Personal Banking

Personal Banking

2024 Economic Outlook

In our 2024 Economic Outlook, we evaluate the current economic environment and its implications for businesses and investors. Key themes shaping this year's outlook include rates, inflation, business and consumer strength, housing, labor, and more.

To accompany the full outlook, watch a recorded presentation by INTRUST's Russell Dunn, CFP®, senior wealth strategist, and Grant Paitz, CIMA®, senior investment strategist, as they explore recent changes in the economic environment at the end of 2023 and look ahead at future trends in 2024.

U.S. economy

Cooling but not cold

The U.S. economy demonstrated surprising resilience in 2023 as inflation eased and consumer strength helped build optimism for a soft landing. Central banks, who reacted swiftly in 2022, slowed their aggressive tightening efforts in 2023 to allow their various economies to absorb the effects of higher interest rates and a tighter money supply. As the economy has slowed, the outlook for a recessionary hard landing to the U.S. economy has been moved further into the future. Focus has now turned to not if, but how soon central banks will begin to loosen monetary policy to help mitigate the probability and magnitude of future economic weakness, and how businesses and consumers will fare in the slowing economy. In the following pages, we evaluate the current economic landscape and its implications for businesses and investors.

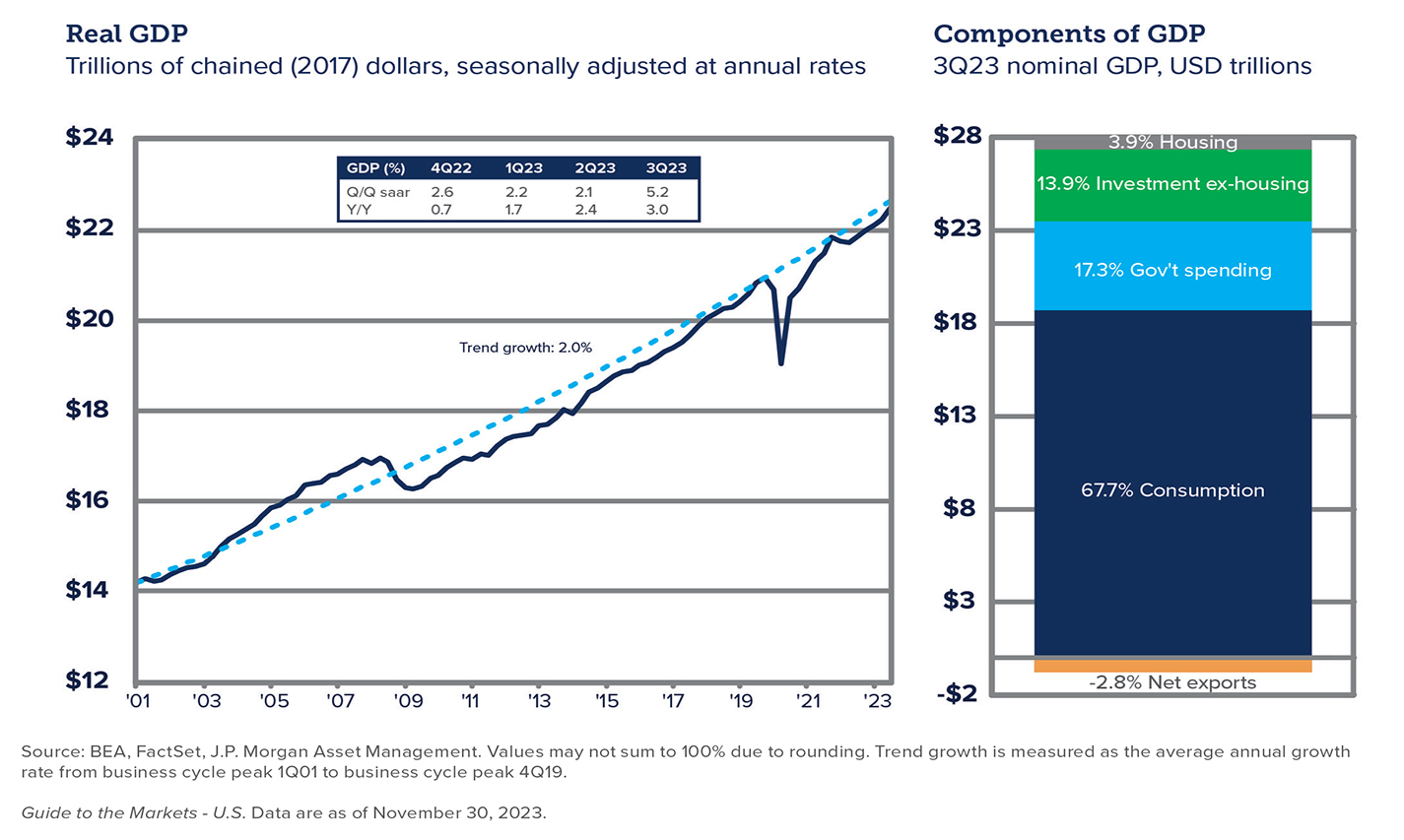

Our economic outlook for 2024 calls for lower but stable GDP growth between 1% and 2%, however, a mild recession is still possible in late 2024. In our outlook, we see continued overall core disinflation, with possible pockets of deflation as the onset of rampant rate increases finally makes its delayed impact. In our opinion, the Fed will have to remain poised to react swiftly to combat a weakening picture following the delayed onset of monetary tightening.

Key themes shaping our outlook

Rate environment - higher for longer, but how long?

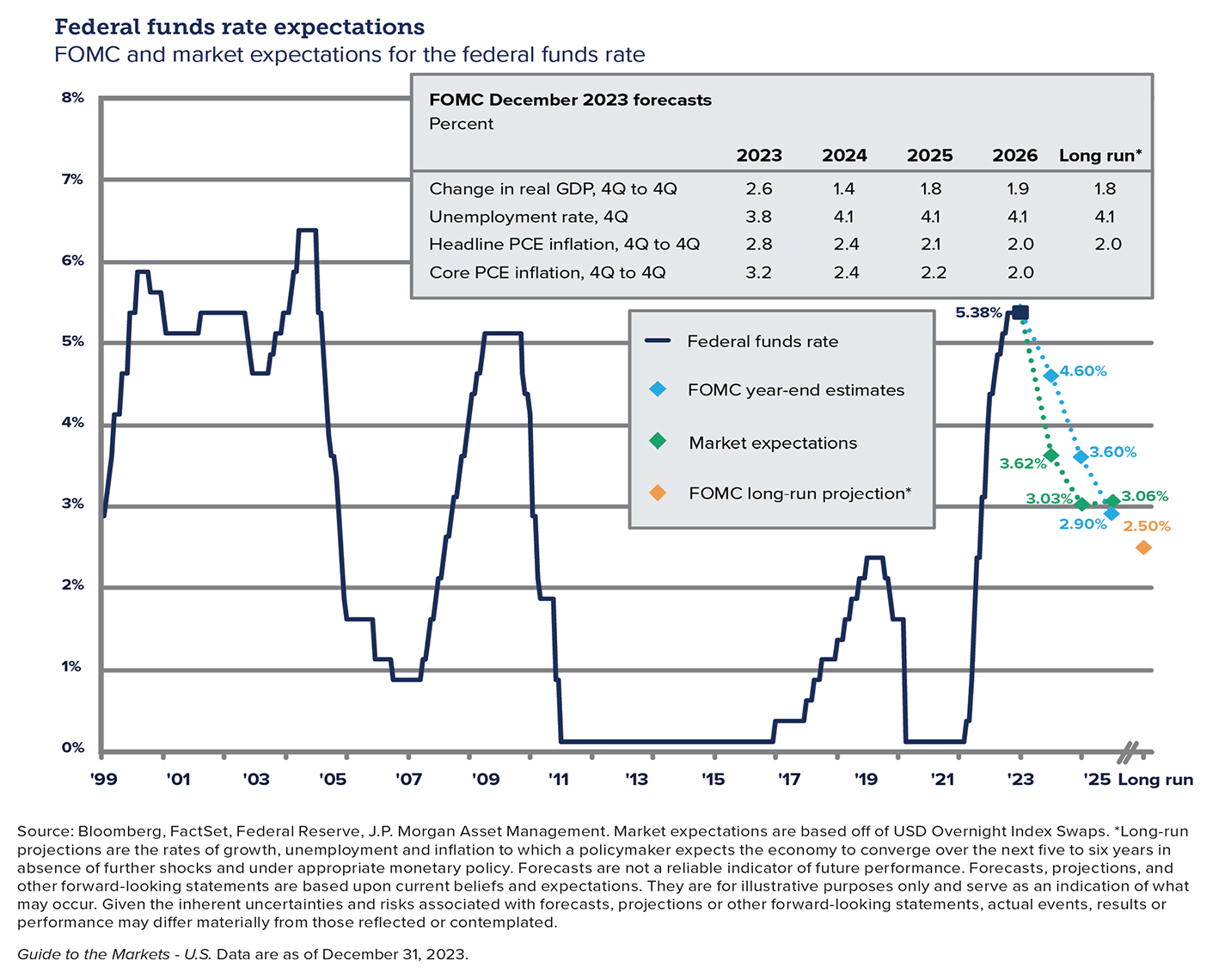

Beginning in early 2022, the FOMC began its aggressive monetary policy tightening cycle in an effort to curb inflation. As inflationary pressures cooled, the FOMC paused their rate hikes to allow the economy to stabilize to the current rate environment. Our outlook notes that the FOMC is likely in a holding pattern until summer ’24, at which point rate cuts would be the most likely course of action. While our outlook calls for a slow easing of monetary policy, central banks could react swiftly in the face of a sudden change in economic health.

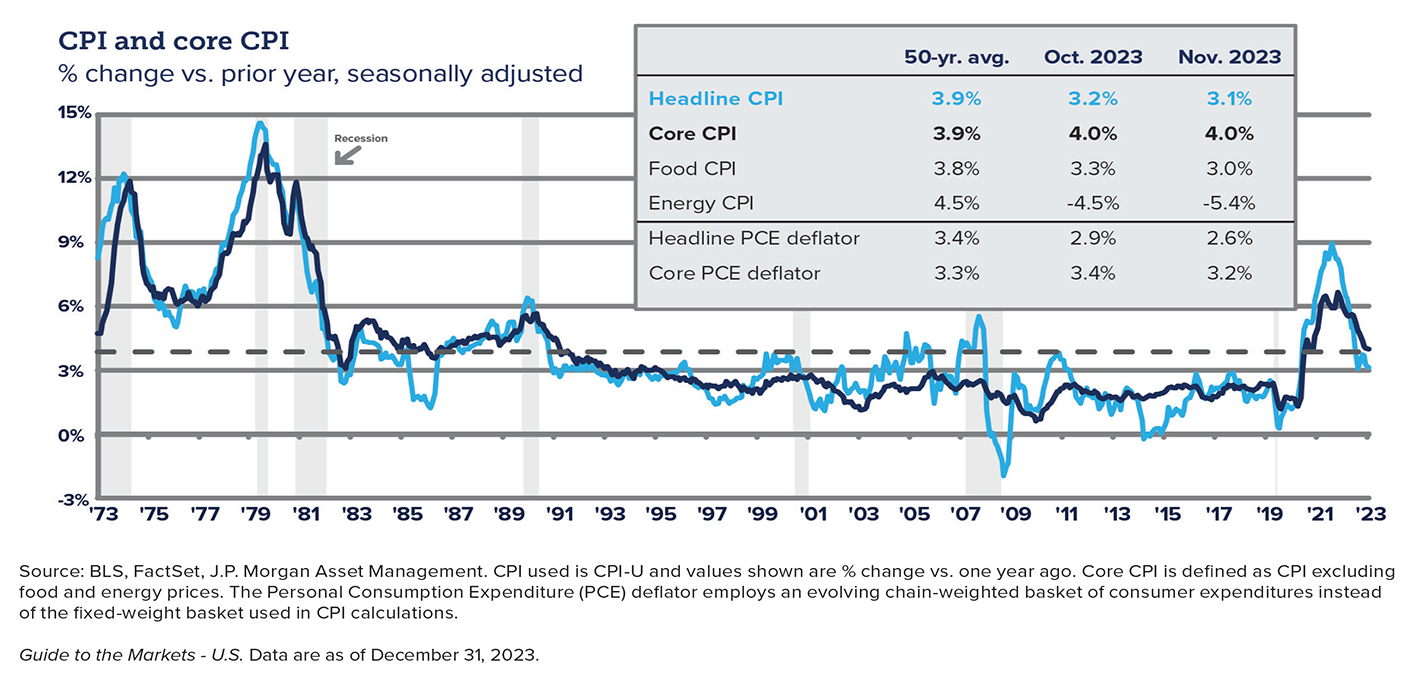

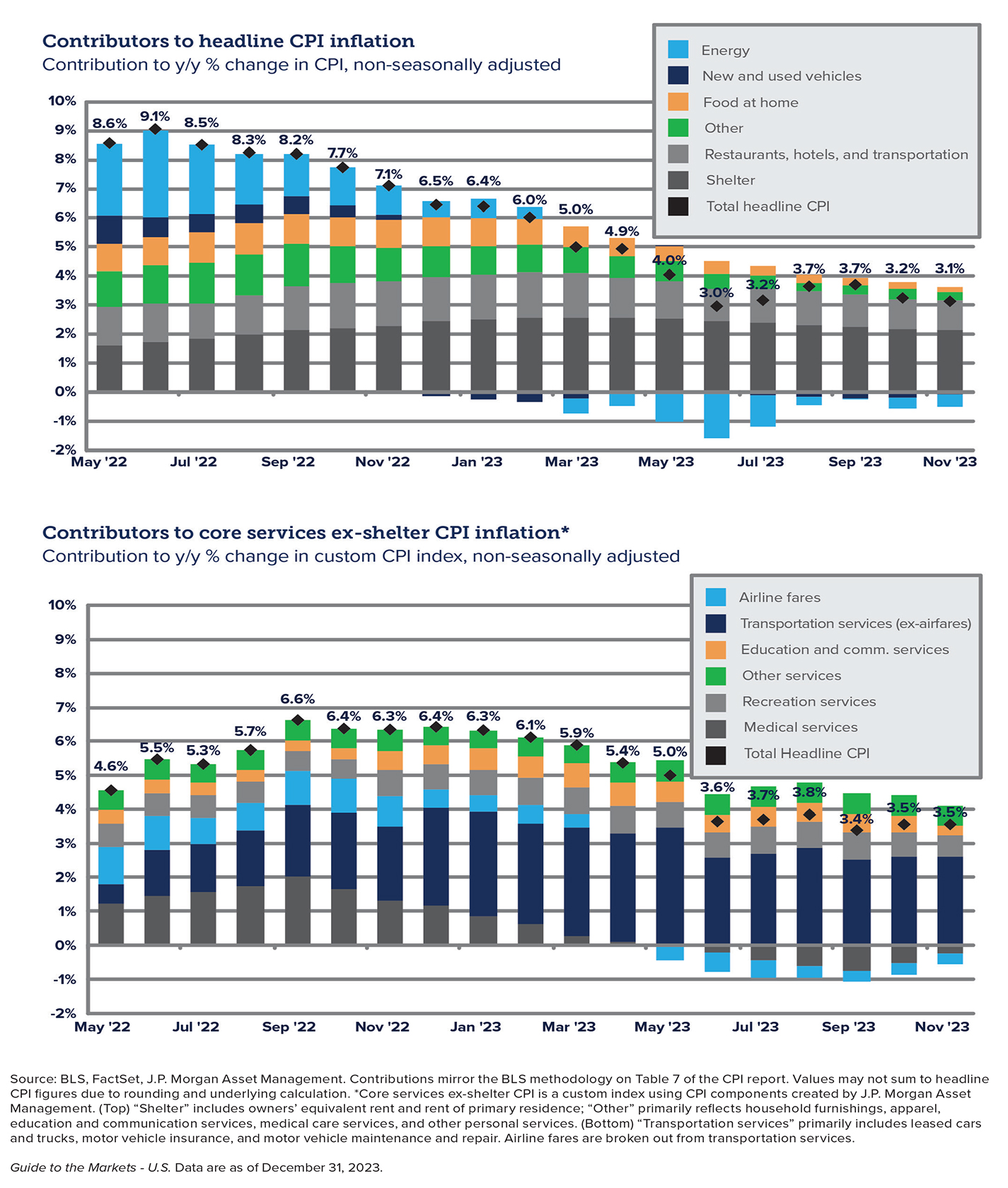

Inflation

Inflation that set in due to supply chain disruptions and changing consumer behavior, but prolonged by the Fed’s fiscal response to the COVID pandemic, appears to be settling near pre-pandemic levels. Our outlook calls for continued core disinflation but at a slower pace as we near the FOMC’s goal of 2% average inflation. We could see pockets of deflation, particularly in the more volatile components, such as energy, but our expectation calls for core inflation to fall below 3% in 2024 and then decline asymptotically toward 2% as sticky supply chain issues (such as housing) may keep 2% out of reach.

Business and consumer strength

Businesses have held up well in this economic transition, but tighter credit conditions and the anticipation of weakened consumer spending are fueling a cautionary outlook for 2024. Businesses are facing significantly higher interest rates as they contemplate new projects or re-terming of existing debt. Companies are healthy, buoyed by strong balance sheets, but debt servicing costs have increased. Earnings may come under some pressure and lenders are looking for larger concessions from borrowers to improve cashflow projections on projects. The credit environment will likely lead to curtailing new and/or expansion projects which could stifle economic growth.

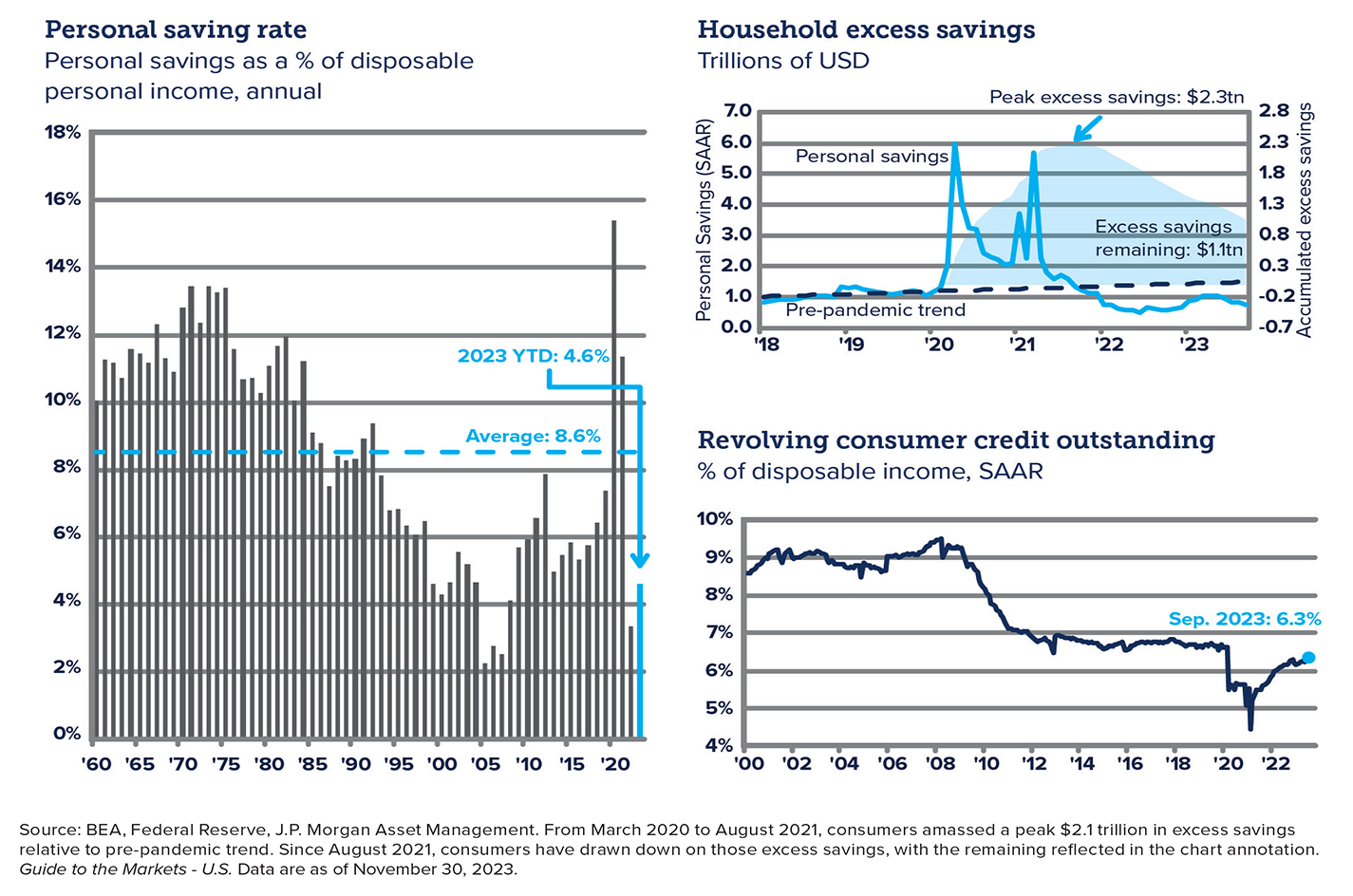

On the consumer side, while consumer spending has been strong, there are possible cracks. Household balance sheets have improved over the past two years, primarily on the strength of housing prices, yet deposit balances indicate many mainstream consumers have spent through the covid-related stimulus payments. Credit card and auto loan delinquencies are increasing in this environment of higher interest rates and the restart of student loan payments is weighing on household cash flow. Since our economy is 70% consumer driven, the strength of the consumer will be a significant factor in economic growth, or any lack thereof, in 2024.

Housing

Cost and availability of housing will continue to weigh on the consumer. Higher interest rates and a supply shortage has negatively affected the supply of affordable housing which is a key limiting factor to business growth in some parts of the country as regions compete for workers. High refinancing costs are also limiting housing turnover as current homeowners are reluctant to give up their low-rate legacy mortgages. Rents have moved up significantly since the pandemic but remain much more affordable than owning a home. Builders are attempting to catch up with demand following two years of supply chain and labor shortages. New construction is focused on the areas of highest demand which often is split between affordable (duplexes and multi-family) and high-end homes.

Labor

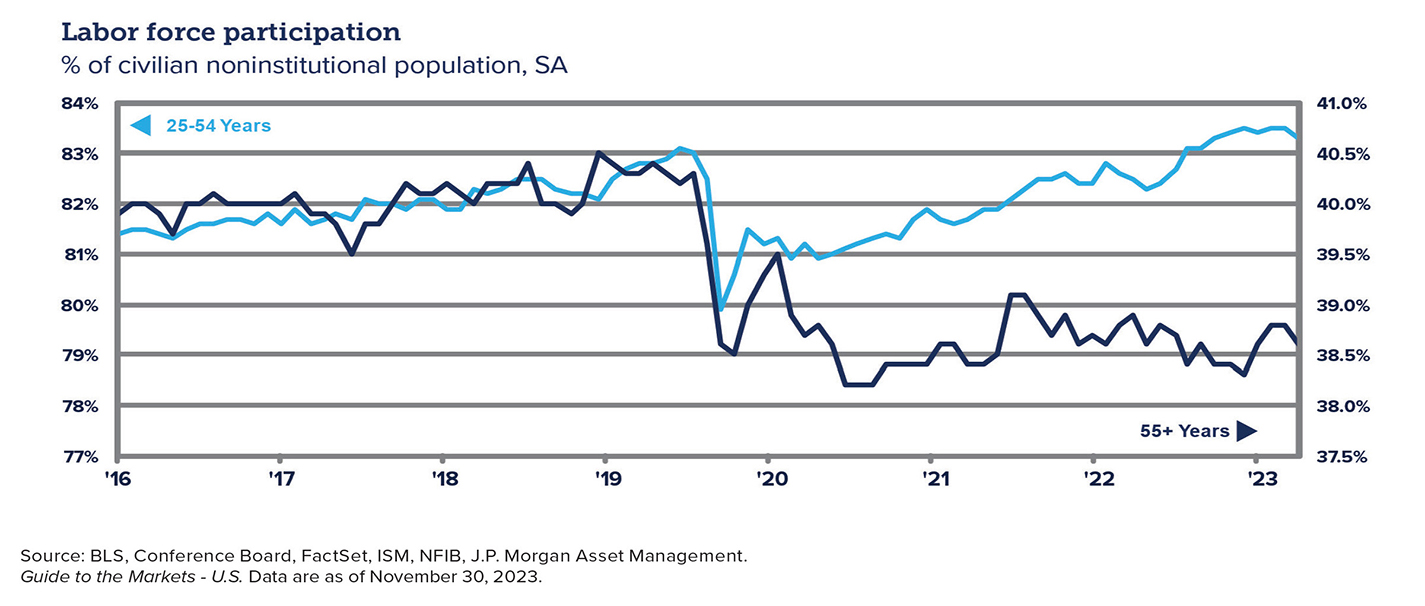

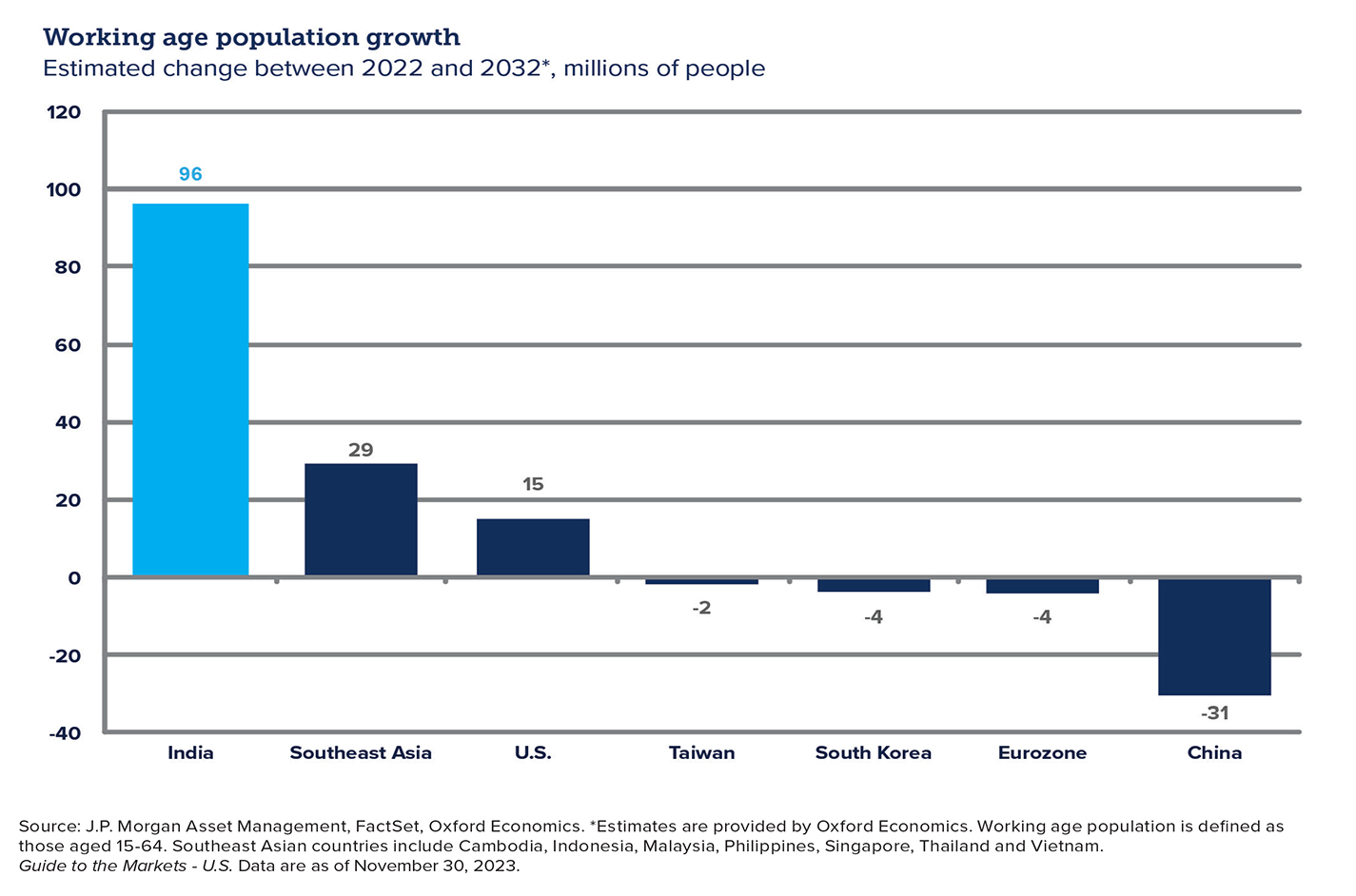

A tight labor supply continues but is moderating. Businesses are slowly filling open positions and, in many cases, are cutting the number of jobs available. Employee unions locked in multi-year, above average wage increases in 2023 as labor conditions remain tight. Examples include the recently-approved UPS, Spirit, and UAW contracts, strikes by Las Vegas culinary workers and the Screen Actors Guild, and potential strike by California dock workers. Labor participation rate among prime age workers (age 25-54) is back above pre-pandemic levels but older workers (55+) appear to be gone for good. Demographics (low birth rate and aging workforce) will likely continue to limit labor supply.

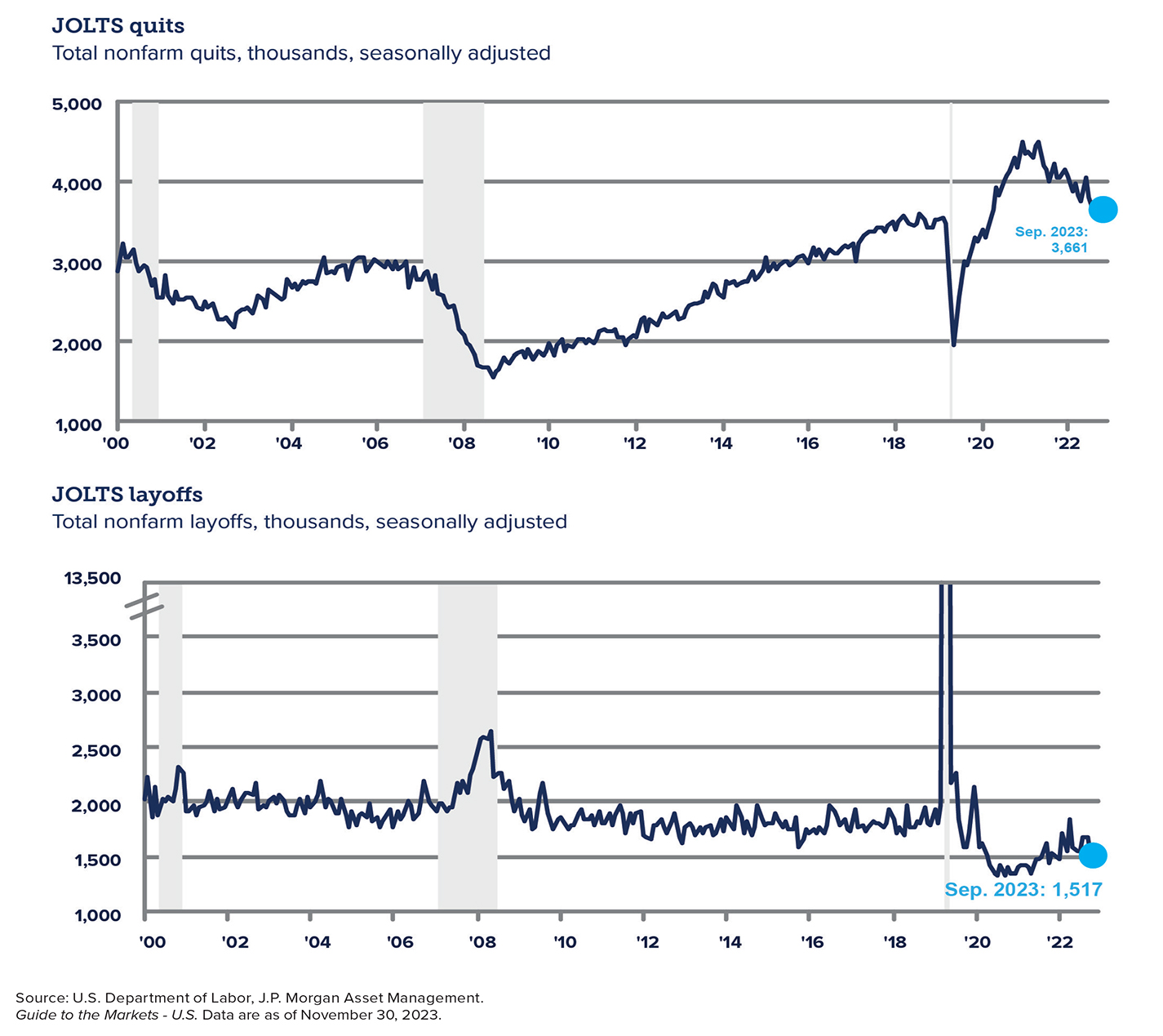

Businesses are reducing open positions, and the employee quit rate, which had been increasing for more than a decade, is returning to pre-pandemic levels. Employers appear to be holding onto employees rather than laying off and recent concessions have led to more hybrid work options. Artificial Intelligence will likely lead to improving efficiencies, but we are too early in the game for there to be a material effect in 2024.

Global economies

Covid-induced supply chain issues and current geopolitical tensions have led to deglobalization and re-shoring of manufacturing capacity. Re-shoring efforts will continue to be limited primarily by labor supply and cost, and these re-shoring efforts will likely be inflationary. China’s economic slowdown, fueled by a real estate crisis and political tension with the U.S., has compromised their position as the world’s manufacturer. On the other hand, India’s increasing population and capital spending are helping to solidify its place as a key player in the global economy.

The global economic picture will continue to be heavily influenced by various geopolitical tensions. Our outlook assumes:

- The war between Russia and Ukraine will continue to grind on as somewhat of a stalemate as both sides dig in and establish a new geographical landscape.

- Military action in Israel and the Middle East will begin to moderate and will not escalate into a greater conflict.

- Tensions in the Pacific will continue and could be an unknown factor in 2024 as China seeks to increase its influence over Taiwan.

Fiscal policy and elections

A divided Congress and an election year will likely increase an environment of government disfunction and stalemate conditions. As such, we don’t expect meaningful policy action in 2024. There will likely be little or no new spending measures apart from the bare minimum required to keep the government operating. Government shutdowns are a possibility and could be impactful depending on their length. Current geopolitical turmoil likely means that defense does not get cut anytime soon. November’s election will have little/no economic impact in 2024 but will lead to increased market volatility. Following the election and moving into 2025, there will likely be increased pressure to address government debt levels and the health of Social Security, but we believe there will be little/no progress in 2024.

Regional economies

As with previous INTRUST Economic Outlooks, we take a closer look at our regional economies. We have a generally positive outlook for our markets, but economic hurdles are present and will provide some level of uncertainty.

The economic landscape in a majority of our markets is positive but is constrained by many of the same economic factors facing the rest of the nation. Labor continues to play a significant role in the economic growth of our region, so many municipalities are employing creative solutions to draw businesses and labor, competing with regions across the country. As a result, the relatively low cost of living the Midwest is known for is experiencing upward pressure as more businesses and families move into the area, demanding housing, services, and infrastructure that has been slow to come online. Employee recruitment, as well as retention, will continue to play a key role in economic growth in both the short- and long-term outlooks.

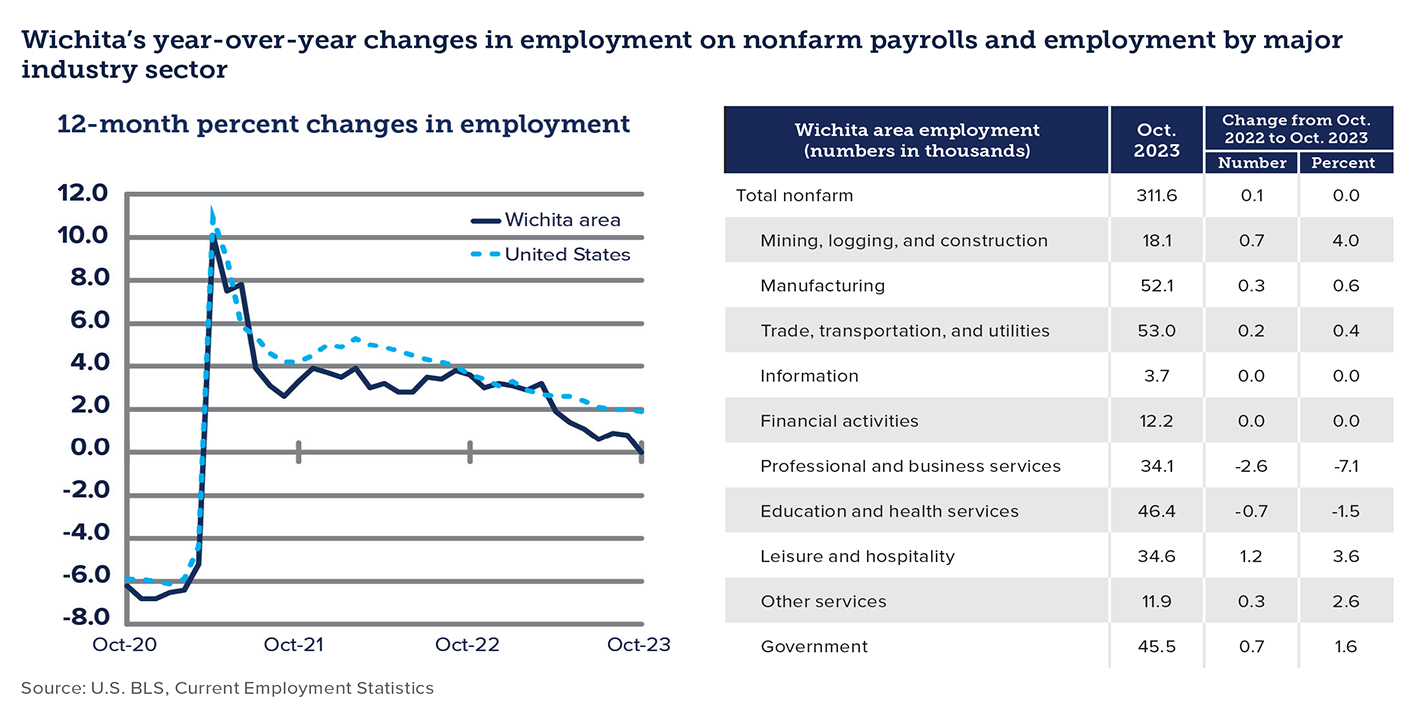

South Central Kansas

Wichita: As with all our local economic forecasts, a heightened emphasis is placed on the labor story as it provides a reasonably accurate depiction of economic growth. To that end, an optimistic outlook exists for the Wichita economy in 2024 as local firms continue to express desires to expand employment opportunities to meet demand. One of those expanding segments is the aerospace industry, a key component of Wichita’s economic growth, which is experiencing elevated opportunities for business jets, commercial aircraft, and military applications after several years of latent demand.

While demand remains high for labor, supply is short as the local market is at almost full employment. As a result, companies may need to make concessions to entice the “side-lined” population back into the labor force or attract new talent from outside of Wichita. Moreover, companies in the aerospace industry are receiving an element of government aid to support labor force growth as tax credits for some new employees are being provided. Naturally, this demand for labor supports wage and benefit improvements which will continue to strengthen the consumer balance sheet locally and support an attractive landscape for Wichita leading into 2024.

Newton and Harvey County: Attracting qualified manufacturing labor continues to be an issue for this region as many manufacturers are experiencing growing demand for their products. Labor supply is tight, affected not only by competition by surrounding communities for employees but also by a shortage of childcare facilities for families within the community. A new manufacturing company and continued expansion of the services offered by the regional hospital should fuel strong growth in this market as we move through 2024. Economic activity in Newton is closely tied to growth in Wichita as both communities expand, and this tie should strengthen as construction on key components of the I-135 corridor are completed.

El Dorado and Butler County: Economic growth in Butler county is often considered from two different views. El Dorado is the county seat of the largest county in Kansas and relies heavily on the growth of commercial manufacturing facilities, whereas Andover has grown primarily as a residential bedroom community for Wichita. Commercial growth in El Dorado has slowed some from the pace in 2022-2023 but is still strong. Continued strength in the energy sector has not only supported expansion projects at the refinery but has also supported employment in surrounding businesses. In Andover, builders are expanding feverishly to keep up with the demand for housing. Construction of large homes is strong as they are still highly desirable and their demand has not been significantly affected by higher interest rates.

Northeast Kansas

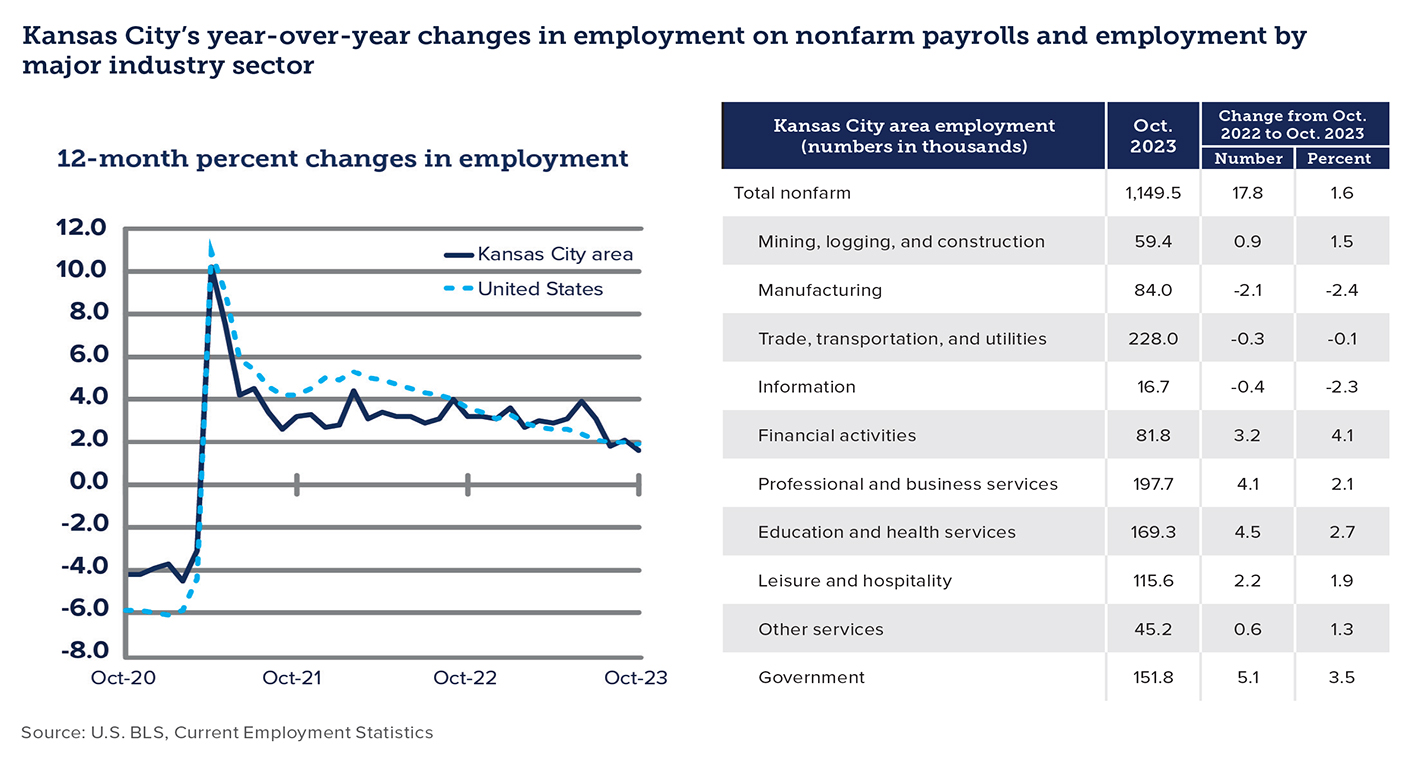

Kansas City: Like many of the regions in our footprint, higher interest rates are beginning to cool robust growth in the Kansas City area, but the city continues to benefit from its large and diverse economy. Construction of the new Panasonic plant west of Kansas City is well underway and hiring of its projected 4,000-job workforce is expected to begin in 2024. The recent Kansas City airport expansion is reaping benefits and excitement is already beginning to build for the FIFA World Cup 2026 matches to be held in Arrowhead stadium. Labor supply is improving but remains tight, particularly for entry-level positions. The housing market remains robust with strong growth west and south of Kansas City, partially due to the new Panasonic plant.

Lawrence and Topeka: Both cities continue to benefit from the growth and stability of their universities, the University of Kansas and Washburn University, as both universities welcomed their biggest freshman classes in the schools’ histories. Proximity to the Panasonic plant in De Soto is fueling housing growth for Lawrence but will be a draw on tight labor resources as we move through 2024. An $18M project to support affordable housing is underway to help address the needs of the growing workforce. The Topeka Economic Development fund offers incentives for professionals to relocate to the area to support growth in the manufacturing sector.

Manhattan and Junction City: The economic climate in these communities remained stable through 2023, buoyed by larger employers such as Kansas State University and Fort Riley. As with other communities in our region, housing remains tight as builders focus more on higher-end home construction. Manhattan Area Technical College has seen some growth, primarily in healthcare licensing and construction skills certifications. In healthcare, Stormont Vail has built a new facility in Manhattan and is adding higher-paying professional jobs to the area. In Junction City, the Michellin plant is undergoing a $100M expansion which will add 200 new jobs. Activity at Fort Riley remains steady as it remains a key training facility, but recent deployments have resulted in downward pressure for the local general economy. Labor shortages, which have been an issue coming out of the pandemic, appear to have stabilized and the outlook from businesses is generally positive.

Oklahoma

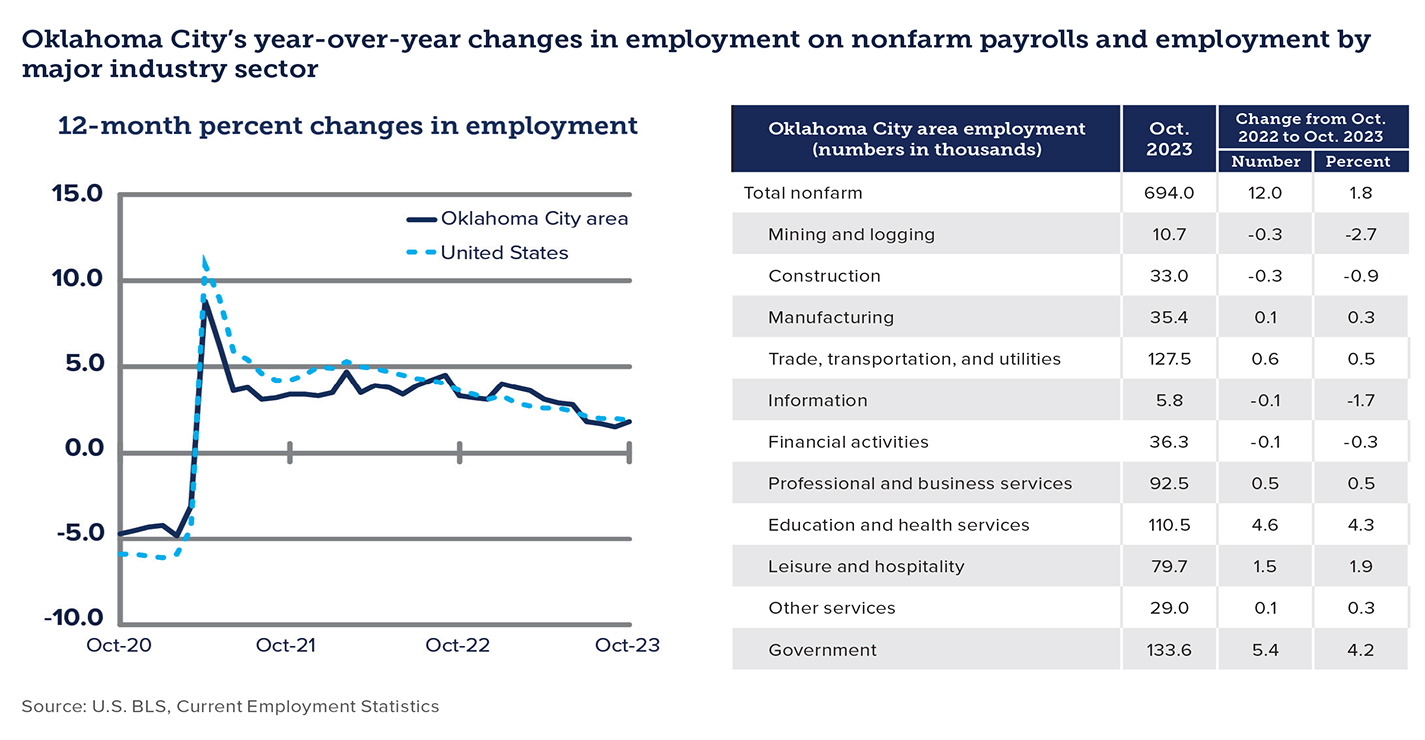

Oklahoma City: Economic growth in the Oklahoma City area continues to be constrained by a shortage of skilled labor. In addition to robust O&G activity, the region continues to grow its aerospace and biomedical industries. Increased efficiencies in the O&G industry have helped limit large employment swings caused by oil price volatility. In addition, student growth has returned at the University of Oklahoma and Oklahoma State to near pre-pandemic levels. Growth in logistics management has benefited from OKC’s location in the middle of the country at the intersections of I-35 and I-40. Housing construction is strong in an attempt to attract a much-needed labor force.

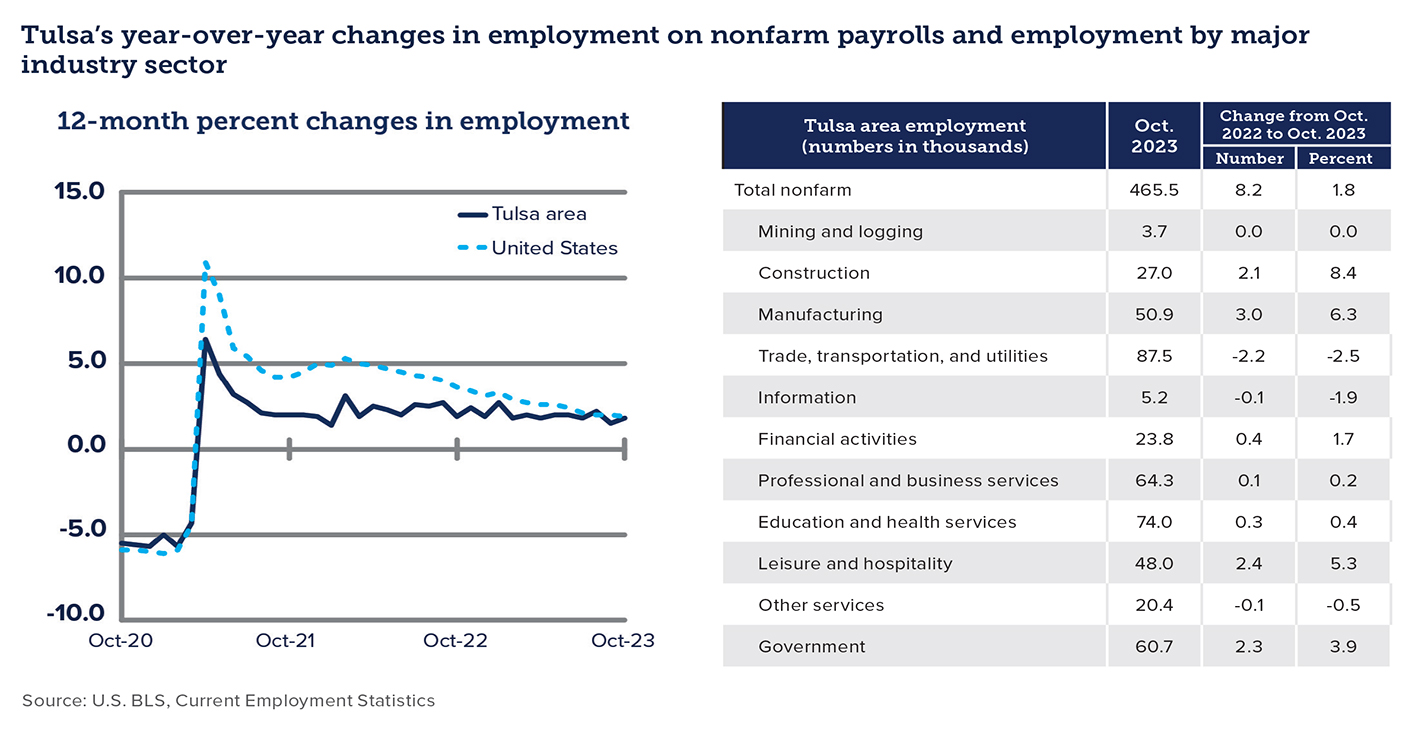

Tulsa As a historically rich O&G economy, the Tulsa area continues to diversify into EV manufacturing, aerospace, and biomedical industries. Electric vehicle manufacturer, Canoo, which has manufacturing facilities in Pryor and Oklahoma City, has delivered its first vehicle made in Oklahoma. Tulsa is also home to American Airline’s maintenance base – the largest of its kind in the world, as well as major aerospace companies such as NORDAM and Spirit AeroSystems. Transportation and logistics companies also play a key role in Tulsa’s economic footprint, with Macy’s and Amazon distribution centers and service from two Class 1 railroads (BNSF Railway and Union Pacific). To attract more employees to the area, the George Kaiser Family Foundation is helping fund Tulsa Remote, a unique recruitment initiative aimed at attracting talented individuals and their families to Tulsa. Our outlook calls for continued strong economic growth in the area, limited only by labor supply.

Northwest Arkansas

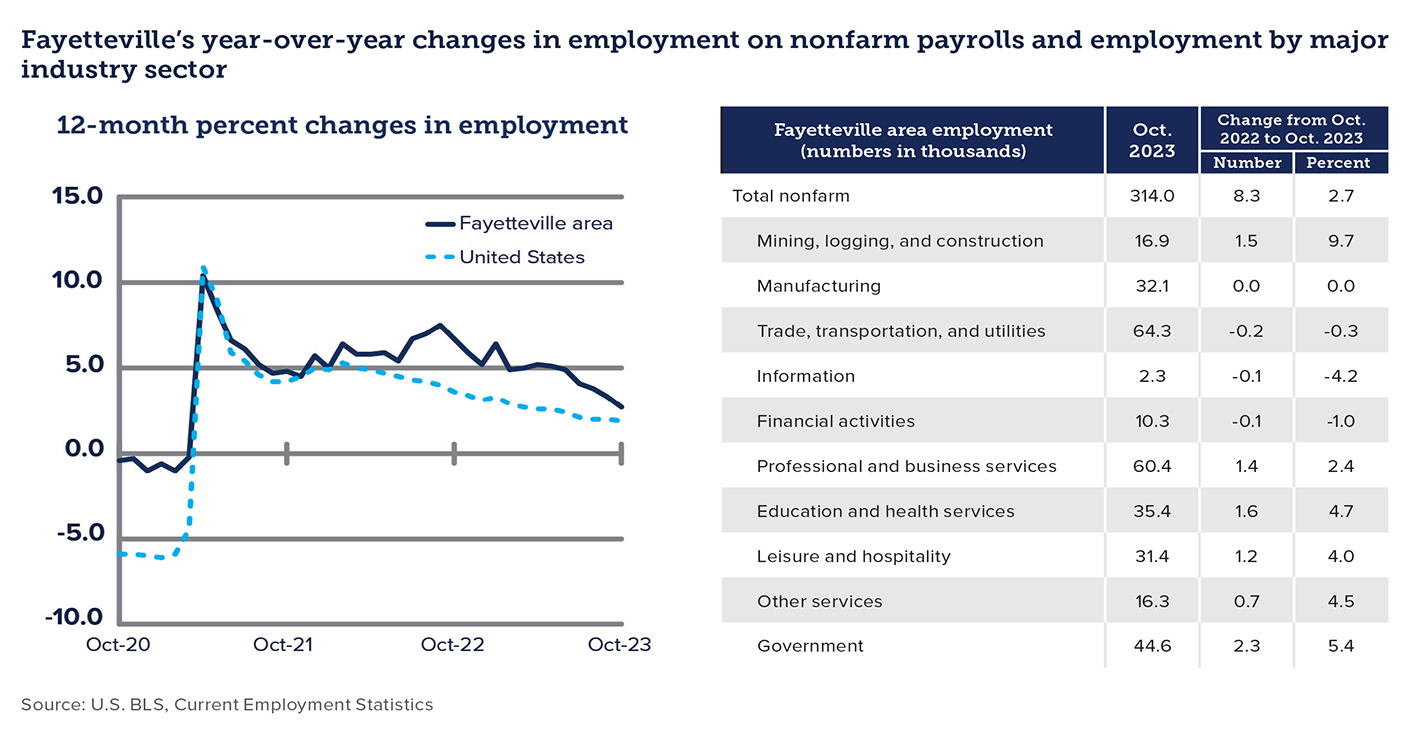

Economic growth in Northwest Arkansas (NWA) continued at a robust pace in 2023, fueling one of the largest employment percentage gains of the regions we serve. Quality of life and a relatively low cost of living is drawing both the workforce demographic as well as retiring Baby Boomers, the latter enticed by a quickly developing healthcare corridor. The area is home to the corporate headquarters of Walmart, J.B. Hunt, and Tyson, both of which are investing heavily in the local economy, bringing in additional jobs both directly and indirectly, as they work to develop logistical economies of scale. Housing and infrastructure have been stretched by the rapid growth, but municipalities and businesses are working to stay ahead. The recently completed I-49 Bella Vista bypass has relieved congestion north of Bentonville and provides easier passage into Missouri. Local builders are focusing on providing affordable housing and many larger businesses are building in capacity for childcare, all in an effort to attract and retain employees. Education capacity is also playing a key role in continued growth with record freshman enrollment in the University of Arkansas and John Brown University. And NorthWest Arkansas Community College, the local junior college in Bentonville, works with the high schools on a program that allows high schoolers to graduate with technical certifications. Our outlook calls for continued above-average growth for NWA.

Investment outlook

Coming off the heels of a difficult 2022, financial markets improved considerably in 2023. As we enter a new year, markets should continue to experience volatility due to geopolitical turmoil, election year political turmoil, and conjecture around FOMC actions.

Equities

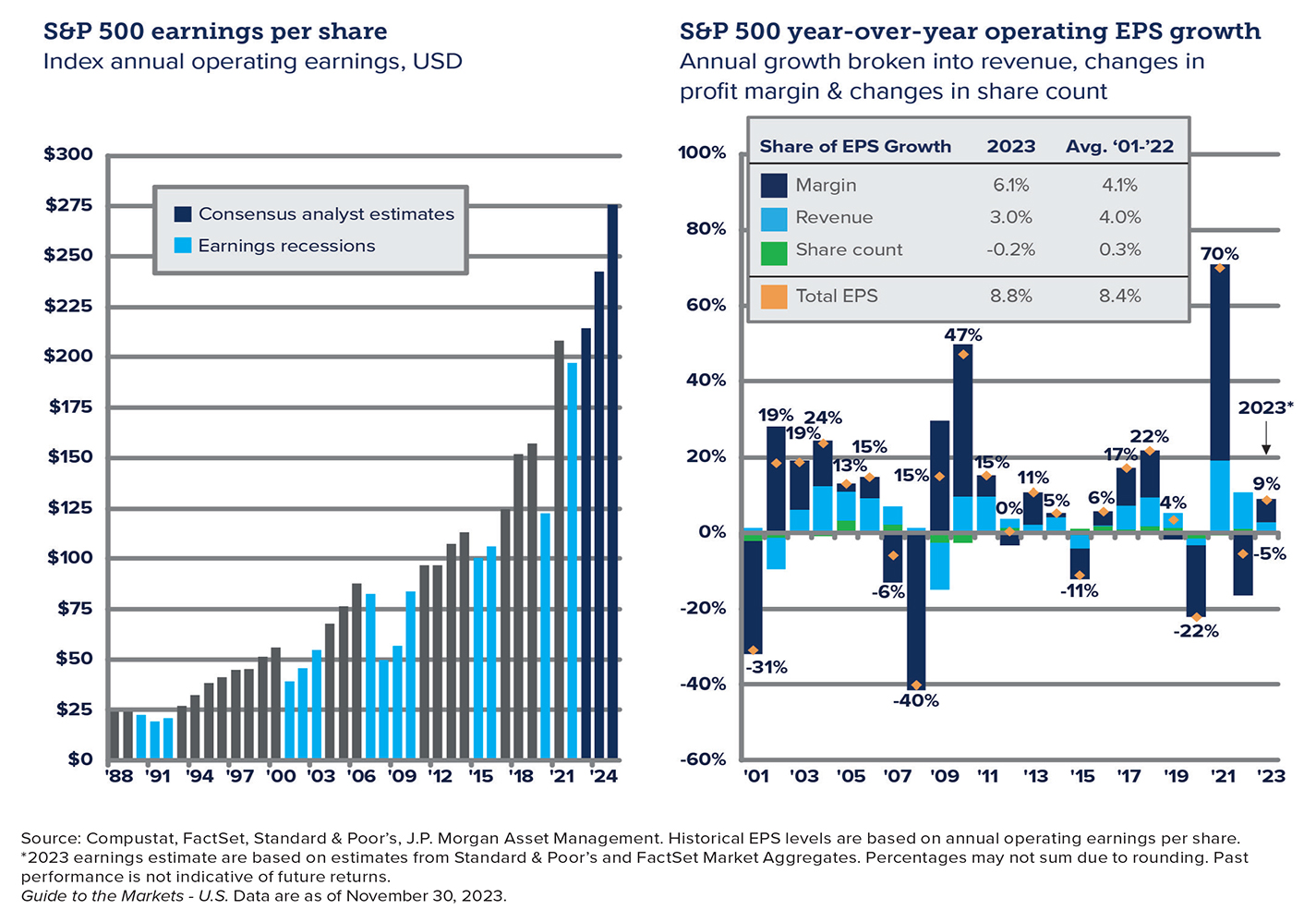

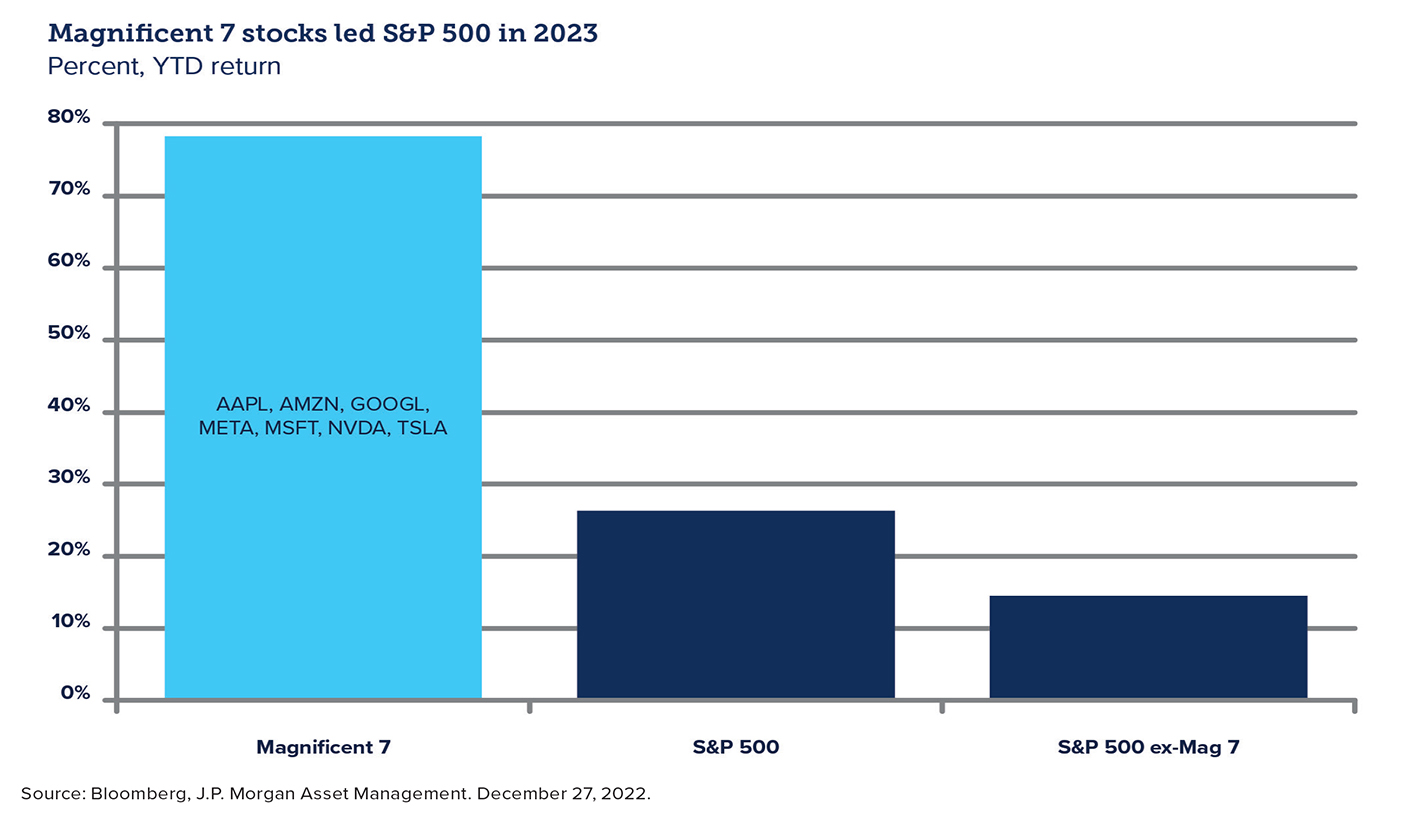

Domestic equities provided strong returns in 2023, led predominantly by the “Magnificent 7” (Facebook/Meta, Amazon, Tesla, Microsoft, Apple, Alphabet/Google, and Nvidia). The remaining “S&P 493” has not seen the same level of price run-up, so valuations should be attractive provided earnings are strong. We expect continued price volatility throughout the year due to election-year headline noise.

Our outlook calls for downward pressure on corporate margins and earnings, primarily due to labor costs and pricing pressure from consumers. International equities continue to remain attractively priced with respect to P/E and dividend ratios.

Fixed income

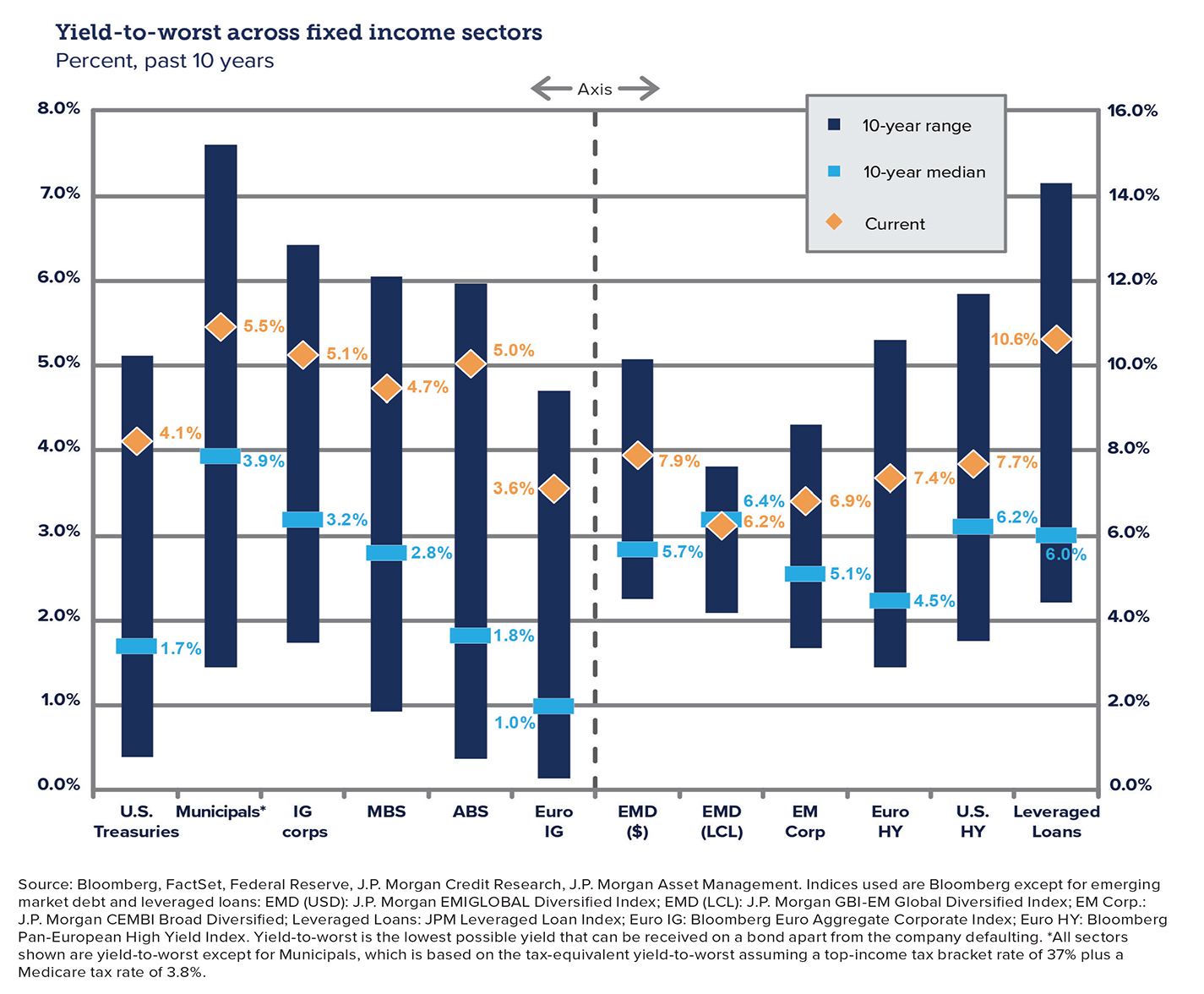

Fixed income has emerged as one of the more exciting investment themes for 2024. Higher-yield environment coupled with the possibility of Fed rate cuts towards the end of 2024 should provide tailwinds to fixed income performance. Bonds are no longer only a diversifier/risk mitigator as yields remain attractive compared to last 10-15 years. Purchasers of U.S. Treasuries have shifted from the Fed and foreign governments to domestic bond managers, which should continue to support higher yields.

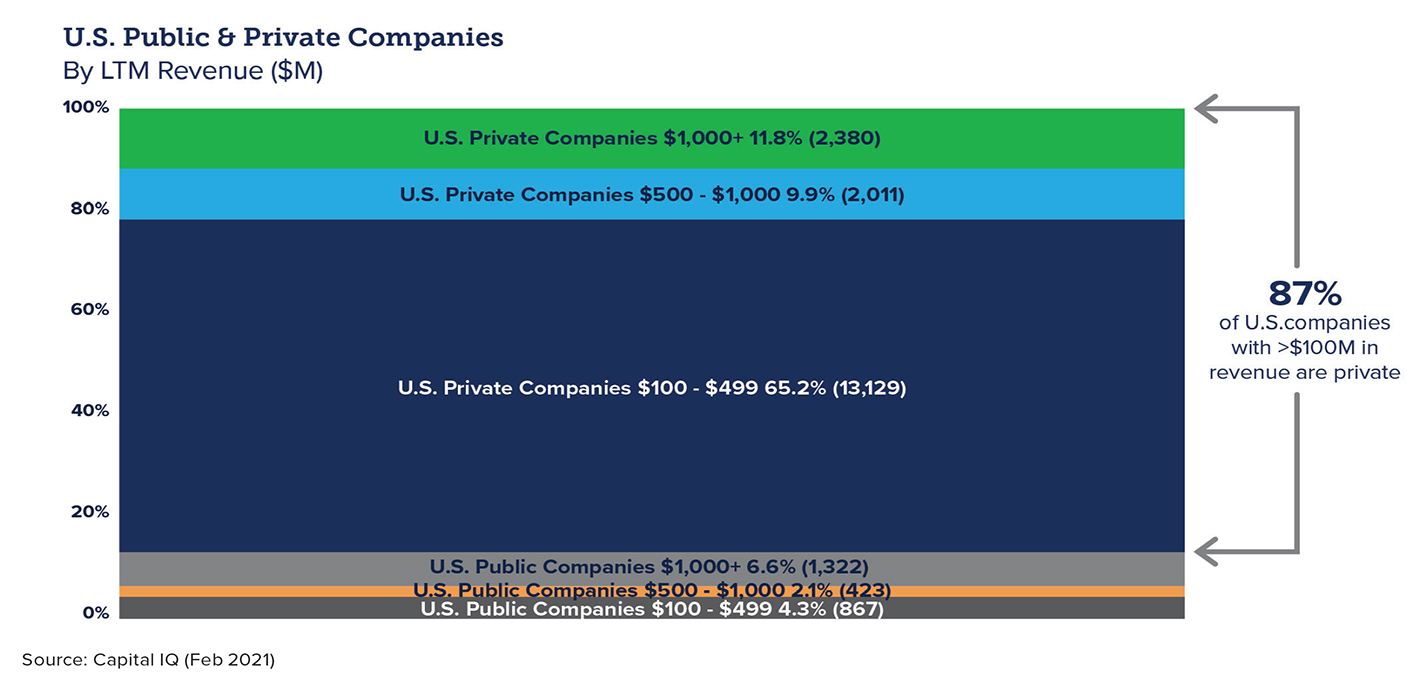

Private capital

As previously highlighted, tighter lending conditions have strengthened the environment for private capital solutions. Companies of all sizes are choosing to stay private longer since they have access to capital solutions without opening their company up to the publicly traded markets and increased regulatory scrutiny. In fact, there are more than 17,000 U.S. private companies with annual revenues above $100M, compared with just 2,600 public companies with those same revenue levels. This has resulted in more investment opportunities for qualified and accredited investors as the need for capital in the private markets has grown. Investors with long investment time horizons and low liquidity needs can capitalize on these market dynamics by incorporating these illiquid investments into a portion of their portfolio.

Portfolio considerations

2023 will enter the annals as a year with strong equity and bond performance, however, it will also be remembered as a tough year with economies and markets under duress from higher prices, higher rates, and a destabilized global marketplace. The market began the year with hopes of a Fed pivot and it was quickly met by the collapse of Silicon Valley Bank which set off a short lived panic in the financial markets. Within a few weeks, the stock market set off on a rally that would take us to the middle of the summer. During this time however, the bond market was hit by a steep increase in yields that moved long dated bonds to levels we haven’t seen in 15 years. This unexpected jump in yields not only hurt fixed income performance, but it also permeated the equity markets and began a sell off that ended with many parts of the market falling into negative territory. It wasn’t until the disinflation story began to solidify in the fourth quarter that the equity and bond markets recovered, and left us catching our breath, with a solid set of returns for 2023.

The U.S. stock market was led by the Magnificent 7 stocks in 2023, but they may lose their dominance in 2024. The narrow leadership of the U.S. stock market will likely not be repeated by these same 7 stocks. A broadening of the market is expected, with the playbook favoring a new set of leaders outside of these mega-cap companies. International valuations continue to look appealing as the US dollar kept its strength through 2023, and although emerging markets share this valuation story, the geopolitical risks associated with emerging markets provide a meaningful amount of risk that should be carefully managed.

Despite the volatility and uncertainty that characterized 2023, the bond market ended the year with yields very similar to where they started. This means that bonds may continue to provide meaningful returns to investors, not just diversification benefits. The credit markets are currently optimistic about the economic outlook for 2024, as evidenced by the tight credit spreads that reflect low default risk and high demand for corporate debt. The credit markets are also anticipating a soft landing for the economy, meaning a gradual slowdown in growth without a recession. A soft landing would likely prompt the Federal Reserve to lower its key interest rate in 2024, which would help restore a more normal shape to the yield curve, where longer-term bonds offer higher yields than shorter-term ones. However, a potential challenge for the bond market is the persistence of inflation. If inflation proves to be stickier than expected, the Fed may have to keep rates higher for longer to prevent the economy from overheating. Keeping duration shortened and credit exposure flexible are prudent steps in 2024 to tackle any opportunities in fixed income.

We consider these factors to plan long-term investments with diversified portfolios that suit your objectives and risk preferences. 2024 will surely have some surprises that we did not foresee in this outlook. In these challenging times, our committed financial experts are ready to assist you in pursuing your goals.

The INTRUST 2024 Economic Outlook is the consensus of the INTRUST Bank, N.A. (“INTRUST”) Investment Strategy team and is based on third party sources believed to be reliable. INTRUST has relied upon and assumed, without independent verification, the accuracy and completeness of this third party information. INTRUST makes no warranties with regard to the information or results obtained by its use and disclaims any and all liability arising out of the use of, or reliance on the information. The information presented has been prepared for informational purposes only. It should not be relied upon as a recommendation to buy or sell securities or to participate in any investment strategy. The forward-looking perspectives are not intended to, and should not, form a primary basis for any investment decisions. This information should not be construed as investment, legal, tax or accounting advice. Past performance is no guarantee of future results.

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

Recommended Articles

.png?Status=Temp&sfvrsn=91c53d6b_2)