–-wage, quality producer that may result in trade opportunities for other emerging economies. However, China’s policymakers are now allowing rates to rise to constrain their credit boom and production overcapacity.

U.S. Economic Growth: Sweeping tax reform, deregulation policies, synchronized global growth, consumer strength, and potential infrastructure spending position the US economy for continued expansion in 2018. However, GDP growth will likely be moderated due to tighter credit standards and a less accommodative monetary environment than existed earlier in the business cycle.

U.S. Inflation and Fed Policy: We expect more upward pressure to inflation partially driven by growth in consumer wages and spending; however, the expanding wave of retiring baby boomers and the impact of technology will likely keep inflation from overheating. The Federal Reserve, led by incoming chairman Jerome Powell, will attempt to balance forecasted economic growth and inflation with policy rate increases. Accordingly, we forecast a continuation of Fed rate hikes in 2018, albeit at a slower pace than typical during this stage of the business cycle.

U.S. Labor Market: We anticipate continued strength in the labor market driven by economic growth and the administration’s considerations for a more pro–-business environment as evidenced by the passage of tax reform legislation in late 2017. Labor markets will continue to transition from an under–employed economy to fully–employed.

U.S. Regional Markets: On a local and regional basis, we see improving opportunities in manufacturing, commercial development, and professional services. The energy sector also appears more favorable relative to the past few years, and plans to increase production in manufacturing should boost the overall local economies. Agriculture may face continued headwinds in 2018 due to an oversupply of grain across the country and the recent lack of moisture across the region. Our outlook for livestock is mixed with strength in the cattle and hog markets but a continuing weakness in dairy prices.

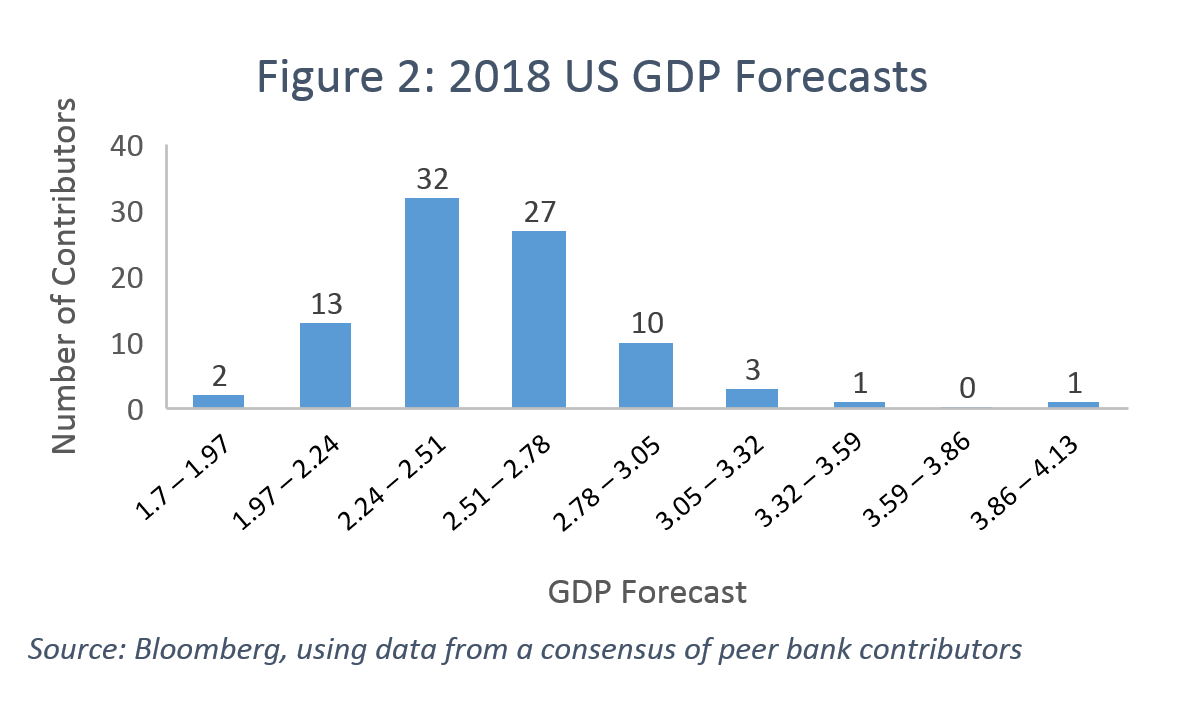

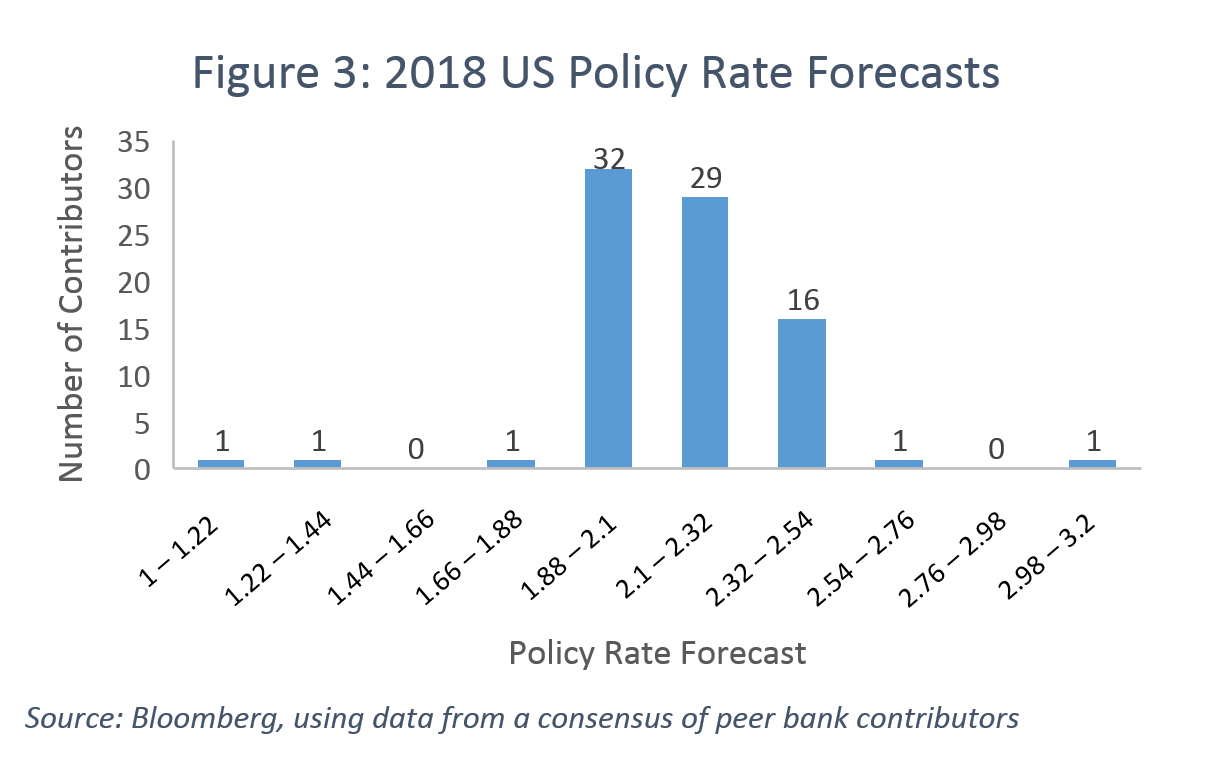

Factors That May Influence Our Outlook: As illustrated in Figures 2 and 3, strong consensus among economists exists for GDP growth and Fed rate increases, but outliers in these forecasts suggest the potential for economic surprises in 2018. Below are several factors that could result in positive or negative economic surprises this year.

US Tax Policy: The full effects of the recently enacted tax reform legislation are unknown, but they could provide a backdrop for higher–than–expected economic growth this year. The corporate tax cut should help boost earnings, thereby providing fundamental support for equity markets to push higher. Moreover, repatriation of offshore dollars to the US may result in more share buybacks, dividends, increased M&A activity, and higher cash levels on corporate balance sheets.

Deregulation: Efforts by the Trump administration to reduce the regulatory burden should continue through 2018. Businesses and local municipalities may see increases in efficiencies as the effects of deregulation ripple through the economy.

Fed Balance Sheet Reduction: The Fed’s balance sheet reduction program, which began in 2017, should ramp up in 2018, providing another cog in a tightened monetary policy. As monetary policy tightens, prices of short–term bonds should fall and yields should move gradually higher.

Overheating US Economy: With continued strength in the labor market, extraordinary inflationary pressures cannot be ruled out. In this scenario, Fed rate hikes may occur at a faster–than–anticipated rate to combat inflation and increase recession odds.

Geo–Political Influences: Turbulent geo–political events could increase volatility to markets and disrupt key trade agreements between global partners.

Potential Infrastructure Spending: Increased emphasis on infrastructure spending in the US could continue to drive unemployment rates down and increase upward pressure on wages.

Technology: With the rapid expansion of technology innovation, productivity may significantly increase, but the evolution of advanced technologies will likely displace certain skilled and unskilled segments of the workforce.

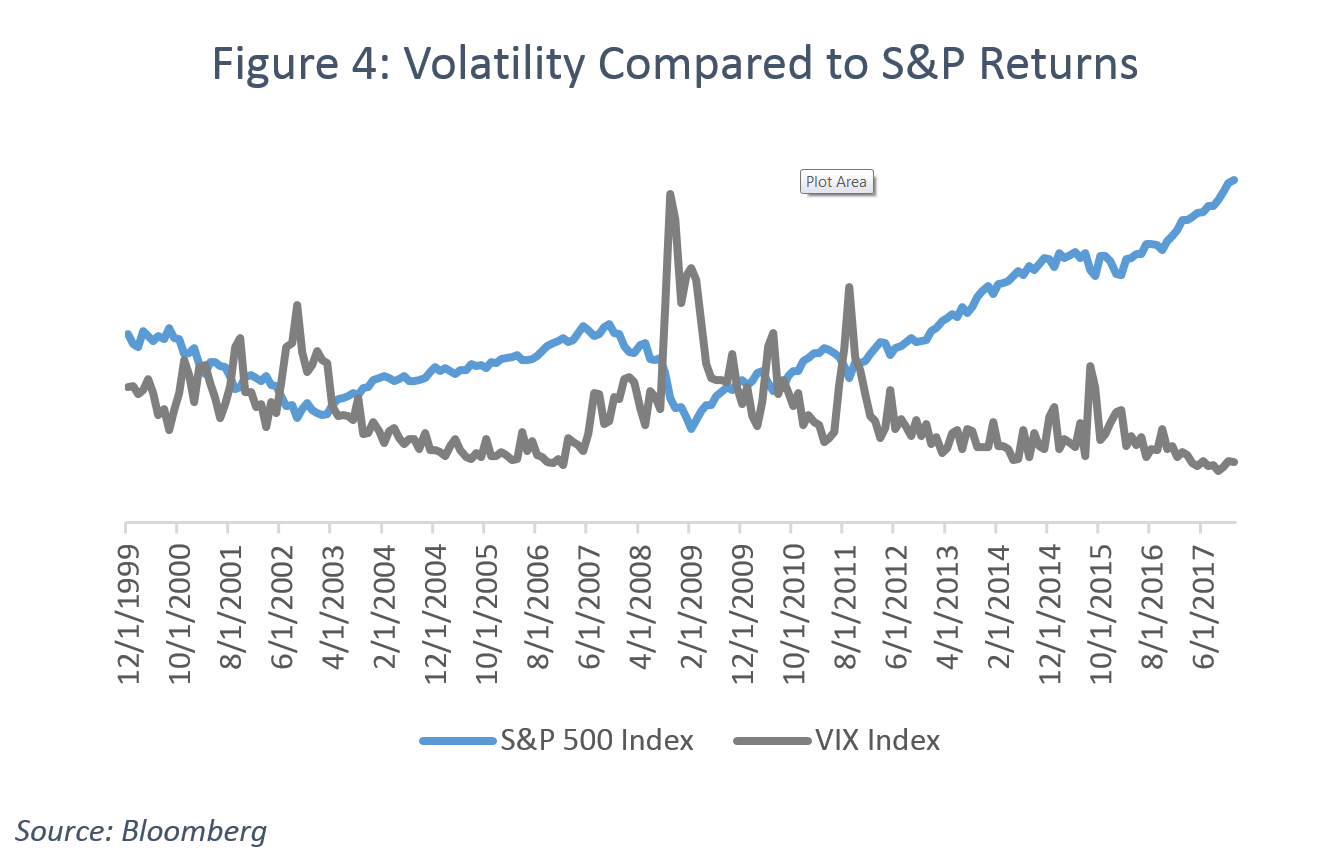

Market Implications: As economies progress later in the business cycle, prices of certain assets such as equities often reach new levels and market volatility generally begins to wane as investor complacency rises. This trend certainly has played out in the US as we enter 2018. Figure 4 illustrates that investor risk aversion was low in the mid–2000s and especially low in 2017 – expressed by decreased market volatility (as measured by the VIX). Figure 4 also shows that the S&P 500 Index reached new heights during periods of investor complacency.

We believe this starting point for 2018 is a critical factor that will influence future market returns. History shows that the 5– and 10–year equity performance beginning in the mid–to–late–cycle phases typically is lower than the equity returns of similar time periods starting earlier in the business cycle. However, periods of market complacency can last multiple years, making it difficult to predict near–term market performance. Generally, given a positive economic backdrop in 2018, the market environment may continue to be more favorable for equities than fixed income, and diversifying strategies will likely play an important role in a lower–return, higher–volatility environment.

Equities: Our forecast for ongoing economic expansion — with limited, but increasing recessionary risks — implies US equities may continue to advance. However, potential corporate profit growth may be offset by higher interest rates. Valuations of developed international stocks appear reasonably attractive, as many of these markets have not appreciated to the same extent as the US equity markets have since 2009. Still, geo–political uncertainty remains a concern and may impact near–term performance. Volatility in the domestic market was substantially below normal levels in 2017, but market volatility may return to higher levels in 2018.

Fixed Income: We believe bonds may face headwinds as the economy continues to reflate. Overall, Fed rate increases will likely impact short–term rates, while the prospects of a strengthening global economic backdrop may put upward pressure on longer–term rates. Generally, during the late business cycle phase, the yield curve flattens, whereby short–term rates are very similar to intermediate– and longer–term rates. This trend unfolded in 2017 and may continue in 2018. Corporate and high yield bonds may benefit from a more favorable business environment, but any gains may be muted by rising rates and tight credit spreads that are indicative of periods of low investor risk aversion. National municipal bonds may be negatively impacted by potentially lower federal income tax rates, but could benefit from infrastructure spending. On a regional basis, Kansas municipals may benefit from the increase in tax rates in the state.

Alternative Investments: We expect alternative assets to play an increasingly important role for investors, as equity volatility may increase and fixed income may continue to experience lower returns. With respect to Real Assets, the environment may be favorable for energy, commodities and Treasury Inflation Protected Securities, but less so for Real Estate in the wake of higher interest rates. Absolute Return strategies may benefit from market volatility and dispersion of returns across asset classes and currencies. Furthermore, Private Equity may continue to provide outsized returns for qualified purchasers who are willing and able to withstand the illiquidity of the asset class.

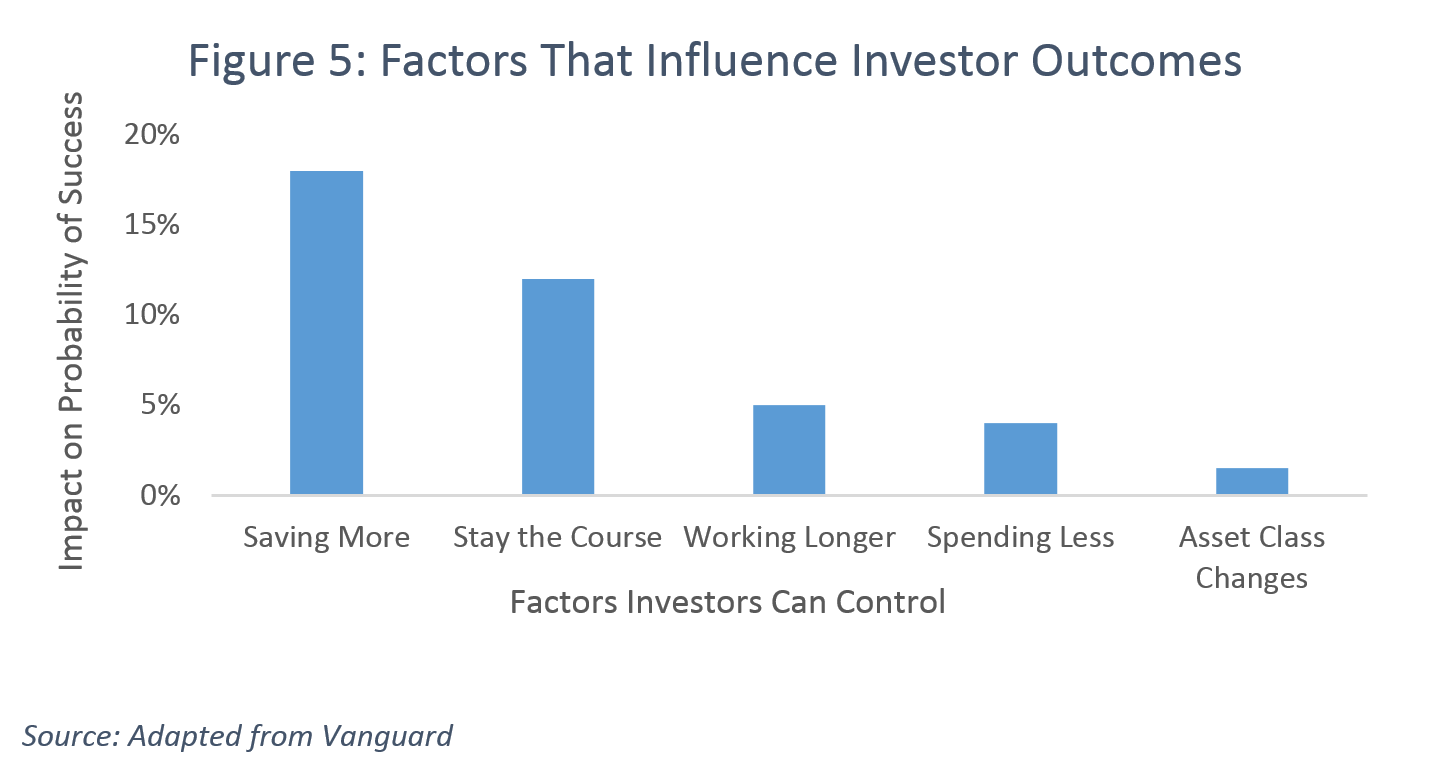

Portfolio Implications: Does the possibility of increased volatility and lower future returns imply dramatic investment strategy changes are warranted? We do not believe so. Our professional experience and research suggests that long–term investment success is driven mostly by factors that are within the control of investors. This list includes adhering to a disciplined investment process, saving more, working longer and spending less. These controllable factors, as illustrated in Figure 5, far outweigh the impact of changing a portfolio’s asset allocation based on anticipated market conditions.

Our focus continues to be on constructing portfolios that are designed to achieve our clients’ desired outcomes as opposed to chasing recent market performance. Given the uncertainty that lies ahead, broad diversification should continue to provide downside protection and help to preserve wealth.

Integrate Goals–-Based Investing and Tax–Smart Strategies: With increased volatility and lower return expectations across many asset classes, managing returns through smart tax management and goals–based investing becomes a crucial part of successful portfolio construction. We believe clients should align their wealth with their goals and work with trusted advisors to construct portfolios built for long–term goal attainment.

Diversification Benefits: After an extended period of outperformance from equities, we believe a consistently rebalanced and diversified portfolio will be rewarded in the long run. The reduction in government intervention and normalization of interest rates may allow a broader array of asset classes to benefit in this new environment.

Avoid Chasing Yield: As fixed income yields return to normalized levels investors should resist the temptation to overstretch for yield. A prudent approach may be to position fixed income allocations with shorter maturities and higher–quality holdings, emphasizing total return more than yield.

Alternative Strategies: Alternative Investment solutions may help to increase returns and reduce portfolio risk amid increased volatility and lower return expectations for equities and fixed income. Absolute Return investments can help augment fixed income allocations by providing diversification benefits and potentially enhancing returns. Real Return strategies can help protect against potential inflation shocks. For qualified purchasers, Private Equity investments may help enhance a portfolio’s long–term return potential.

Consistent Portfolio Construction: Achieving desired outcomes in turbulent markets requires portfolio construction that consistently utilizes quality investment strategies, periodic rebalancing, appropriate risk controls, and tax–smart trading practices. These are components of the disciplined investment process that we will continue to implement for our clients in 2018.

The INTRUST Market Perspectives are the consensus of the INTRUST Bank, N.A. ("INTRUST") Wealth Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

05/20/2019

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)