Digital Banking

Banking at your fingertips.

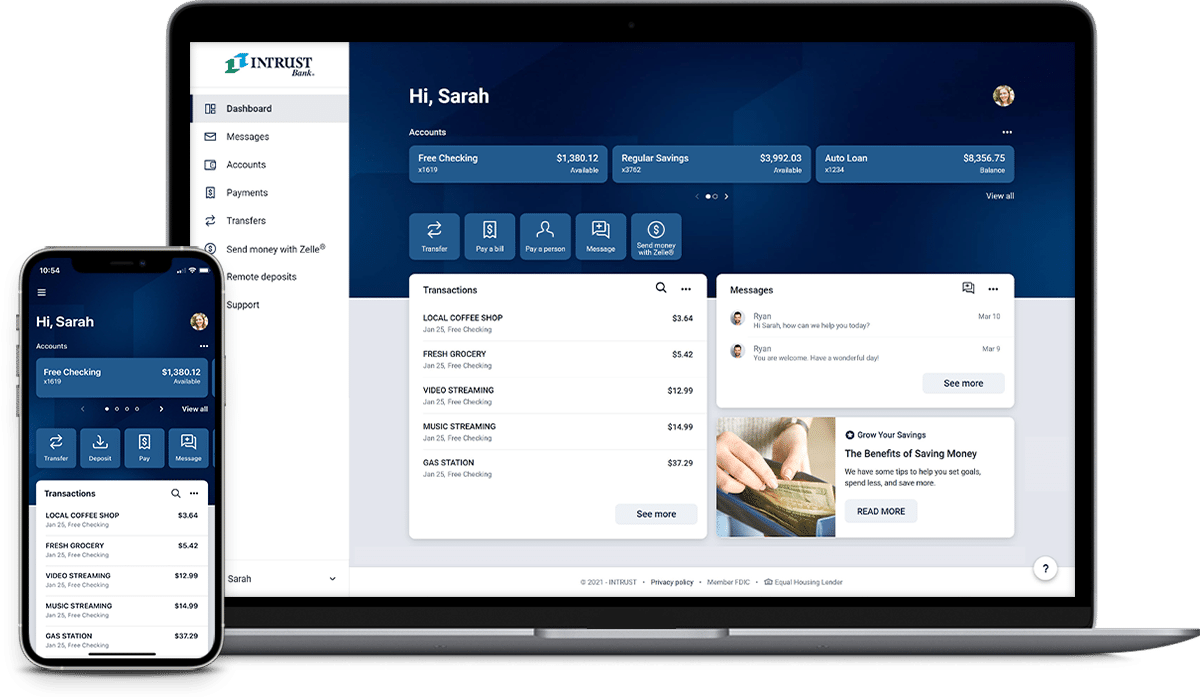

Experience seamless banking with our online and mobile platform, offering convenience, robust security, and a comprehensive suite of tools. Manage your finances, transfer funds, and pay bills effortlessly, all from the palm of your hand.

Packed with financial tools

Whether you access your accounts online or through our mobile app, you can take advantage of all of these features.

Dashboard and Accounts

Track balances and account activity

The customizable dashboard gives you a quick snapshot of what's happening with your accounts. Arrange the dashboard in a way that works for you by highlighting the tools and accounts you use the most.

- View your available balances

- Search through recent transactions

- Create custom text and email alerts

- View account statements and other documents

- Add notes and images to any transaction

Bill Pay

All of your bills in one place

Pay all of your bills from one secure, convenient location. Add new payees whenever you need. No envelopes or stamps required.

- Pay any business in the U.S.

- Schedule one-time or recurring payments

Pay Friends and Family

Send money with Zelle®

Zelle is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S., typically within minutes. With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank.1

More convenient features

Transfer money

Easily transfer money between your INTRUST accounts, or between your accounts at INTRUST and those you own at other financial institutions.

Manage your debit card

Turn your debit card off and on as needed. Set rules for how your card can be used, including dollar limits and merchant and transaction type limits.

LEARN MORE >Deposit checks

Deposit paper checks into your accounts using our app and your phone’s camera.

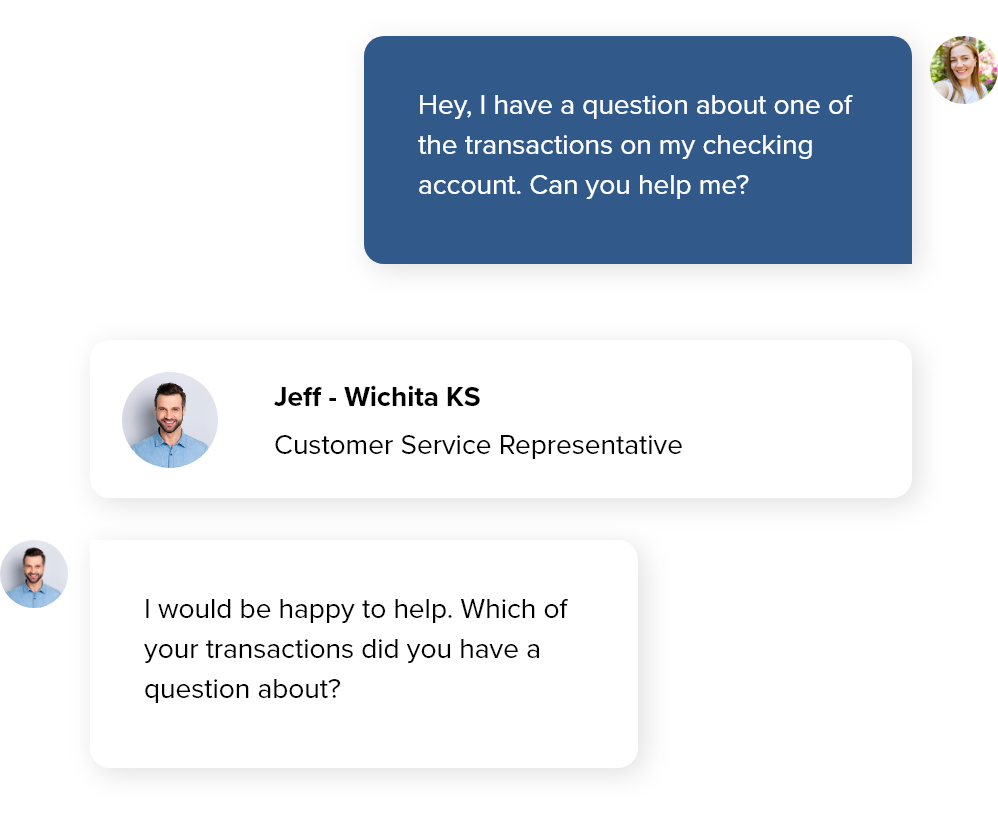

LEARN MORE >Messages

Get help when you need it.

If you have questions or need help managing your INTRUST accounts, you can connect directly and securely with a customer service representative through online and mobile banking with Messages.

No bots. Just real help from a real person.

Explore more ways to use online and mobile banking

Alerts Deliver Important Account Information To You

How To Stay Organized With Online and Mobile Banking

Personal + Business

Leverage online and mobile banking for your business.

The same great features, plus even more tools built specifically for business users. Easily toggle between your personal and business profiles.

Answers to frequently asked questions

Start taking control of your accounts

Enroll online or download the app to start securely managing your accounts at your convenience.

Don't have an INTRUST account? Explore our accounts.

1. To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

.png?Status=Temp&sfvrsn=91c53d6b_2)