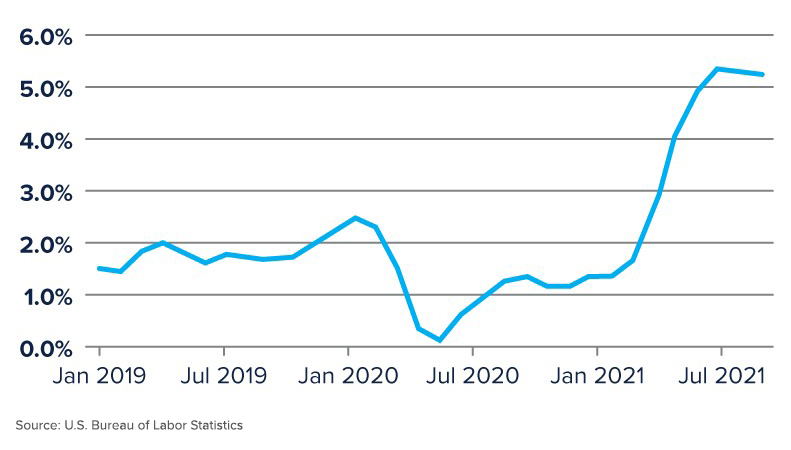

Inflation – Temporary Inconvenience or Something More?

In our INTRUST 2021 Economic Outlook, we identified three scenarios on the speed of the U.S. economic recovery, noting that if our most optimistic scenario unfolded, unanticipated increases in inflation could emerge. Through the third quarter of this year, the U.S. has indeed experienced elevated levels of inflation, primarily caused by disruptions in the global supply change and labor shortages.

As we move into the fourth quarter, inflation is showing signs of moderating as those sectors which experienced rapid price increases in the early stages of recovery – lumber, used/new cars, airfares, and hotels – are showing similar rapid decreases in prices. Improvements in global supply chain should help moderate inflationary increases, but elevated labor costs, which are less transitory in nature, will likely result in higher inflation than we experienced pre-pandemic.

Moderating inflation numbers will likely relieve pressure on the Fed to quickly move to more restrictive fiscal and monetary policies. We maintain our forecast of inflation two years out to be in the 2.5% - 3.0% range.

U.S. Inflation Rate (Annualized)

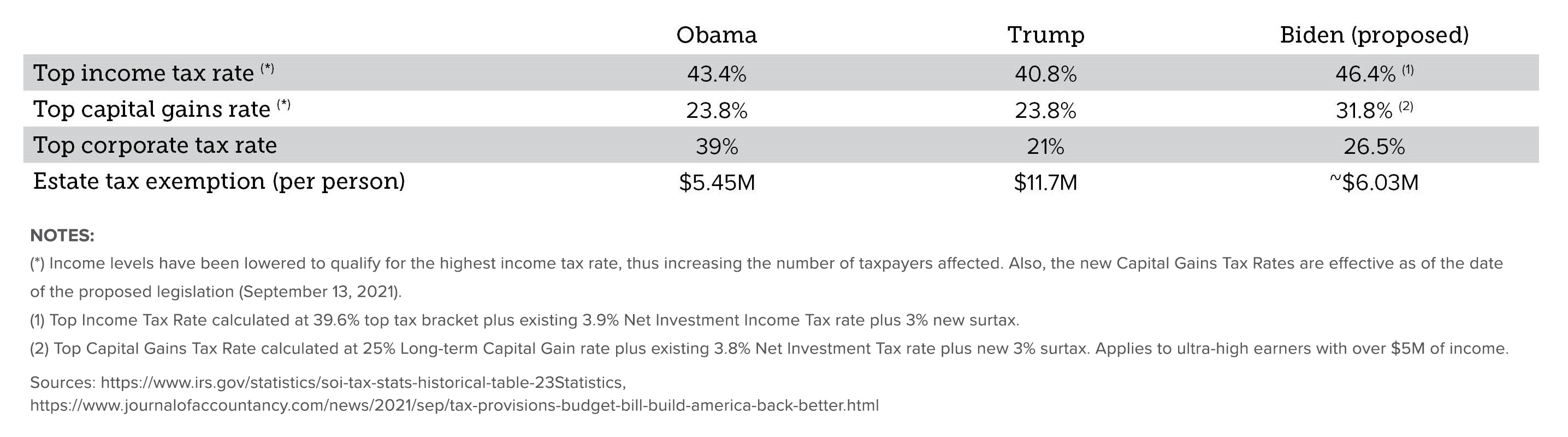

Proposed Tax Law Changes

President Biden and the Democratic-led Congress are proposing significant changes in U.S. Tax Law in an effort to raise revenue to fund their proposed federal budget. The most recent proposal, from the House Ways and Means Committee, proposed tax law rate changes are aimed primarily to the highest earners, generally those individuals making more than $400k per year as well as corporations.

However, additional proposed changes would affect a larger share of the population. Changes in the estate tax exemption amount and changes to the long-term capital gains, dividend and interest tax rate would result in increased taxes for many middle-class taxpayers. Likewise, higher corporate tax rates will likely be passed on to consumers through higher prices on goods and services. The passage of the proposed budget through the reconciliation process remains uncertain. The Senate has also yet to make public any proposal that will likely have differences from the House bill.

The table below highlights some of the key proposed changes from the Biden administration.

We believe that after-tax performance is a key component of an actively managed investment portfolio. Applying tax-smart strategies, such as proactively harvesting losses to offset gains and optimizing the location of assets among taxable, tax-deferred, and tax-free accounts, will help taxable investors keep more of what they earn. Active tax management will become an increasingly important component of maximizing investor returns amid the backdrop of higher taxes and more-restrictive tax policies.

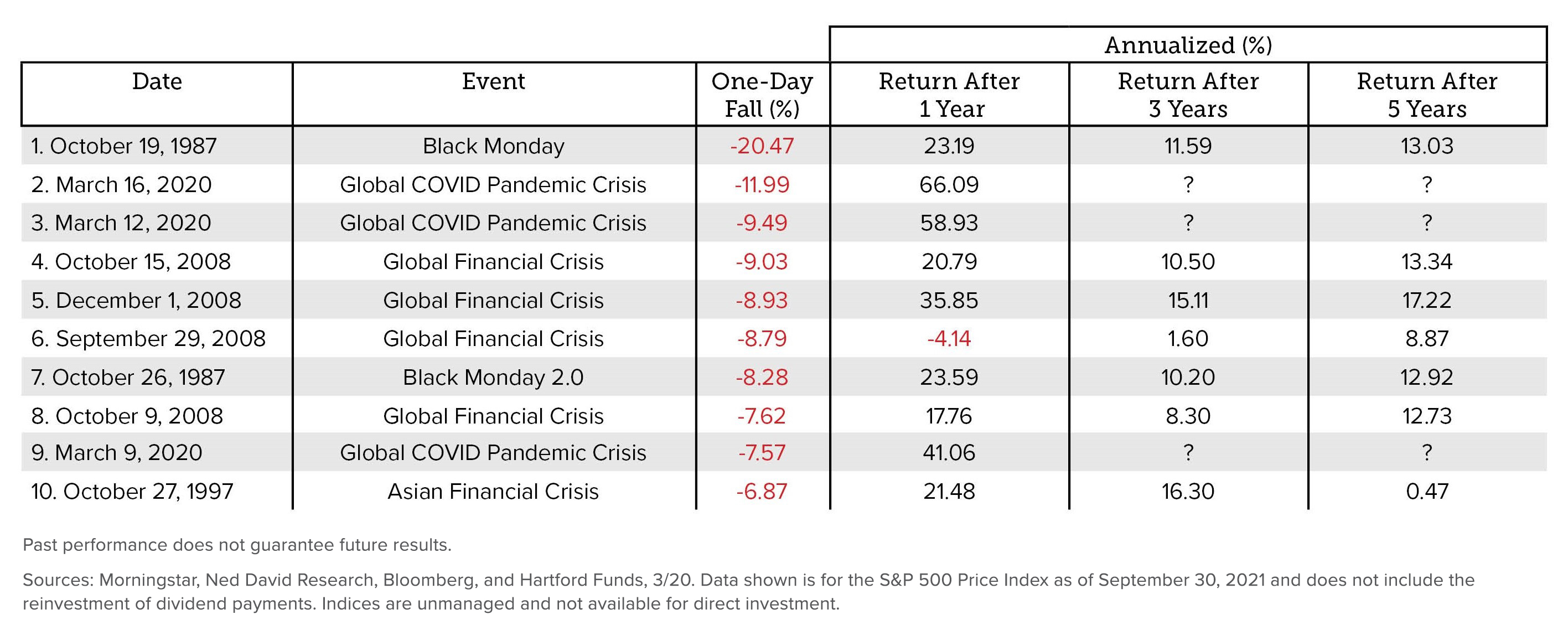

Long-Term Results Require Patience

The COVID-19 Pandemic Crisis brought significant periods of market volatility in 2020 as investors sought to understand the economic and market impact of the virus. As is common in periods of uncertainty, days of significant market drops were often followed by significant market increases, adding further uncertainty to investor’s minds.

Periods of high market volatility often cause investors to get nervous and seek perceived advantage by making significant allocation changes in their portfolios. However, overreacting to short-term volatility often hurts investors in the long term. As shown in the table below, markets historically respond strongly and favorably one, three, and five years following a significant daily drop in performance. Time will tell if this is the case following the Global COVID Pandemic Crisis.

We continue to believe a balanced portfolio based on long-term goals, coupled with active tax management, will reward the patient investor.

10 Worst Single-Day Percent Declines for U.S. Stocks 1980-2019

Economy/Financial Markets

- Delta variant of the COVID-19 virus could dampen overall inflation as well as U.S. economic recovery

- Fed committed to maintain accommodative policy to support the economy until data (particularly inflation and unemployment rate) support a change but has indicated a desire to reduce asset purchases in 2022

- The Fed Funds Futures market is forecasting low likelihood of any further rate changes until late 2022

- Future Federal stimulus efforts will become clearer as budget and tax policies are negotiated and passed in Washington

- The strength of the economic rebound will largely depend on an improvement in business confidence and/or consumer confidence levels

- Labor shortages could continue to hamper economic recovery efforts

- Inflation has accelerated in recent months as the economy heats up but is showing signs of moderating

Growth Assets

- Equity market performance in 2021 has been driven by a strong rebound in corporate earnings

- Attractive valuations exist in parts of the markets, particularly in international markets

- Volatility levels have tempered from historic highs in 2020 and are approaching average levels

- Future Corporate earnings will be heavily influenced by supply-chain disruptions and availability of labor

- Emerging Markets performance is heavily influenced by the strength of the U.S. Dollar. Risks associated with trade, the spread of the coronavirus, and China’s regulatory pressure have hampered Emerging Markets near-term prospects. Longer-term, Emerging Markets continue to look attractive from a risk/ return standpoint

- Historically, markets have performed well coming out of a recession

Defensive Assets

- A potential rising-rate environment will be a key driver of fixed income performance

- Treasury rates have risen this year but remain historically low; active bond managers can make portfolio adjustments on Fed news and other periods of volatility

- Corporate and high-yield bonds have seen spreads widen relative to Treasury yields, but have provided better downside protection than equities during market corrections

- An environment of higher levels of interest rate volatility is likely to continue

The INTRUST Quarterly Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Forward–Looking Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

10/08/2021

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)