In January, we published our 2019 Perspectives. As we enter the second half of the year, we believe Fed actions will play a significant role in the future direction of our aging U.S. economy. Below are our reviews and reflections on our earlier viewpoints.

Economic Themes

U.S. Economic Growth

Review: The U.S. economic expansion will likely become the longest on record this summer. However, we anticipate the aging economy to slow in 2019 due to tightening financial conditions, slower global growth, and the fading of fiscal stimulus.

Reflect: In June, the expansion became the longest in U.S. history, but economic growth is showing signs of slowing. Further Fed tightening did not occur. However, slower global growth conditions negatively impacted the U.S. economy.

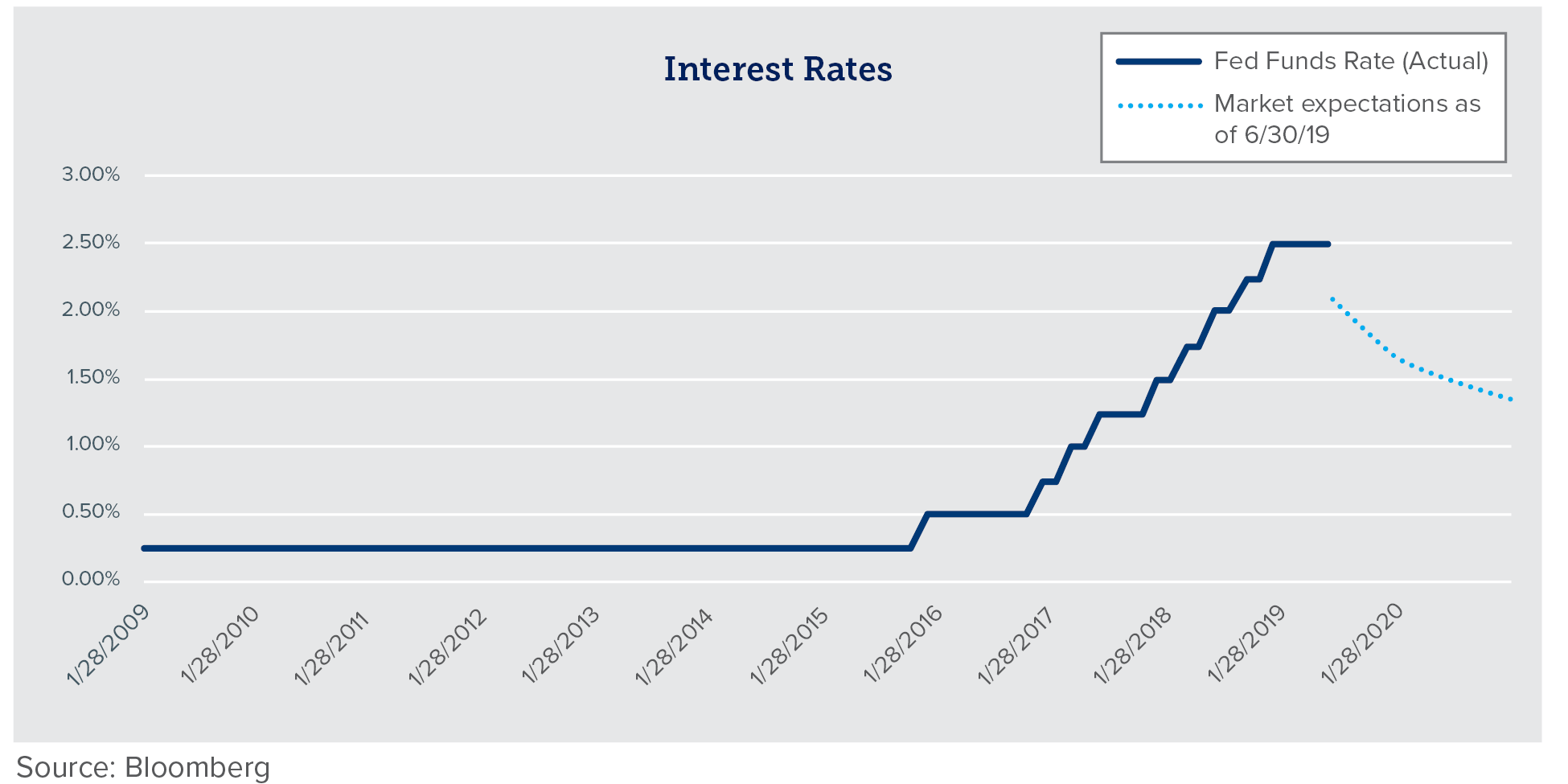

U.S. Fed Policy

Review: Uncertainty remains around Fed tightening in 2019. In December, Fed Chairman Powell suggested the possibility of additional rate hikes. However, market expectations based on Fed funds futures imply further rate hikes in 2019 are unlikely.

Reflect: The Fed reversed its stance in 2019, signaling that further tightening will not happen in the near term. In June, Fed Chairman Powell suggested the next Fed action is likely a rate cut, perhaps as early as this summer. Preemptive action by the Fed may enable the U.S. economic expansion to continue into 2020.

U.S. Labor Market

Review: We anticipate the unemployment rate remaining near its lowest level since the Vietnam War, but some slack may persist in the labor market.

Reflect: Unemployment has reached a multi-decade low, and there are more open jobs than available workers. Nevertheless, significant wage inflation has not emerged.

Factors that may impact our economic outlook

At the start of the year, we noted that a 2019 recession was unlikely, and we maintain this perspective entering the second half of the year. We also identified factors that could disrupt economic activity more than expected. Below is a summary and update of these factors:

Tighter financial conditions

Review: The Fed may overshoot with their tightening measures, thereby increasing the odds of a 2020 recession.

Reflect: Recently, the Fed changed their forecast of the continuance of rate hikes in 2019 to potentially multiple rate cuts this year. Given this reversed stance, the risk of the Fed over tightening has significantly decreased.

Trade war escalation

Review: Trade tensions with China have minimally impacted the U.S. economy thus far. If the trade truce struck in December between the U.S. and China unravels, GDP could be impacted by 1% or more.

Reflect: The Trump administration’s use of tariffs as the weapon of choice with China – and lately Mexico – will likely lead to higher prices for U.S. consumers, putting recessionary pressure on the economy.

Financial stability risks

Review: Economic growth in 2019 could potentially stall out if market volatility continues to increase and financial asset prices continue to fall. An emerging market debt crisis could materialize if trade wars escalate, the U.S. dollar remains strong, or the global economy slows more than anticipated.

Reflect: During the first six months of 2019, volatility has declined, equity markets have appreciated, and the dollar has weakened. Accordingly, financial stability risks have lessened from late last year.

China’s economy falters

Review: China’s economy is expected to slow in 2019. If Chinese policymakers fail to provide sufficient stimulus or China-U.S. relations deteriorate further, a hard economic landing may be in store for China, which would likely lead to a broader global slowdown, impacting the U.S. and many other economies.

Reflect: Even though China’s GDP growth rate hovers around 6% - high by world standards, this growth rate is the slowest it has been in decades. A protracted trade war with the U.S. could further deteriorate China’s growth. In light of mounting tensions in Hong Kong and slower growth, China risks still remain a relevant factor to monitor.

Portfolio Implications

While we continue to monitor economic, monetary, and market conditions, we believe the key to successfully achieving financial goals requires formulating a good plan based on sound investment principles and sticking to it. Research shows that factors within an investor’s control-such as adhering to a disciplined investment process, saving more, working longer, spending less, and minimizing friction costs (e.g. taxes) – far outweigh the less reliable benefits of shifting portfolio allocations. Ultimately, we believe disciplined, patient investors are likely to be rewarded over the long term.

Market Implications

Review: Given our outlook of slowing growth and higher capital costs, last year’s market volatility may spillover into 2019. Inflation-sensitive assets normally perform well toward the end of economic expansions, but may underperform historical norms in this late cycle as the risk of high inflation appears unlikely. Overall, investment expectations should be tempered, as few asset classes look cheap at the start of 2019.

Reflect: Market volatility surged in late 2018, but has fallen to more normal levels in 2019. Generally, equity and fixed income markets have performed better than anticipated. The Fed’s reversal in its rate policy has helped fuel increases in asset prices during the first half of this year.

Equities

Review: Downside risks appear greater for equities. Geopolitical risks and slower growth expectations may impact near-term performance of international stocks.

Reflect: The U.S. rally in equities during the first half of the year far surpassed expectations. First quarter returns were the strongest since the early 1990s. Similarly, international stocks bounced back in early 2019. Equities may face headwinds later this year if corporate profitability weakens as a result of slower economic conditions.

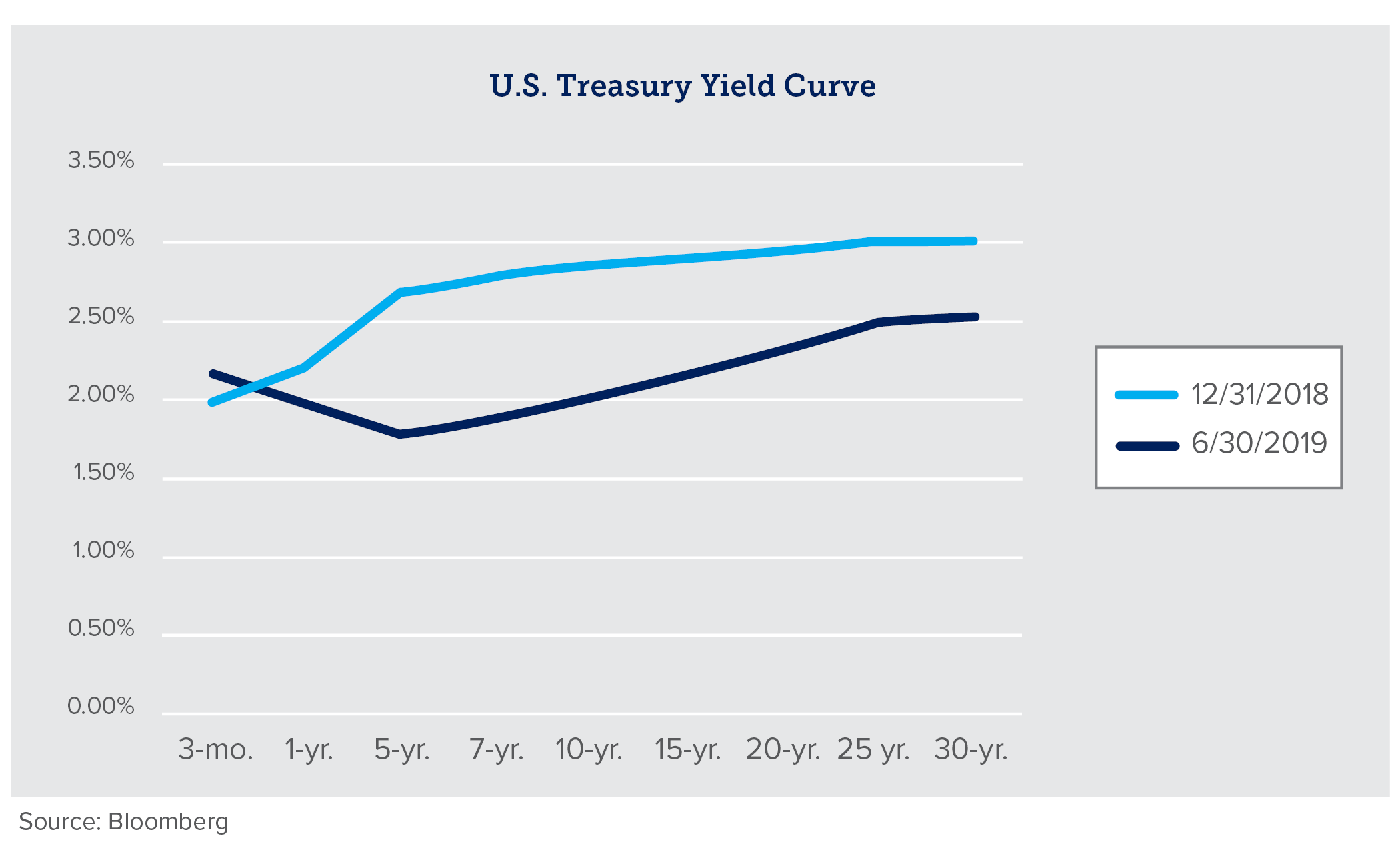

Fixed Income

Review: Downside risks appear greater for high yield bonds than high-quality fixed income.

Reflect: Riskier assets, such as equities and high yield bonds, generated strong returns in the first half of 2019. Also, as rates have dropped with the 10-year Treasury falling below 2% in June, fixed income asset prices have appreciated more than expected. However, lower current yields may limit further upside in fixed income for the remainder of the year.

The INTRUST Market Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

07/16/2019

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)