Entering the fourth quarter of 2022, there are several historical trends we can use to provide perspective on current events. Our third quarter perspectives look at contributors to headline inflation, yield-to-worst across fixed income sectors, international markets vs. U.S., and S&P 500 index average returns following midterm elections.

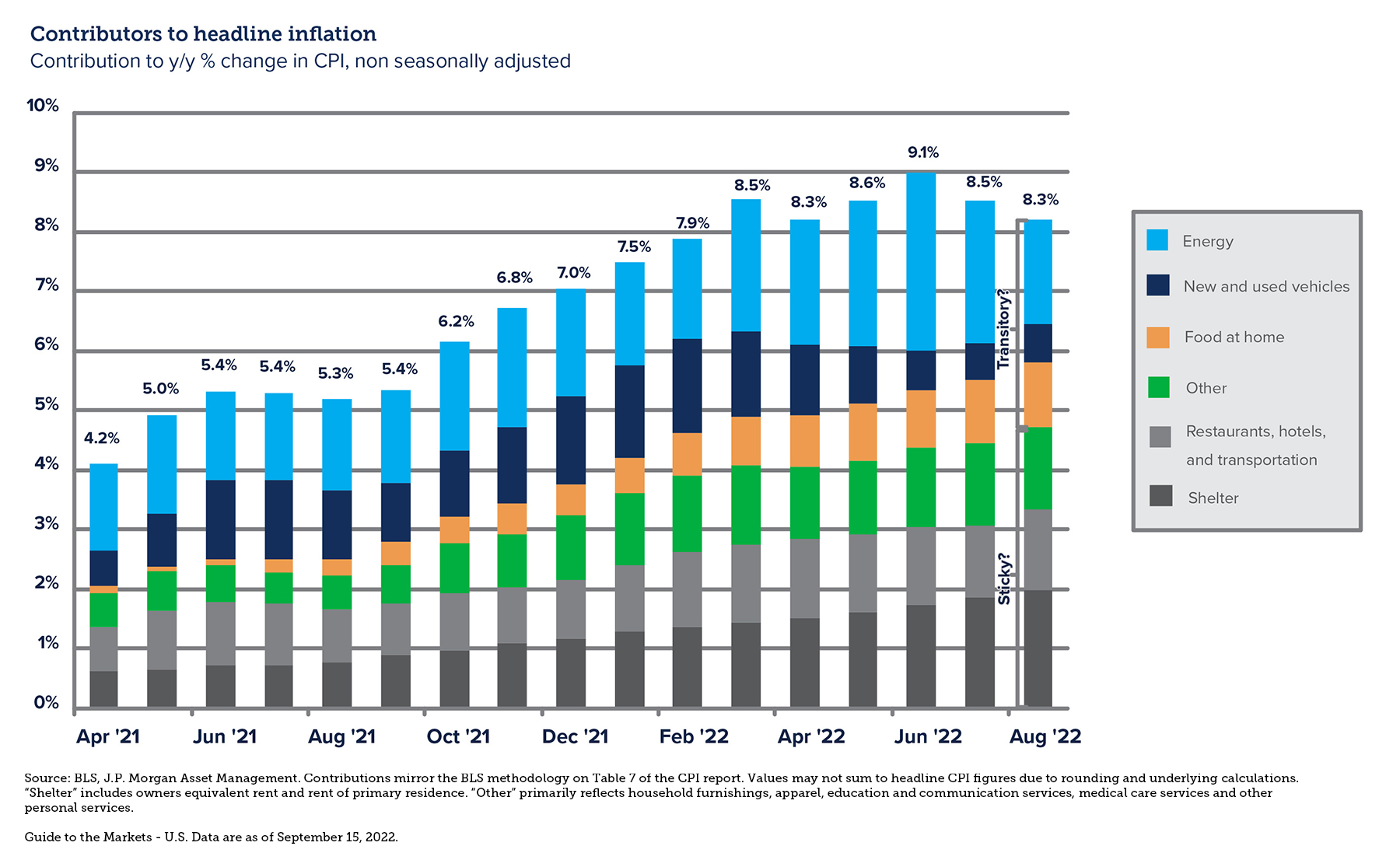

Inflation relief to be slow and rocky, likely to bring recession

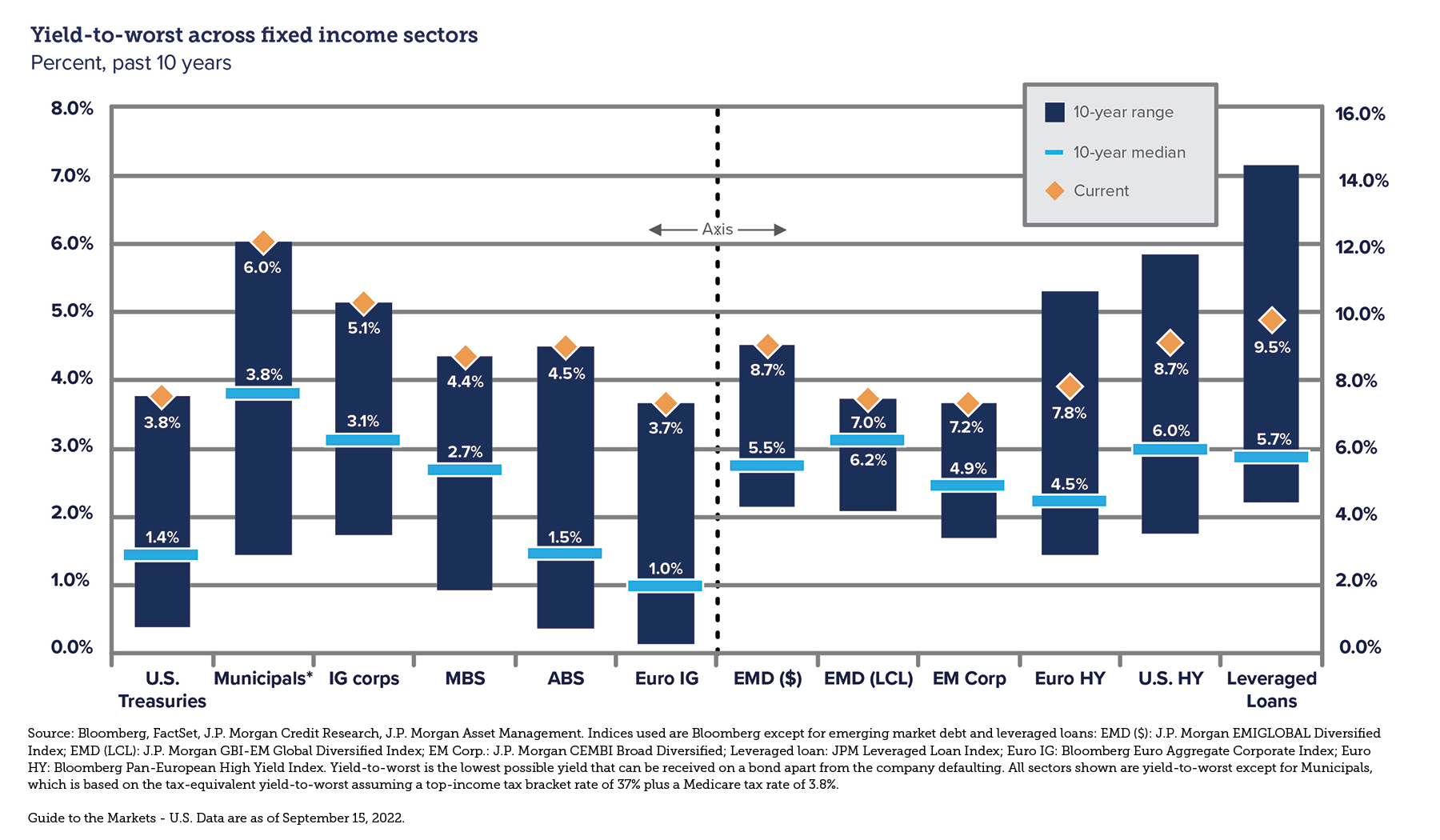

Bonds are now attractive investment component

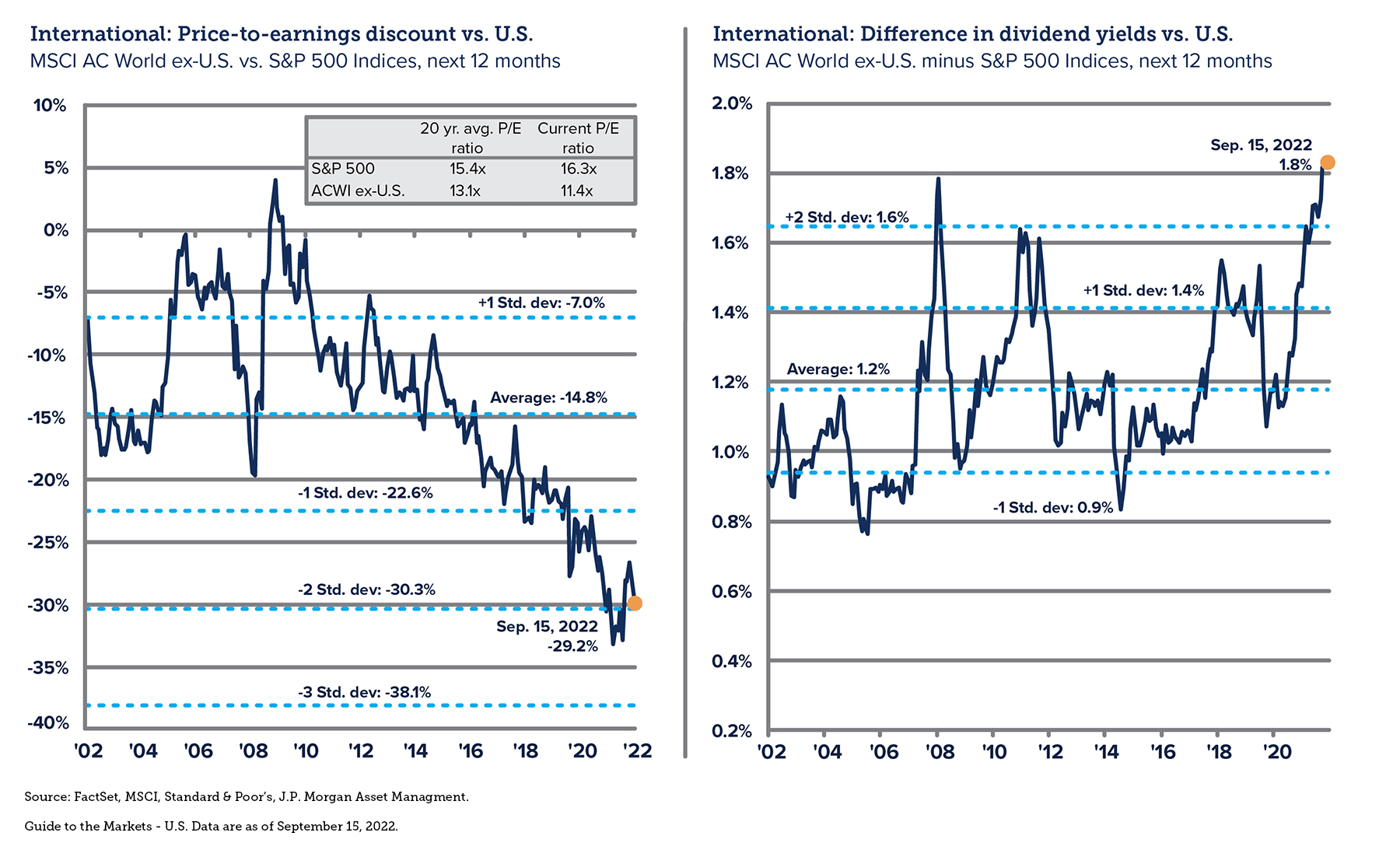

Opportunities in international equity markets fed by attractive fundamentals

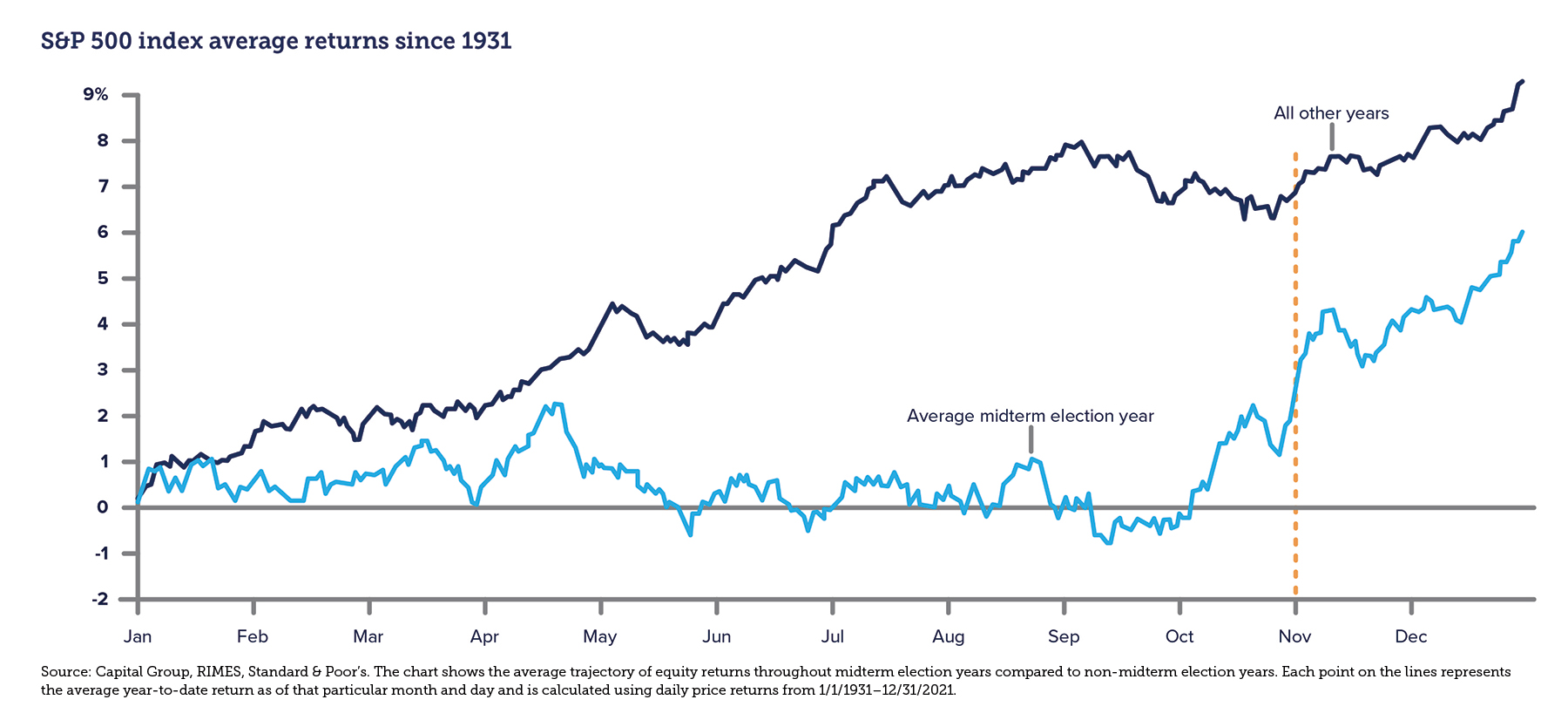

Markets historically perform well following midterm elections

The INTRUST Quarterly Perspectives are the consensus of the INTRUST Investment Strategy team and are based on third-party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third-party information.

INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on, the information.

The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The Quarterly Perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Posted:

09/28/2022

Category:

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)